Bitcoin has managed to reclaim the $90,000 degree after days of intense volatility, however upward momentum stays restricted because the market continues to battle uncertainty and worry. Whereas bulls have regained some floor, promoting strain continues to be dominating sentiment, and hypothesis in regards to the begin of a brand new bear market continues to develop. Many analysts warn that the current bounce might not be sufficient to shift the broader pattern except stronger demand returns.

Associated Studying

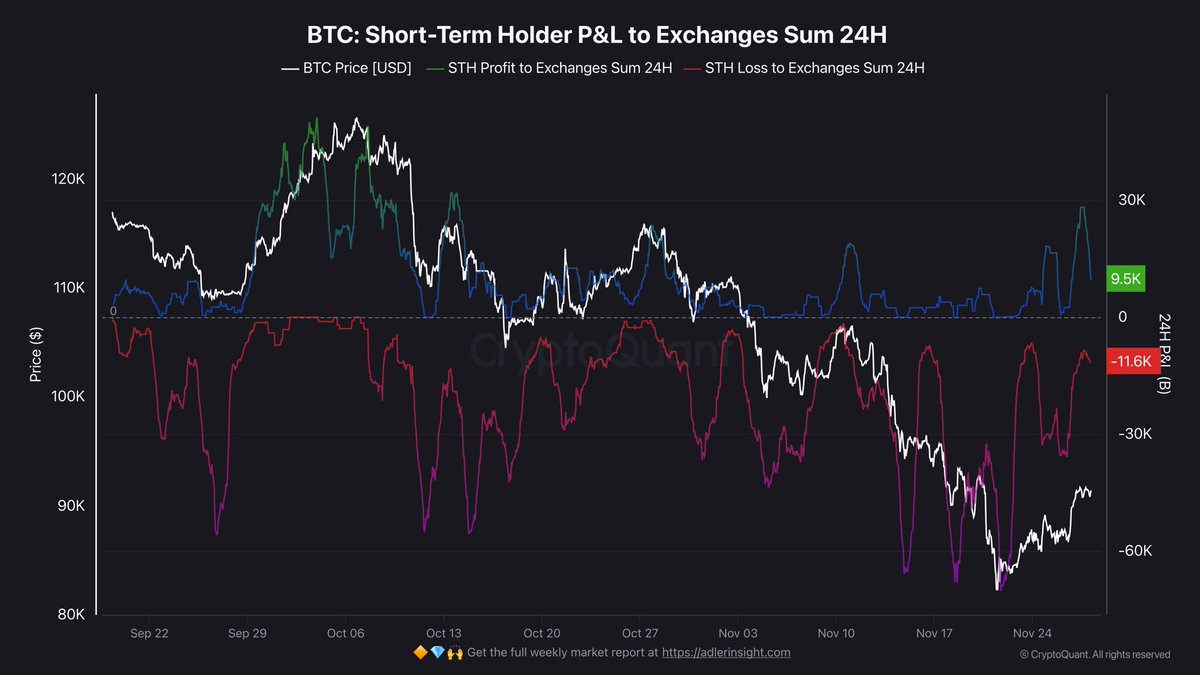

In accordance with recent knowledge from Darkfost, short-term stress amongst buyers has eased barely. The quantity of BTC despatched to exchanges at a loss has dropped sharply, now sitting round 11,600 BTC—considerably decrease than the acute 67,000 BTC capitulation spike recorded on November twenty second. This decline means that panic-driven promoting could also be cooling off, giving the market a short lived second of stabilization.

Nonetheless, regardless of this enchancment, Bitcoin nonetheless faces sturdy headwinds. Traders stay cautious, liquidity circumstances are tight, and macro uncertainty continues to weigh on danger belongings. For now, BTC should maintain above the $90K area and present sustained power to keep away from renewed draw back strain. The approaching classes could decide whether or not this rebound marks the beginning of restoration—or only a pause earlier than one other leg decrease.

Brief-Time period Holders Face a Crucial Choice Level

Darkfost provides that the quantity of BTC in revenue being despatched to exchanges by short-term holders stays comparatively low at round 9,500 BTC. Nonetheless, a slight improve has appeared as Bitcoin climbed again above $90K, exhibiting that some STHs have begun testing the market to safe small positive factors or cut back their publicity.

This delicate shift highlights a rising stress amongst current patrons, who should select between ready for a full return to interrupt even or promoting now to attenuate additional losses.

This example creates a fragile atmosphere. Although promoting strain has eased, STHs stay extremely delicate to small worth actions, and their habits usually dictates short-term market course. The previous few days have been unusually calm in comparison with the violent capitulation seen earlier within the month, and that calmness is definitely constructive. It means that panic has quickly subsided and the market is looking for stability.

What turns into essential now’s monitoring how STHs react as Bitcoin approaches their realized worth. In the event that they maintain and confidence will increase, BTC might acquire sufficient stability to push increased. In the event that they promote aggressively, renewed draw back strain might shortly return. The following transfer from this cohort will probably set the tone for the approaching weeks.

Associated Studying

Bitcoin Makes an attempt Restoration However Faces Heavy Overhead Resistance

Bitcoin’s day by day chart reveals the asset trying a restoration after reaching a capitulation low close to $80K, however the construction stays fragile. Value has reclaimed the $90K space, but momentum is proscribed as BTC trades beneath the 50-day and 100-day shifting averages—each of which proceed sloping downward, signaling sustained bearish strain.

The 200-day shifting common sits increased, reinforcing the broader downtrend that has shaped since early October’s $126K peak.

Latest candles mirror a hesitant rebound: upward wicks present sellers defending each push towards $92K–$94K, whereas the tight physique ranges spotlight indecision. Quantity has cooled considerably in contrast with the panic-driven sell-off earlier in November, suggesting that pressured promoting has eased however sturdy buy-side conviction continues to be lacking.

Associated Studying

Structurally, BTC stays beneath key resistance clusters shaped throughout its earlier consolidation. Reclaiming these zones will probably be important for invalidating the bearish pattern. Till then, each bounce dangers changing into a decrease excessive inside a broader corrective construction.

On the draw back, the $85K–$87K area stays crucial assist. A breakdown beneath it might reopen the trail towards deeper corrective targets. For now, Bitcoin is trying to stabilize, however bulls should reclaim increased ranges quickly to shift market sentiment and keep away from renewed draw back strain.

Featured picture from ChatGPT, chart from TradingView.com