- Bitcoin leads the restoration with 62% of whole crypto inflows and bettering sentiment.

- On-chain knowledge reveals a powerful accumulation section forming as brief sellers get trapped.

- A break above main provide clusters might ignite a push towards the $100K zone.

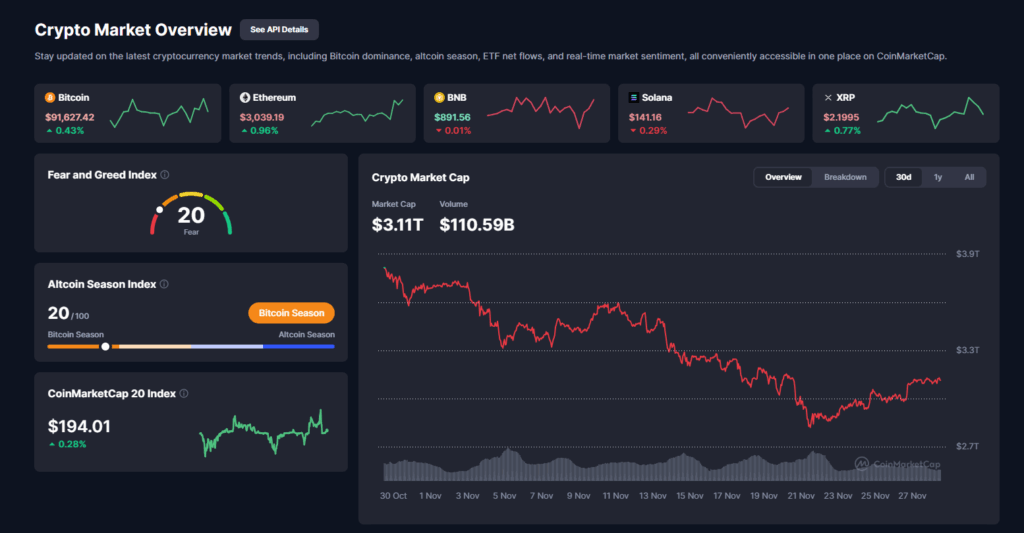

The ultimate week of November is shaping up as a uncommon second of calm after three brutal pink weekly candles that erased roughly $970 billion from the whole crypto market cap. This week alone, the market has climbed over 5%, pulling in $160 billion in contemporary inflows and establishing what could turn out to be the primary inexperienced shut of the month.

Bitcoin is driving your complete transfer, accounting for 62% of all inflows, whereas the Altcoin Season Index has plunged to mid-July ranges. With flows consolidating closely into BTC, the Bitcoin worth prediction tendencies stay firmly bullish heading into December.

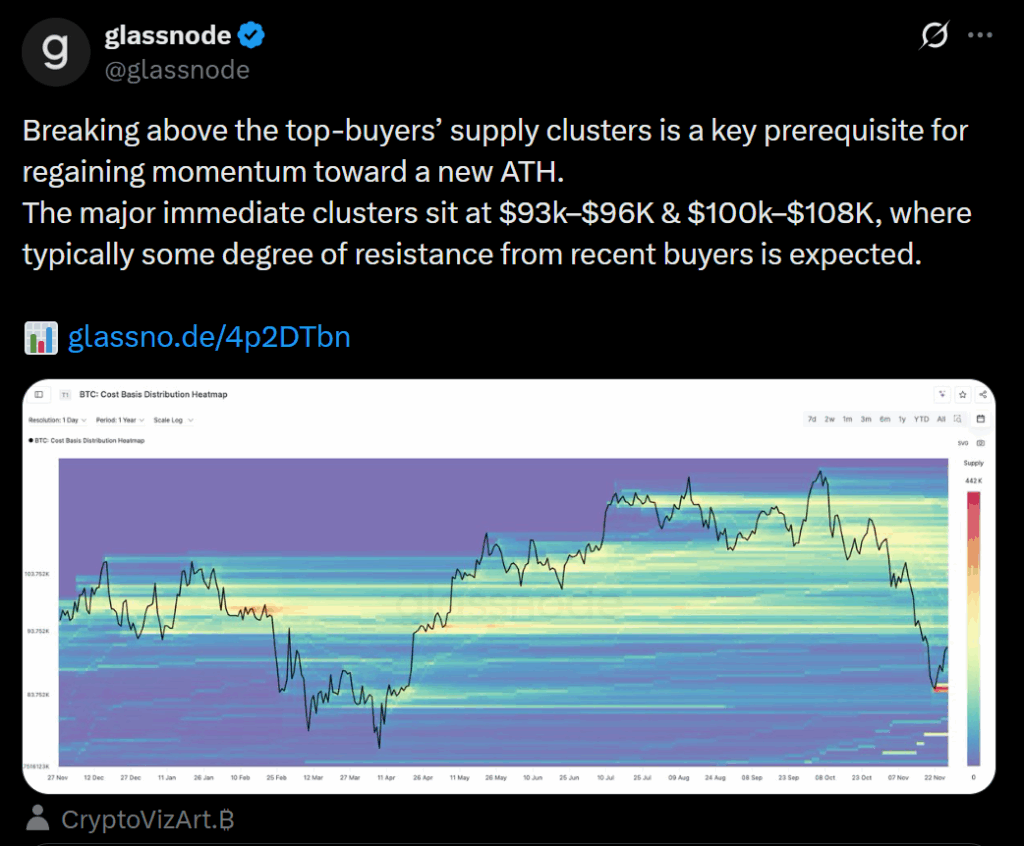

Key Resistance Nonetheless Holds

Even with the bounce, the market isn’t in full bull-run mode simply but. Glassnode knowledge highlights 4 main provide clusters—worth zones the place long-term holders beforehand purchased and should look to interrupt even. These clusters typically act as resistance as a result of older wallets are likely to distribute throughout stress reduction rallies.

Regardless of this, sentiment is quietly bettering. The Worry and Greed Index jumped eight factors this week, transferring from excessive concern right into a calmer “average concern” zone. On-chain metrics are additionally rebounding, suggesting danger circumstances are easing and traders are coming into a brand new accumulation section. The setup resembles a possible bear lure, creating the vitality wanted for BTC to press greater.

Quick Sellers Get Squeezed

The shift in momentum has triggered a strong response in derivatives. CoinGlass reveals that this week produced $1.13 billion in liquidations, with 61.3% coming from brief positions—the primary time this month shorts dominated lengthy liquidations.

This alerts a really completely different market tone in comparison with the three prior weeks, which noticed constant lengthy flushes. Merchants had closely shorted the market throughout peak concern, and people positions are actually getting trapped as BTC rotates again into energy.

With sentiment flipping and shorts beneath strain, Bitcoin has begun reclaiming ranges that beforehand acted as resistance.

Can Bitcoin Actually Push Towards $100K?

Many analysts consider the setup for a six-figure transfer is now strengthening. BTC’s capitulation metrics are recovering, with Web Realized Revenue/Loss turning inexperienced and realized losses easing throughout the community. Mixed with greater inflows and bettering on-chain conduct, these alerts suggest that offer is quietly being absorbed.

From a technical standpoint, this pattern typically precedes a serious resistance breakout. If BTC can push previous the overhead provide clusters, the pathway to a $100K Bitcoin worth prediction opens up rapidly.

With shorts squeezed, sentiment normalizing, and accumulation returning, the market seems to be setting its sights on greater ranges—assuming macro circumstances keep supportive.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.