- Bitwise up to date its Avalanche ETF submitting with staking options and industry-low 0.34% charges, aiming for a Q1 2026 launch.

- AVAX jumped almost 7% to $15 after the submitting, although it nonetheless sits under main resistance at $18.

- The proposed BAVA ETF can be the primary within the U.S. to stake as much as 70% of its AVAX holdings, giving it a serious edge over VanEck and Grayscale.

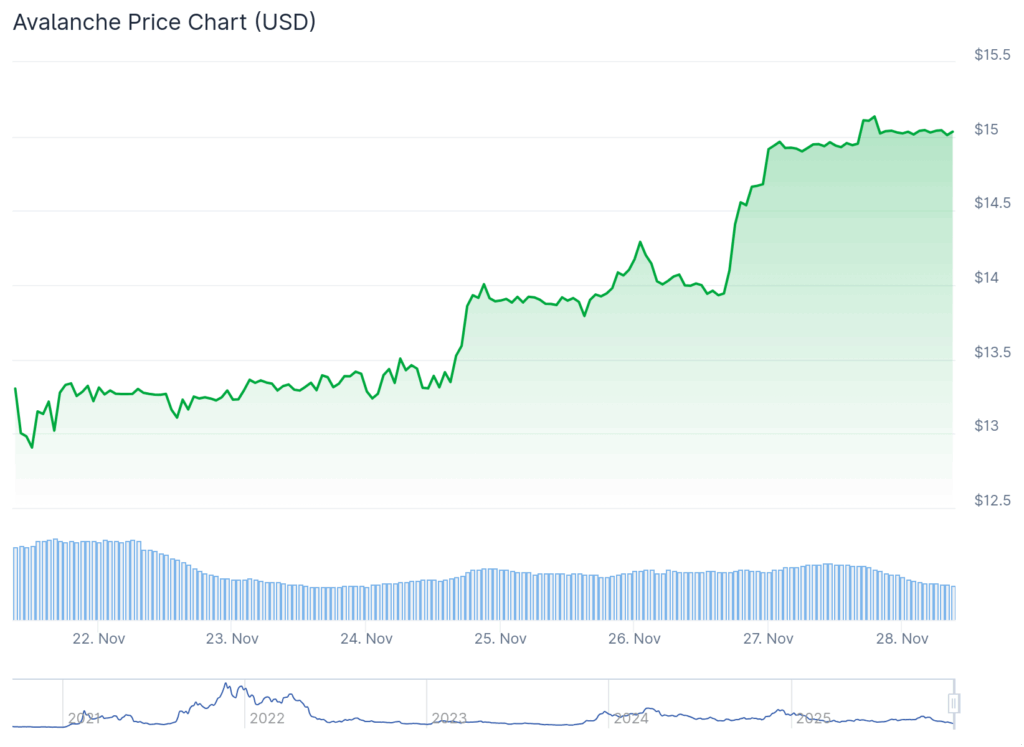

Bitwise stirred the market as soon as once more after updating its Avalanche ETF submitting, a transfer that immediately despatched AVAX climbing virtually 7% towards the $15 vary. The revised submission, delivered to the SEC on November 27, lays out a construction that feels unusually aggressive for a U.S. crypto ETF — primarily as a result of it leans immediately into staking, one thing opponents have prevented regardless of rising curiosity from establishments. Whereas these adjustments don’t assure approval, the replace makes it clear Bitwise desires to be first in line when regulators lastly green-light a staking-enabled ETF.

Bitwise’s BAVA ETF Introduces Staking and Beneath-Cuts Opponents

The ETF will commerce beneath the ticker BAVA on NYSE Arca if authorized, and Bitwise is ensuring the economics look tempting from the beginning. Its administration price lands at 0.34%, noticeably cheaper than VanEck’s 0.40% and Grayscale’s heavier 0.50%. Beneath the floor, although, the true disruption is the fund’s capability to stake as much as 70% of its AVAX holdings — one thing no different proposed U.S. ETF has tried. Current IRS steerage helped clear the fog round yield-generating property, and Bitwise appears wanting to take benefit earlier than anybody else steps in.

The fund retains 12% of staking rewards as a part of its working bills, letting the remaining move on to shareholders. VanEck and Grayscale don’t supply staking of their filings, which means Bitwise is betting that yield will pull curiosity through the early part of competitors. Notably, Bitwise plans to seed the ETF with 100,000 shares at $25 every, price $2.5 million, basically placing its personal capital on the road to bolster confidence.

Custody, Charges, and New Safeguards Forward of Launch

To get the inspiration proper, Coinbase Custody Belief Firm will safe the AVAX holdings, whereas BNY Mellon takes care of the money facet. The up to date submitting additionally comes with heavier disclosures, together with references to quantum-computing dangers, trade vulnerabilities, and an expanded liquidity reserve aimed toward avoiding disruptions in unstable markets. As an incentive, Bitwise will waive all charges for the primary month or till the ETF hits $500 million in property — a method that mirrors its earlier launches tied to XRP and Dogecoin.

Market Response: AVAX Pops however Nonetheless Faces Technical Obstacles

The market didn’t hesitate to reply. AVAX jumped round 7% the second the submitting hit the wire, lifting the token towards $15 with a market cap now hovering round $6.41 billion. Even with the transfer, AVAX nonetheless sits under its 50-day transferring common close to $18 — a stage merchants see as a vital momentum set off. A clear break above that zone might open targets close to $22, and presumably even $28 if quantity kicks in. If sellers regain management, nevertheless, the $14 help space turns into vital; a breakdown there might drag the token again to the $12 vary.

Regulatory Path: Q1 2026 Shaping Up as Avalanche’s Massive Second

Bitwise isn’t alone on this race. VanEck and Grayscale are each pushing for their very own Avalanche ETFs, with NASDAQ lined up as their most popular itemizing venue. All three issuers look like aiming for Q1 2026 approvals, though nothing is assured given present regulatory pacing. The up to date Bitwise submitting depends on the CME CF Avalanche-Greenback Reference Price as its benchmark, which ought to give traders a clear and clear learn on AVAX’s underlying worth all through the ETF’s lifecycle.

The put up Avalanche (AVAX) Worth Jumps as Bitwise Pushes a Staking-Enabled ETF Nearer to Actuality first appeared on BlockNews.