Solana (SOL) has reclaimed a key technical stage that might decide its subsequent huge transfer. On the time of writing, SOL is priced at round $142, displaying a 4% achieve previously 24 hours. Over the past week, it’s down by virtually 1% (per CoinGecko knowledge).

$130: The Pivot Degree for Path

Analyst Crypto Patel shared that SOL has bounced from the $130 assist stage. This bounce traces up with each a horizontal assist zone and a long-term rising trendline on the weekly chart. These areas have served as sturdy turning factors earlier than.

$SOL reclaimed the $130 assist with a clear bounce.

Sustained acceptance above $130 reactivates the $250 upside goal.

Failure to carry converts construction bearish, opening draw back towards the 0.382 Fib retrace at $75 and the 0.5 Fib stage at $50.$130 stays the essential… pic.twitter.com/fSfarBhKp6

— Crypto Patel (@CryptoPatel) November 26, 2025

Holding above $130 might maintain momentum on observe and produce targets close to $250 and $293 into focus. Each ranges have acted as resistance in previous market cycles.

Nonetheless, if SOL closes under $130 once more, the construction could flip bearish. This might open the best way to $74 and $50, that are marked as key Fibonacci retracement ranges and areas of earlier worth curiosity.

Moreover, CryptoCurb has outlined what appears to be like like a big Cup and Deal with sample on the long-term chart. The cup spans the transfer from SOL’s 2021 peak right down to its 2023 low and again up. The present range-bound motion is forming the deal with.

For this sample to play out, a transfer above the $250–$300 vary would wish to carry. This is able to set the subsequent key resistance space and will set off a transfer towards $2,000 if the value continues upward.

On-Chain Knowledge Displays Market Stress

On-chain analyst Ali Martinez has pointed to latest knowledge displaying that SOL has entered the capitulation zone on the Web Unrealized Revenue/Loss (NUPL) indicator. This implies most holders are at present underwater.

In line with the info, related strikes into this zone in 2022 lined up with longer-term worth bottoms.

“Solana normally bottoms when traders capitulate—and that’s what we’ve seen over the previous two weeks,” stated Ali.

The development has caught consideration, however the worth motion within the coming weeks will present whether or not it marks a real low.

Institutional Exercise and ETF Flows

Institutional participation has additionally grown. Upexi Treasury, which holds over 2 million SOL, is elevating as much as $23 million by way of non-public placement to assist operations and enhance SOL publicity.

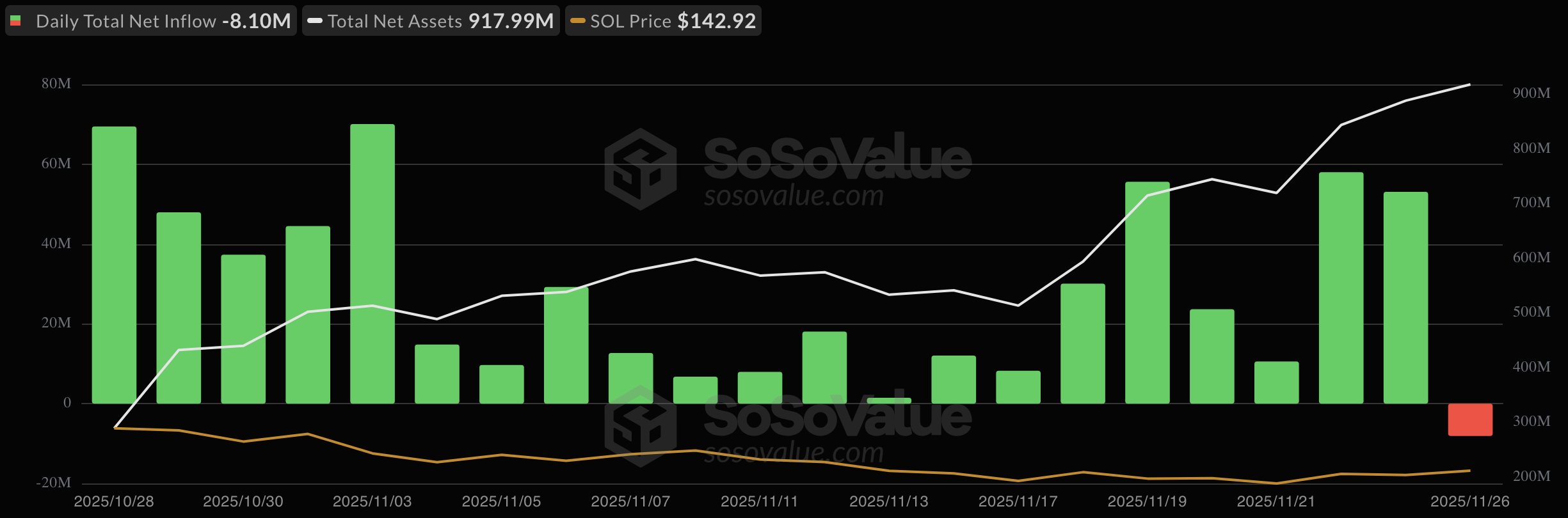

In ETF information, SOL ETFs pulled in $531 million throughout their launch week, pushed by 7% staking yields and decrease charges than Bitcoin ETFs. Nonetheless, on November 26, the primary web outflow was recorded at $8.1 million. Whole belongings underneath administration stay close to $918 million.

As CryptoPotato reported final month, a spot Solana ETF additionally gained regulatory approval in Hong Kong.

The publish Huge Solana (SOL) Transfer Forward? Watch This Essential Degree appeared first on CryptoPotato.