The true-world asset market has been recovering after a sluggish November, with contemporary curiosity rising from stablecoin experiments and powerful technical setups. Exercise stays uneven throughout the sector, however just a few charts are organising extra cleanly than the others.

Among the many key RWA tokens to look at, three stand out as December approaches. Every reveals a unique mixture of energy, restoration potential, and threat.

Stellar (XLM)

Amongst key RWA tokens to look at in December, Stellar (XLM) stands out as a payments-first chain that huge monetary gamers really use.

Sponsored

Sponsored

November was nonetheless tough, with XLM down about 18.9%, however the final seven days introduced a 4.9% bounce as US Financial institution’s stablecoin exams and rising AUDD exercise pushed contemporary consideration towards the community.

On the chart, Stellar is quietly constructing a reversal setup. Between November 4 and November 21, the value reached a decrease low; nevertheless, the Relative Power Index (RSI) fashioned the next low.

RSI measures momentum on a 0–100 scale, so this “worth down, RSI up” sample, commonplace bullish divergence, usually hints that promoting strain is fading underneath the floor.

The rebound started instantly after that sign, but XLM stays trapped in a decent vary between $0.253 and $0.264. A clear day by day shut above $0.264 is the primary signal that bulls are again in management.

If that occurs, the subsequent upside areas to look at are $0.275 after which $0.324 if the broader market improves.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

If the XLM worth falls under $0.239 as an alternative, the bullish setup weakens, and the transfer may stretch towards $0.217, delaying any RWA-driven restoration story.

Sponsored

Sponsored

Quant (QNT)

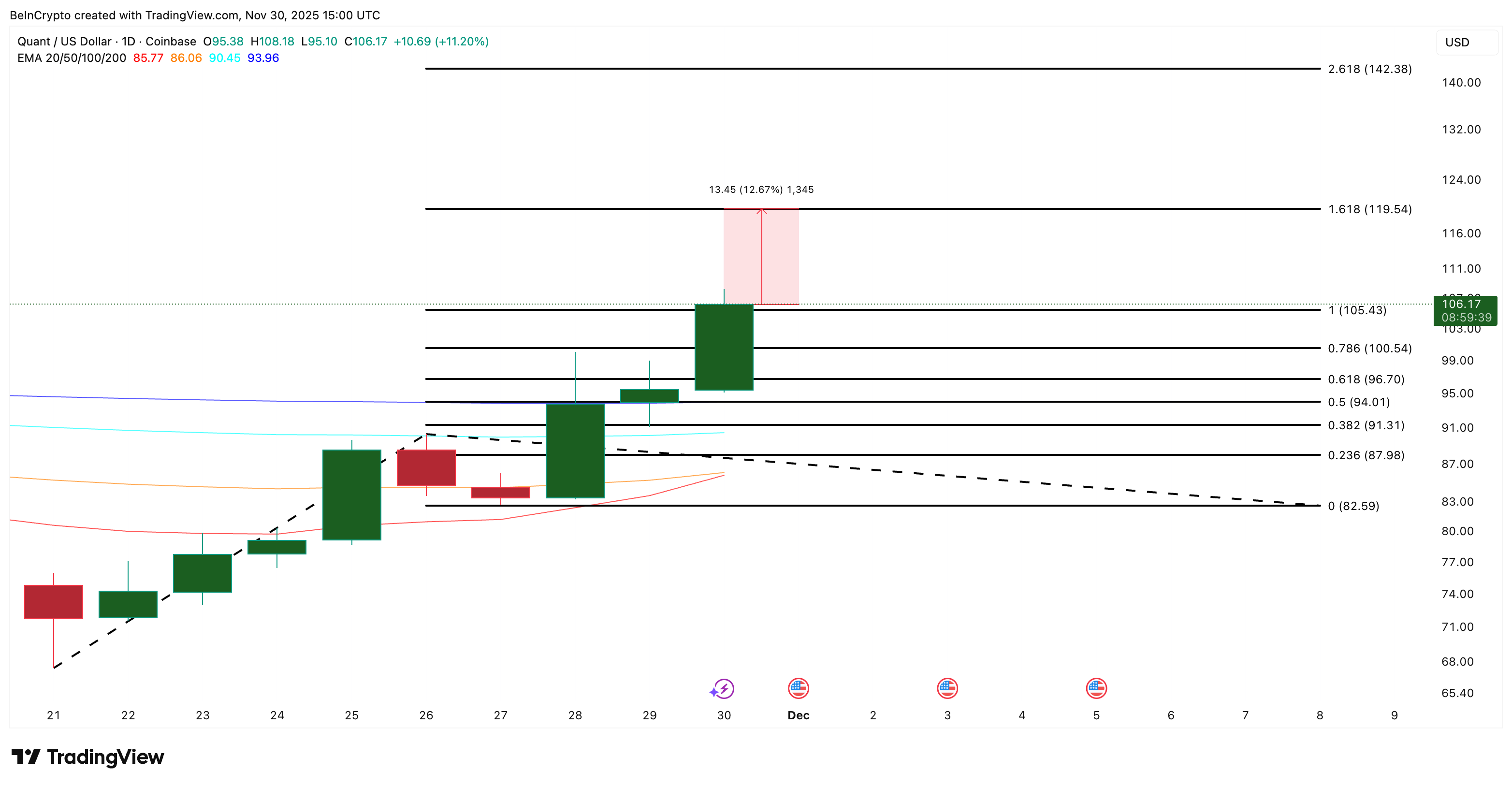

Quant is the clear outlier amongst RWA tokens to look at proper now. Whereas most real-world-asset performs struggled by means of November, QNT moved in the wrong way. It’s up about 32% this month and roughly 37% up to now seven days. Within the final 24 hours alone, the token added one other 12%, making it one of many strongest charts on this phase.

Quant sits on the heart of the “interoperability for finance” narrative. Its Overledger tech connects personal and public blockchains, which is why it usually reacts sooner than different RWA cash when institutional demand strengthens.

On the chart, momentum continues to be constructing. QNT is near forming a bullish EMA (Exponential Shifting Common) crossover on the day by day chart, the place the 20-day EMA is about to maneuver above the 50-day EMA.

This setup usually alerts that patrons are gaining management. If the crossover completes, Quant (QNT) may have room for one more sturdy push.

The EMA, or Exponential Shifting Common, is a pattern line that provides extra weight to latest costs, permitting merchants to see short-term momentum extra clearly.

The primary stage to clear is $119. This stage traces up with the 1.618 Fibonacci extension. If patrons keep energetic, even $142 comes into view as the subsequent main resistance.

Sponsored

Sponsored

On the draw back, $100 is the primary help to look at. Shedding that stage can pressure QNT again towards $91 and $87. The broader bullish construction breaks provided that the token falls under $82. That is the purpose at which the present uptrend stops making sense.

For now, Quant stays essentially the most resilient title on this RWA group and carries the strongest momentum heading into December.

Ondo (ONDO)

Ondo sits in an attention-grabbing spot among the many key RWA tokens’ checklist. It’s up 9.3% over the previous seven days however stays one of many weakest performers on a 30-day view, down 25%.

Curiosity across the token elevated this week after a publish highlighted that Ondo Finance could prolong tokenized US shares and ETFs throughout Europe.

If this route holds, it may add weight to Ondo’s position within the broader RWA area. And that might even impression the value motion.

Sponsored

Sponsored

That uncertainty reveals up on the chart. Ondo has posted a gradual rebound since November 21, however the extra vital improvement is clear in its OBV line.

OBV, or on-balance quantity, measures whether or not shopping for quantity is stronger than promoting quantity over time. Ondo’s OBV has damaged above the descending trendline in place since early November.

This breakout occurred whereas the value has been caught between $0.50 and $0.54 since November 27, which means that accumulation could also be forming beneath the floor.

For upside motion, step one is a clear shut above $0.54. That stage sits about 6% above the present worth. Clearing it could actually pave the best way for a transfer towards $0.60, and a stronger market may push the ONDO worth towards $0.70.

If OBV fails to carry above the breakout line and slips again underneath it, the transfer turns into a fake-out. In that case, shedding $0.50 turns into extra probably, and the subsequent key help is close to $0.44.

Among the many RWA tokens, ONDO has essentially the most balanced setup. It has the construction to maneuver larger if accumulation continues, however the identical vary can break on the draw back if OBV weakens once more.