Be a part of Our Telegram channel to remain updated on breaking information protection

Tether CEO Paolo Ardoino says that the S&P International Scores company’s downgrade of Tether’s USDT stablecoin is an indication that the normal finance “propaganda machine is rising nervous.”

“The classical ranking fashions constructed for legacy monetary establishments, traditionally led non-public and institutional traders to speculate their wealth into firms that regardless of being attributed funding grade rankings collapsed,” Ardoino wrote in a current X publish.

“The normal finance propaganda machine is rising nervous when any firm tries to defy the power of gravity of the damaged monetary system,” he added. “No firm ought to dare to decouple itself from it.”

He then mentioned that Tether is the “first overcapitalized firm within the monetary trade, with no poisonous reserves.”

“Tether resides proof that the normal monetary system is so damaged that it’s turning into feared by the emperors with no garments,” Ardoino mentioned.

S&P Downgrades USDT’s Greenback Peg Score To Lowest Rating

Ardoino’s remarks come after S&P International Scores downgraded Tether’s USDT to the bottom rating on its stablecoin stability scale, citing issues across the token’s capability to take care of its peg to the US greenback.

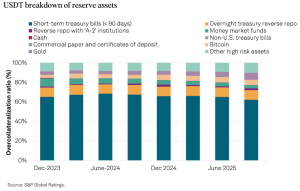

The “weak” evaluation was on account of a number of components, together with Tether’s resolution to again its USDT token with “higher-risk” property similar to Bitcoin, gold, loans and company bonds that it believes are topic to greater volatility than the greenback.

“Bitcoin represents 5.6% of USDT in circulation, exceeding the three.9% overcollateralization margin related to a collateralization ratio of 103.9%,” the rankings company wrote in its report.

“A decline within the worth of bitcoin or the worth of different higher-risk property might subsequently scale back collateral protection.” it went on to warn.

Breakdown of the property backing USDT (Supply: S&P International Scores)

The rankings company additionally highlighted that Tether is headquartered in El Salvador and controlled in response to the Nationwide Fee of Digital Belongings (CNAD), which it says has looser necessities for reserve property.

One other challenge that was highlighted by the S&P International Scores is the dearth of adequate audits or proof-of-reserve studies for Tether’s USDT.

Regardless of the weak ranking, the company did add that 75% of USDT’s backing comes from US Treasurys and different short-term monetary devices which are considered “low-risk.”

Report Comes Amid Landmark Yr For Stablecoins

The report from S&P International Scores follows what has been a report yr for stablecoins.

The house began to achieve substantial momentum after US President Donald Trump signed the GENIUS Act into legislation in July.

Stablecoin market cap (Supply: DefiLlama)

The regulatory readability that the GENIUS Act offered the trade noticed a number of main conventional finance companies begin to discover stablecoins. This led to the capitalization of the stablecoin market hovering to above $300 billion for the primary time.

Amid the increase within the stablecoin market, Tether’s USDT has maintained its dominance. Presently, the stablecoin accounts for over 60% of the market, or round $184.529 billion, knowledge from DefiLlama reveals. The subsequent-biggest stablecoin is Circle’s USD Coin (USDC), which has a capitalization of over $75.48 billion.

Tether Appearing Like A Central Financial institution

Together with its dominant place within the stablecoin market, Tether can also be the Seventeenth-largest holder of US Treasurys on the planet, with over $112 billion in short-term US authorities securities. This places it forward of most international locations, together with South Korea, Saudi Arabia, and Germany, in response to Ardoino.

With 135 billion of U.S Treasuries, Tether is now the Seventeenth largest holder of U.S debt, passing additionally South Korea.

Quickly Brazil! pic.twitter.com/wUDyvGcSHE— Paolo Ardoino 🤖 (@paoloardoino) October 29, 2025

Tether has additionally been accumulating massive quantities of gold. Jefferies not too long ago estimated that the stablecoin issuer holds round 116 metric tonnes of gold, which makes it “the most important private-sector gold holder outdoors central banks.”

Within the third quarter this yr alone, the stablecoin agency reportedly added 26 tonnes, which was roughly 2% of the worldwide gold demand throughout that interval.

Nevertheless, the corporate has not solely acquired substantial quantities of bullion, however has additionally reportedly acquired a big fairness stake of as much as 37.8% in a gold-royalty firm as a part of its broader push to develop its mining sector publicity and tokenized-gold infrastructure.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection