HBAR value is down about 6% prior to now 24 hours, underperforming an already weak crypto market. Even with this strain, the chart is flashing a uncommon mixture of three early rebound clues that the majority mid-caps should not exhibiting proper now.

If the broader market steadies, HBAR may very well be one of many first to maneuver, particularly if it protects a key help degree mentioned later.

Sponsored

Sponsored

Accumulation Indicators Construct Beneath the Decline

HBAR has moved inside a broad falling wedge since early September. This sample usually turns bullish when sellers lose management close to the decrease boundary, and that shift first appeared round November 21.

The primary clue comes from the altering quantity habits. HBAR’s exercise follows a Wyckoff-style coloration sample: pink reveals sellers in management, yellow reveals sellers gaining management, blue marks patrons gaining management, and inexperienced reveals patrons totally in management.

Since HBAR peaked at $0.155 on November 23 and fell almost 15%, the bars have shifted from heavy pink to a mix of yellow and blue. That mix is a traditional signal of vendor exhaustion and early tug-of-war. The final time this combine confirmed up — between October 15 and October 28 — HBAR climbed 41% proper after.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

A second clue seems within the MFI (Cash Stream Index), which tracks shopping for and promoting strain utilizing each value and quantity. Between November 23 and December 1, the HBAR value stored making decrease highs whereas MFI made greater highs. That divergence reveals dips are being quietly purchased. The same divergence shaped between October 6 and October 24 and led to a 33% soar as soon as it accomplished.

Sponsored

Sponsored

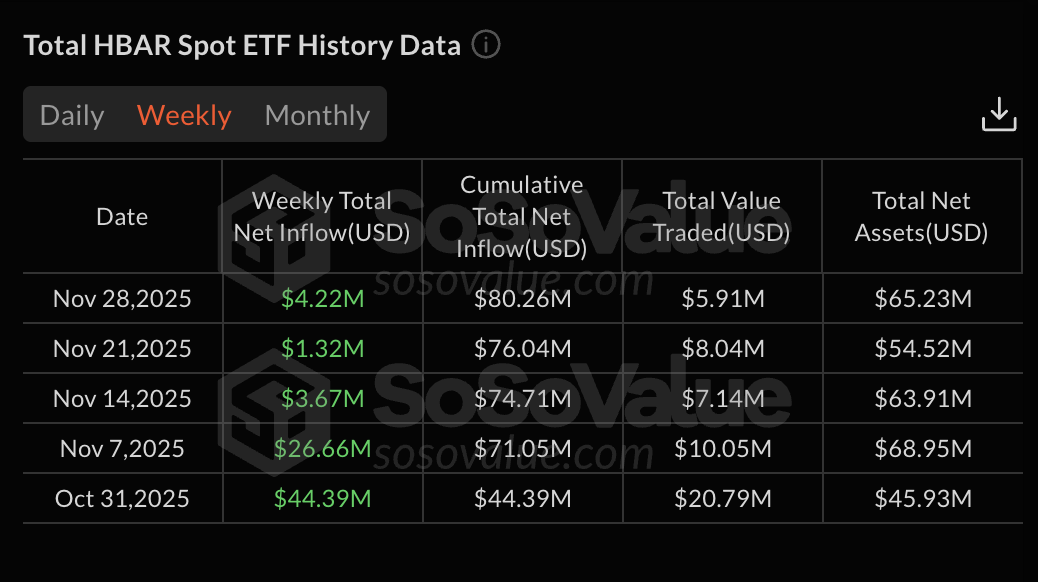

The third clue comes from regular spot ETF demand. The Canary HBAR Spot ETF has posted optimistic weekly inflows in 4 of the final 5 weeks, with greater than $80 million in cumulative inflows. Inflows are smaller than late October, however they continue to be optimistic whilst value falls — that means broader demand has not vanished.

Collectively, these three clues — shifting quantity management, dip-buying strain, and ongoing ETF inflows — present early accumulation forming beneath the floor.

Key HBAR Worth Ranges Determine Whether or not the Rebound Can Maintain

The wedge’s decrease boundary close to $0.122 is a very powerful help for HBAR proper now. Holding that space retains the rebound case alive. Dropping it exposes the following main zone close to $0.079, which might flip the construction from “early accumulation” to a deeper slide.

For power, HBAR must reclaim $0.140 first, a 5% rebound from the present degree. That might present that patrons are lastly overpowering the sell-side strain. If $0.140 breaks, the following main degree sits at $0.155. Clearing $0.155 opens the trail towards $0.169 and even $0.182 if the crypto market improves.