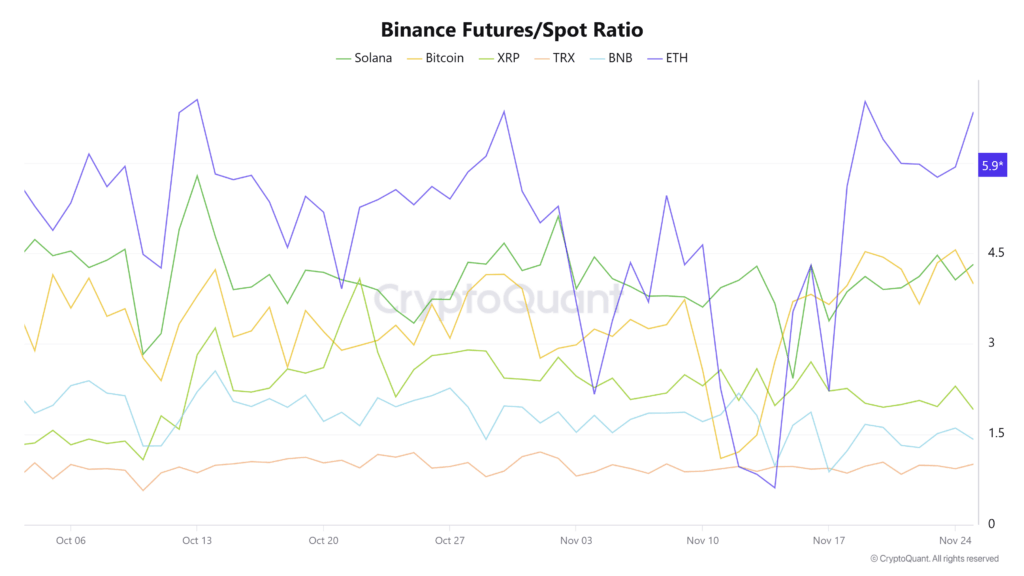

- ETH futures-to-spot ratio surged to six.84, signaling aggressive leverage and rising volatility expectations.

- Bitcoin open curiosity fell whereas ETH remained secure, suggesting threat rotation towards Ethereum.

- Bulls are eyeing $3,390 as the following main liquidity and resistance zone if $3,000 efficiently flips to assist.

Ethereum merchants have quietly flipped again into threat mode, with recent derivatives knowledge displaying a pointy shift in positioning whereas ETH pushes deeper right into a important technical zone. Binance’s futures-to-spot ratio for Ether jumped from roughly 5 to six.84, marking its highest stage of This autumn and signaling that merchants are selecting leverage over spot accumulation once more. In comparison with Bitcoin and Solana — sitting nearer to 4 and 4.3 — ETH has turn out to be probably the most aggressively positioned large-cap crypto, and that divergence normally hints at expectations of incoming volatility or a catalyst on the horizon.

Bitcoin Open Curiosity Fades Whereas ETH Holds Regular

On-chain derivatives knowledge additionally reveals ETH holding its floor extra firmly than Bitcoin. BTC’s open curiosity has seen a gentle unwind over the past two weeks, whereas ETH’s has dipped solely barely, averaging a tender 0.47% each day pullback. The sample suggests merchants are quietly rotating threat capital from Bitcoin’s drained uptrend into what they see as a higher-beta alternative in Ethereum. This shift comes simply as ETH reclaimed the $3,000 stage, dragging consideration again towards whether or not the asset can lastly flip this build-up of leverage right into a clear breakout.

Can ETH Break the $3,390 Liquidity Cluster?

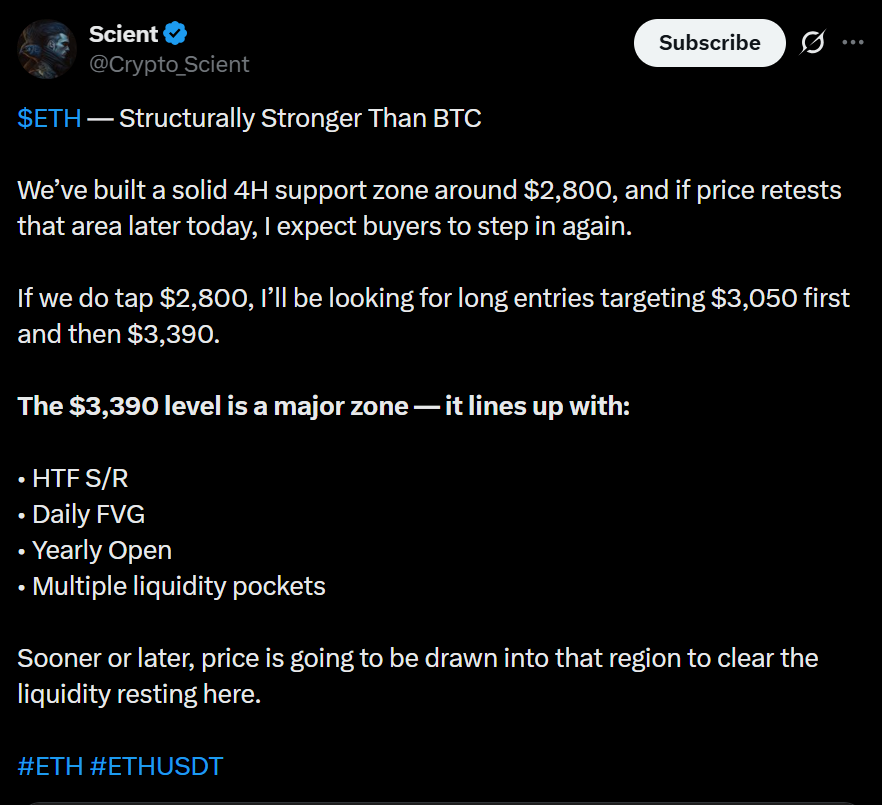

Not everybody agrees on the place this transfer leads subsequent. Dealer Scient argues that ETH seems structurally stronger than Bitcoin proper now, noting a bolstered 4-hour assist base round $2,800 that has held repeatedly. Bulls need to see that stage entice recent patrons if retested, probably opening the door towards $3,050 after which the main liquidity pocket sitting round $3,390. That area traces up with the yearly open, a good worth hole, and a high-time-frame resistance zone — principally the extent most watchers agree ETH must clear to substantiate momentum.

Analysts Break up as “Thanksgiving Lull” Units the Tone

Others keep cautious. Lab Buying and selling’s Ken warned that ETH has been rejected time and again on the four-hour 100-EMA, and until ETH flips $3,000 cleanly into assist, one other draw back extension continues to be on the desk. In the meantime, Kingpin Crypto highlighted that ETH lately tapped the 0.618 retracement of all the 2025 rally, calling the present setup an ideal “springboard” for a December push if liquidity rotates again in. With Bitcoin dominance beginning to soften and seasonal flows traditionally favoring ETH, merchants say a so-called “Ethereum Santa rally” into the $3,300s isn’t unimaginable — it simply wants stronger affirmation than what we’ve seen thus far.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.