- Solana spot ETFs lastly broke a 21-day outflow streak with $5.37M in internet inflows, led primarily by Grayscale’s GSOL and Constancy’s FSOL.

- Regardless of renewed institutional demand, SOL value slipped again underneath $140 and stays down 30% over the previous month.

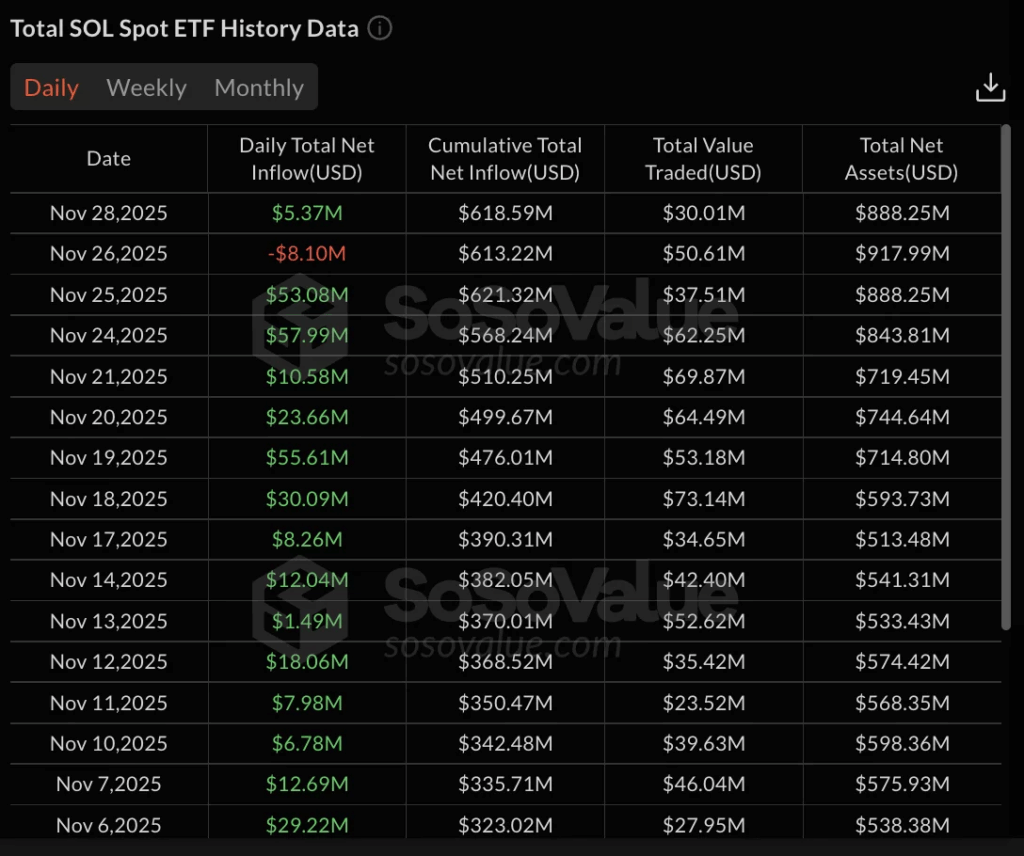

- Whole Solana ETF inflows reached $618.59M, however the disconnect between rising ETF demand and weak value motion suggests accumulation at decrease ranges.

Solana’s spot ETFs lastly flipped inexperienced after an extended 21-day stretch of straight outflows, giving merchants a little bit breather… despite the fact that the value itself didn’t observe the temper. On November 28, the ETFs pulled in $5.37 million in internet inflows, snapping the dropping streak, however SOL nonetheless couldn’t maintain above $140 and drifted decrease once more. It’s a type of bizarre market moments the place institutional cash is available in—however the chart kinda shrugs anyway

(Supply: SoSoValue.com)

GSOL and FSOL Lead the Push, however Outflows Offset A part of the Bounce

Grayscale’s GSOL carried a lot of the weight, pulling in $4.33 million all by itself, with Constancy’s FSOL including one other $2.42 million. On the flip facet, 21Shares’ TSOL shed $1.38 million, trimming a number of the features, whereas Bitwise’s BSOL, VanEck’s VSOL, and Canary’s SOLC principally stayed silent—zero stream exercise in any respect. Not precisely fireworks, however at the least it wasn’t one other pink day after three straight weeks of bleeding.

The influx comes proper after a stretch the place SOL ETFs have been dumping capital—Nov. 26 alone noticed an $8.10 million outflow. Simply earlier than that, although, November 24 and 25 introduced in sizeable inflows of $57.99M and $53.08M. Kinda just like the market has been tug-of-war’ing all month.

Worth Motion Nonetheless Weak Whilst ETF Flows Recuperate

Regardless of the ETF rebound, Solana’s value motion didn’t perk up. SOL is down 2% within the final 24 hours and a heavy 30% within the final 30 days. It briefly touched $143 earlier within the day however couldn’t dangle on, slipping again underneath $140 the place it’s been caught most of the time. The one shiny spot is a modest 8% achieve over the previous week—not sufficient to offset the bigger downtrend however at the least one thing.

Cumulative internet inflows throughout all Solana ETFs now sit at $618.59 million as of Nov. 28, with whole AUM at $888.25 million. Buying and selling quantity for the day hit $30.01 million, displaying that curiosity remains to be circulating even whereas the token value cools off.

Grayscale and Bitwise Nonetheless Management the Narrative

Zooming out, Bitwise’s BSOL remains to be the clear heavyweight with $527.79 million in whole inflows since launch. Grayscale’s GSOL sits at $77.83 million, whereas Constancy’s FSOL holds $32.30 million. 21Shares’ TSOL, in the meantime, has fought a dropping battle since day one with $27.60 million in cumulative outflows. VanEck’s VSOL and Canary’s SOLC proceed to function with smaller bases.

The humorous half is the disconnect—establishments are clearly nibbling at SOL at these decrease ranges, but the value isn’t acknowledging it. Whether or not that’s stealth accumulation or simply broader market fatigue remains to be up for debate, however for now, SOL hasn’t been in a position to reclaim the $140 deal with even with the ETF restoration serving to from the sidelines.

The publish Solana ETFs Lastly Break Their 21-Day Purple Streak, however SOL Nonetheless Slips Underneath $140 first appeared on BlockNews.

BITWISE RECORDS LARGEST INFLOW FOR SOLANA

BITWISE RECORDS LARGEST INFLOW FOR SOLANA