- Arthur Hayes warns Tether’s rising publicity to Bitcoin and gold may create liquidity threat throughout a pointy market drop.

- Analysts argue Tether is financially stronger than critics declare, with $181B in belongings and practically $10B in annual revenue.

- Tether operates extra like a fractional-reserve system, however with far larger liquidity ratios than conventional banks.

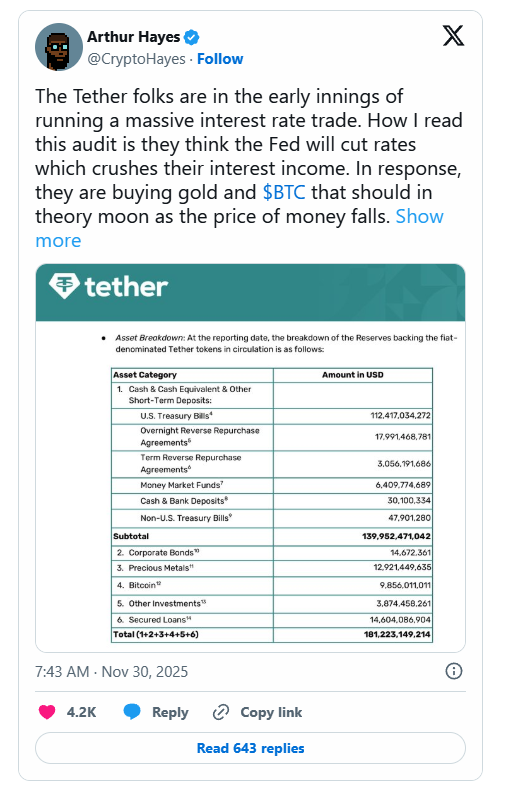

BitMEX co-founder Arthur Hayes stirred up a contemporary wave of fear this week after claiming that Tether — the world’s largest stablecoin issuer — is taking over critical threat throughout the coming Federal Reserve rate-cut cycle. He pointed to Tether’s rising publicity to Bitcoin and gold, arguing {that a} sudden pullback in these belongings may squeeze its liquidity and set off concern round USDT’s backing. However the crypto neighborhood, analysts, and even former Wall Road researchers pushed again quick, saying Tether shouldn’t be solely solvent, however in all probability stronger than most banks working right now.

Hayes Raises the Crimson Flag on Tether’s Reserves

Hayes claims the shift in Tether’s newest report is the actual hazard: as a substitute of maintaining every thing in cash-like reserves, the corporate has been leaning additional into BTC, gold, and different investments. Tether holds round $181 billion in complete belongings, with $174 billion in liabilities — solvent on paper, however not 100% liquid at any given second. Based on Hayes, if Bitcoin or gold instantly tanked, that would drag down Tether’s fairness cushion and spark panic promoting. S&P International echoed one thing related earlier this 12 months, slapping Tether with a “weak” stability score partly as a result of its reserve combine isn’t purely defensive.

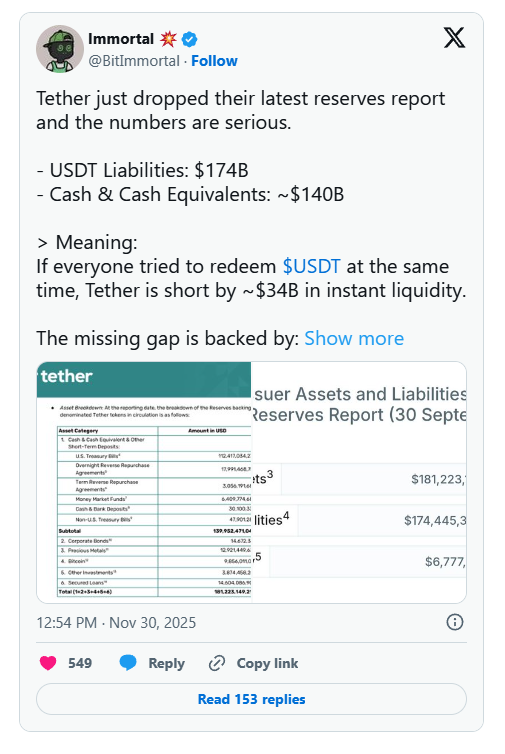

Tether, for its half, dismissed the S&P framework as outdated and pointed to its monumental day by day settlement flows as proof that the system works. Analyst BitImmortal broke the reserves down even additional: $140 billion is totally liquid (money and equivalents), however roughly $34 billion sits in Bitcoin, gold, secured loans, and different combined investments. Structurally, that appears extra like a fractional-reserve mannequin — the identical mannequin banks use — somewhat than a completely liquid vault. Every part features easily when redemptions are regular, however an excessive panic may put stress on how shortly Tether can unwind the non-cash chunk.

Analysts Argue Tether Is Stronger Than Critics Suppose

Former Citi Analysis crypto lead Joseph stepped in to counter Hayes, saying the reserve report isn’t even the complete image. He defined that the disclosure solely covers the matched reserves for USDT, not Tether’s full company steadiness sheet. The corporate additionally holds separate fairness — together with mining operations, non-public investments, and probably extra BTC — which doesn’t seem in the identical submitting however nonetheless contributes to the corporate’s monetary security web.

Joseph additionally argued that Tether is insanely worthwhile. With over $120 billion in Treasuries incomes round 4% since 2023, and virtually no operational overhead, Tether is producing near $10 billion per 12 months in revenue. That places its fairness valuation deep into the tens of billions, which means Tether has much more flexibility than critics assume. In a liquidity crunch, promoting fairness or tapping company reserves may resolve the issue lengthy earlier than USDT holders really feel any shock.

A Liquidity Debate, Not a Solvency One

Joseph completed by evaluating Tether to the standard banking system: banks sometimes maintain solely 5–15% of deposits in liquid reserves, far lower than Tether’s ratio. The distinction, he mentioned, is that banks have a central-bank backstop, whereas Tether doesn’t. That lack of a lender of final resort doesn’t mechanically imply instability — it merely means Tether has to handle its construction in a different way. And thus far, it has completed that whereas increasing provide, growing buffers, and staying massively worthwhile.

The underside line? Hayes is warning about liquidity pace, not whether or not Tether is definitely underwater. Analysts consider Tether is much stronger than the concern narrative suggests — however the debate over how “protected” a stablecoin really might be isn’t going away anytime quickly.

The put up Arthur Hayes Warns Tether Is Sitting on Main Threat — Right here Is Why Analysts Say He’s Improper first appeared on BlockNews.