BitMEX co-founder Arthur Hayes has warned that Tether dangers balance-sheet insolvency if its Bitcoin and gold reserves endure a 30% drawdown.

His November 30 put up targets the structural vulnerabilities in Tether’s newest asset allocation. He suggests the agency has tied its solvency to the efficiency of unstable danger belongings relatively than relying solely on the soundness of presidency debt.

Sponsored

Hayes Critique Tether’s Gold and Stablecoin Holdings

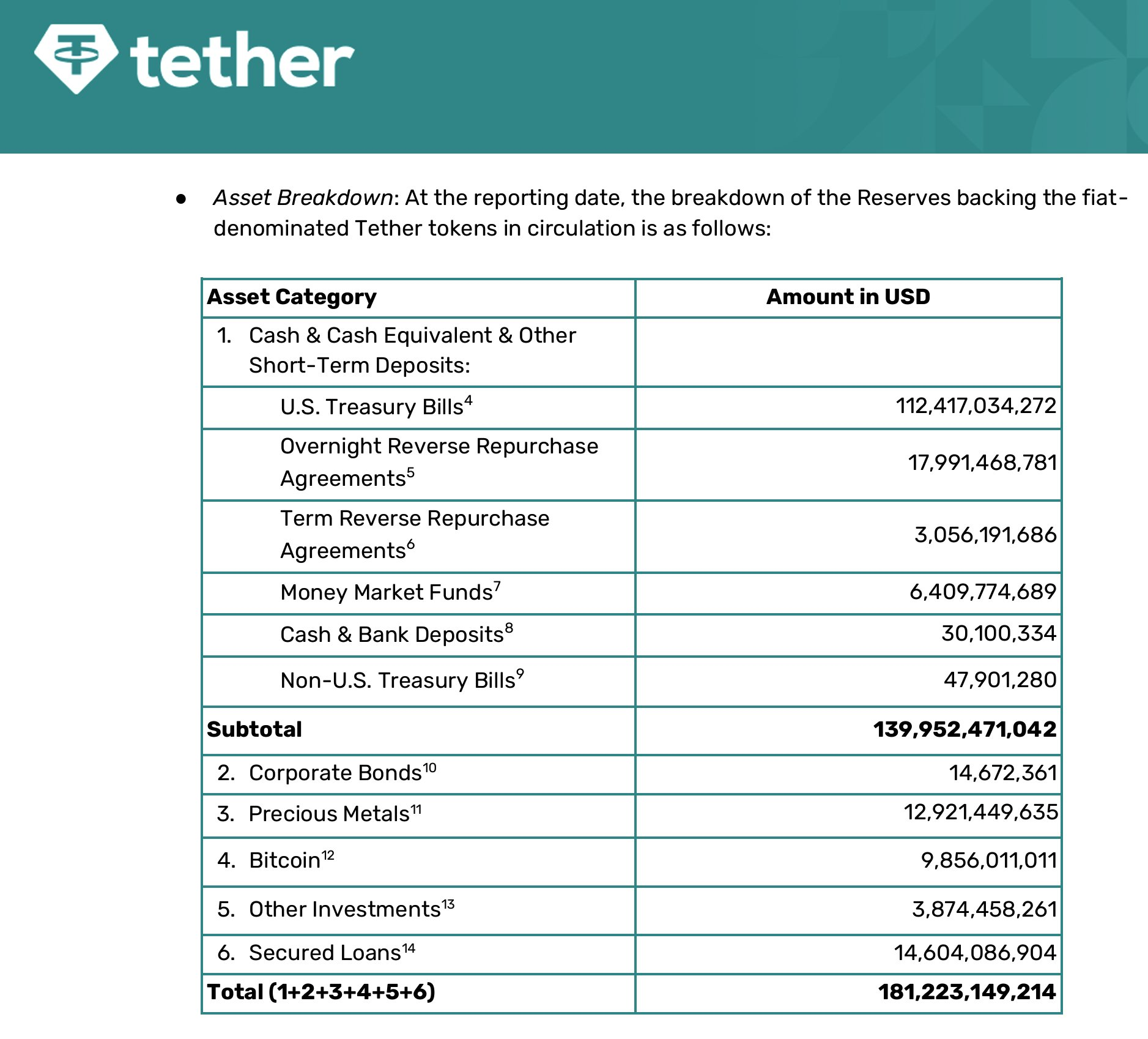

Hayes’ evaluation attracts on Tether’s third-quarter 2025 attestation, which reveals a major rotation into non-fiat collateral. The report exhibits the issuer now holds $12.9 billion in valuable metals and $9.9 billion in Bitcoin.

In keeping with Hayes, this allocation represents a deliberate “rate of interest commerce.” His thesis posits that Tether is making ready for Federal Reserve fee cuts that might compress the yield on its large portfolio of US Treasury payments.

“[Tether] thinks the Fed will minimize charges, which crushes their curiosity earnings. In response, they’re shopping for gold and BTC that ought to in principle moon as the worth of cash falls,” Hayes famous.

Nonetheless, Hayes argues this technique introduces uneven danger to the corporate’s skinny layer of fairness.

Hayes contends that this determine exceeds Tether’s surplus capital, rendering the agency theoretically bancrupt even when it stays operationally liquid.

Sponsored

He warned that such a state of affairs would doubtless pressure massive holders and exchanges to demand a real-time view of the stability sheet to evaluate the security of the peg. Notably, this warning aligns with S&P International’s resolution to assign USDT a ‘5’ score, the bottom on its scale.

Business Stakeholders Defend Tether

Business proponents keep that the insolvency thesis conflates stability sheet accounting with precise liquidity danger.

Tran Hung, CEO of UQUID Card, dismissed the warning as essentially flawed.

He famous that the overwhelming majority of Tether’s $181.2 billion stability sheet stays parked in extremely liquid, low-risk devices. Certainly, the attestation confirms Tether holds $112.4 billion in US Treasury Payments and practically $21 billion in repo agreements.

Sponsored

Hung argues these “Money and Money Equivalents” present a liquidity wall adequate to cowl the overwhelming majority of USDT in circulation.

Contemplating this, he argued that Tether would stay totally redeemable even when a market downturn eradicated its company fairness buffer.

“Tether has constantly demonstrated robust redemption capability, together with $25 billion redeemed in simply 20 days through the 2022 market disaster (FTX disaster), one of many largest liquidity ‘stress checks’ in monetary historical past,” Hung famous.

Sponsored

In the meantime, Cory Klippsten, CEO of Swan Bitcoin, identified that Tether’s leverage is more aggressive than that of conventional monetary establishments.

Tether is working about 26x leverage with a 3.7% fairness cushion. About three quarters of belongings are short-term sovereign and repo; one quarter is a mixture of BTC, gold, loans, and opaque investments,” Klippsten stated.

In keeping with him, a 4% portfolio loss would erase the frequent fairness, whereas A 16% drop within the riskiest belongings would have the identical impact.

Nonetheless, regardless of the structural leverage, he suggests the danger is mitigated by Tether’s sheer profitability. Certainly, the stablecoin issuer is on monitor to report a revenue of greater than $15 billion this 12 months.

Furthermore, Klippsten additionally famous that Tether’s homeowners not too long ago withdrew a $12 billion dividend. Contemplating this, he argued they’ve the capability to recapitalize the agency instantly if its buffer had been ever breached.