- JPMorgan now expects a December 10 charge reduce with odds rising again towards 85 %.

- Fed officers have turned extra open to near-term easing as labor information softens and no main experiences stay earlier than the assembly.

- A December reduce would align with traditionally sturdy year-end market efficiency, probably setting off a robust rally.

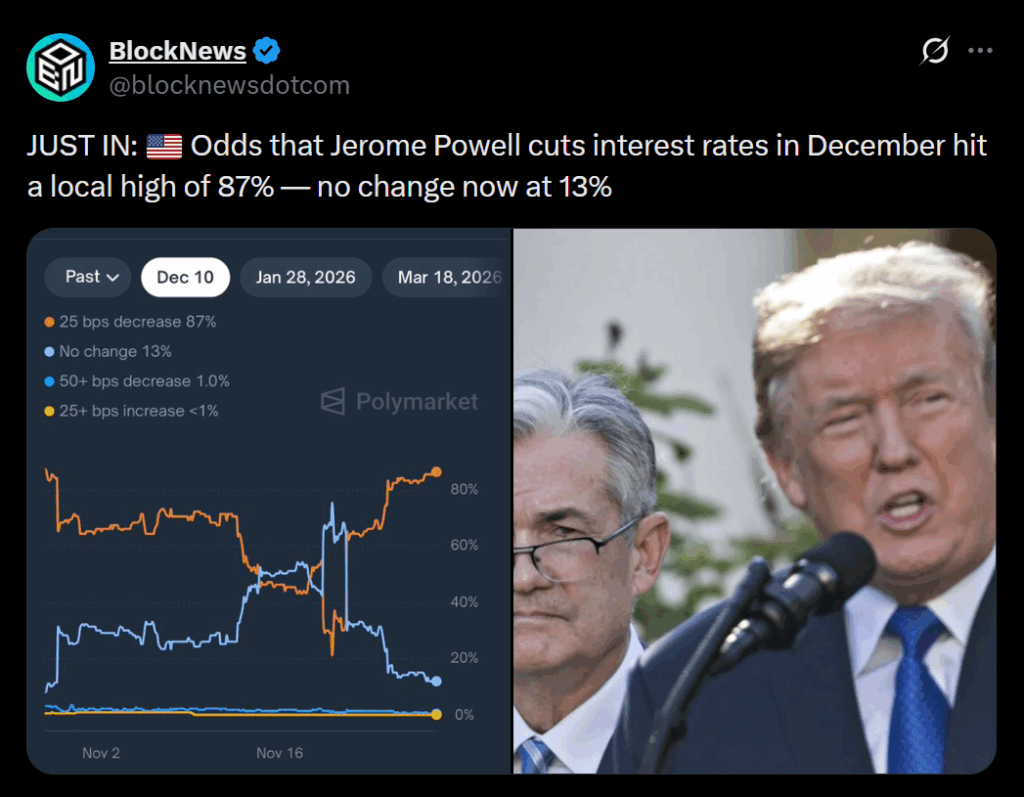

JPMorgan has abruptly reversed its earlier stance, now forecasting that the Federal Reserve will reduce rates of interest by 0.25% on the December 10 assembly. It is a sharp departure from weeks of messaging suggesting the Fed would delay till January. The shift comes simply as a number of Fed officers have grown extra open to easing sooner, particularly amid cooling labor circumstances. With odds climbing again towards 85%, markets are rapidly adapting to the renewed risk of a December coverage shift.

Why December Expectations Have Whipsawed

The trail to December has been unusually unstable. Charge-cut odds hit practically 100% in late October, plunged to 30% in early November when the federal government shutdown delayed key financial information, and surged once more as policymakers advised extra urgency. New York Fed President John Williams signaled {that a} December reduce could also be acceptable to forestall additional weak point. With no main information releases earlier than the December 9–10 assembly, the runway for a pre-holiday charge transfer is now open.

Why a December Charge Lower Might Supercharge Shares

If the Fed cuts this month, the timing is highly effective. Decrease charges sometimes increase equities by lowering borrowing prices and lifting valuations — however December traditionally amplifies that impact. The S&P 500 finishes December larger practically 73% of the time, whereas the Dow posts its greatest common month-to-month return. The Santa Claus rally window — the final 5 buying and selling days of the yr and the primary two of January — delivers good points virtually 80% of the time. A December reduce might gasoline a fair stronger year-end rally heading into 2026.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.