- Kaspa spiked greater than 20 p.c as whales gathered closely by the latest downturn.

- Enhancing macro sentiment and rising odds of a December price minimize added gas to the transfer.

- Regardless of momentum, post-holiday volatility might set off a short-term correction.

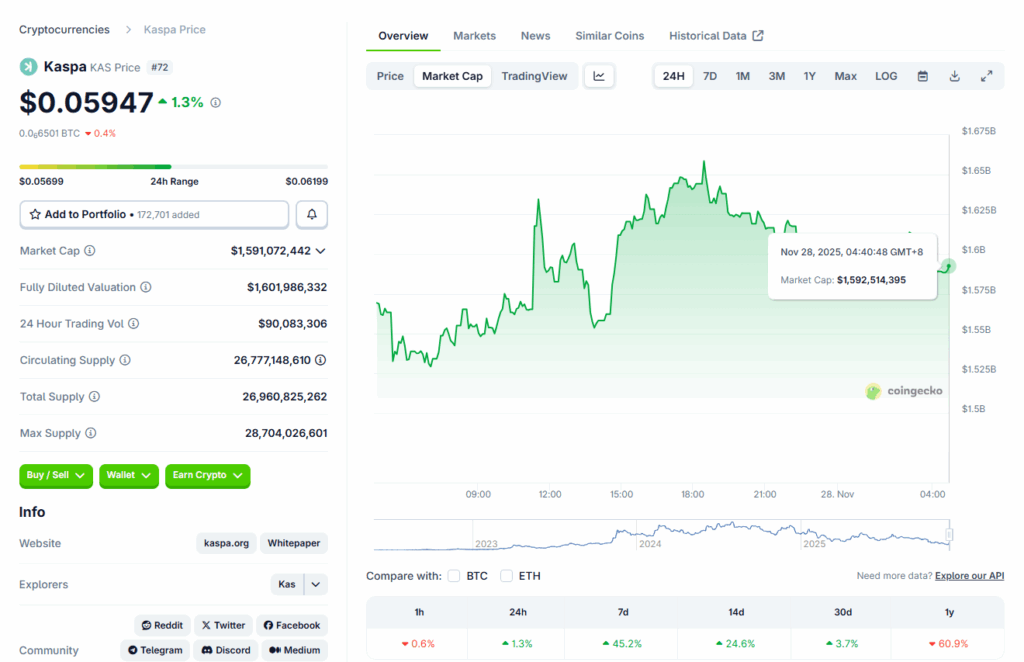

Kaspa has immediately turn into one of many strongest movers available in the market, leaping greater than 20 p.c prior to now 24 hours and lengthening strong features from earlier within the week. The token is now up greater than 43 p.c over seven days, despite the fact that it’s nonetheless far under the degrees it held late final yr. Merchants watching the transfer say the uptick feels completely different from earlier aid bounces, largely as a result of the amount behind it has picked up and the rally isn’t taking place in isolation. Bitcoin has been grinding again towards the $92,000 mark, and that broader energy seems to be giving smaller proof-of-work tasks like Kaspa a carry.

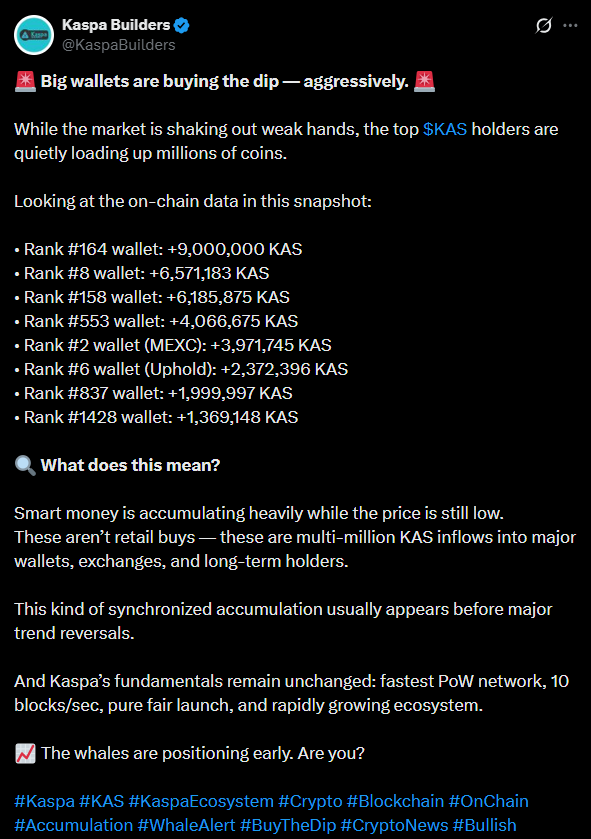

Whale Accumulation Sparks Momentum

One of many large catalysts got here from whale exercise. Kaspa group accounts have flagged aggressive shopping for from high holders all through the latest market dip. In line with them, these whales quietly scooped up tens of millions of tokens whereas retail buyers had been nonetheless panicking, and that purchasing stress usually exhibits up in value motion a couple of days later. With the broader crypto market stabilizing from its early-November slide, these whale buys might have lastly pushed KAS right into a cleaner breakout. Mixed with stronger sentiment round altcoins this week, the setup created the sort of transfer that smaller caps thrive on.

Macro Tailwinds Add Gas to the Transfer

Kaspa’s run can also be driving on shifting expectations across the Federal Reserve’s subsequent transfer. Charge-cut odds for December climbed to roughly 85 p.c based mostly on CME FedWatch knowledge, giving threat belongings a noticeable increase. There’s rising chatter about Kevin Hassett probably changing Jerome Powell as Fed chair, and Hassett has brazenly supported deeper price cuts. A softer coverage stance tends to assist high-volatility belongings like crypto, and if the Fed delivers one other minimize in early 2026, cash within the mid-cap vary may benefit probably the most. With confidence creeping again in and BTC recovering from its lows, merchants see sufficient macro assist to justify short-term upside in Kaspa.

Can the Rally Really Maintain?

Even with the robust push, there’s nonetheless an opportunity Kaspa cools off once more. Vacation weeks within the U.S. usually deliver skinny buying and selling situations, and the market might simply whip round as soon as exercise returns. The token has been extremely delicate to Bitcoin’s course, so any pullback in BTC might drag KAS down with it. For now, the development is leaning bullish, however the subsequent few periods will decide whether or not that is the beginning of an even bigger rebound or simply one other sharp however short-term bounce.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.