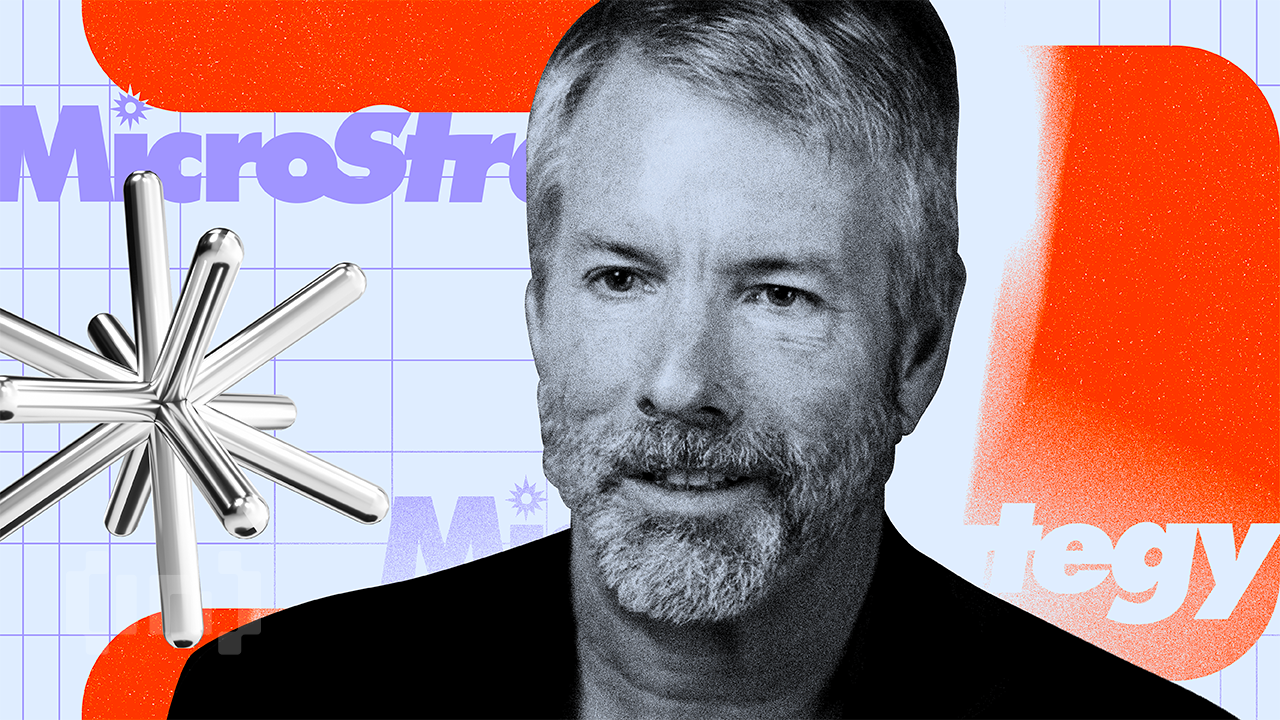

MicroStrategy Chairman Michael Saylor’s cryptic submit, “What if we begin including inexperienced dots?” to his well-known Bitcoin accumulation chart, has fueled widespread hypothesis throughout crypto circles.

The sign emerges simply as CEO Phong Le publicly acknowledged, for the primary time, that the corporate might promote Bitcoin beneath sure stress circumstances. This twin narrative might mark a turning level for the company world’s most aggressive Bitcoin treasury technique.

Sponsored

Sponsored

Decoding the Inexperienced Dots Thriller

Saylor’s Sunday submit on X displayed the corporate’s Bitcoin portfolio chart. It outlined 87 buy occasions totaling 649,870 BTC, valued at $59.45 billion, with a mean value of $74,433 per Bitcoin. Orange dots mark every acquisition since August 2020, whereas a dashed inexperienced line exhibits the common buy worth.

The crypto neighborhood rapidly interpreted the inexperienced dots as a sign for accelerated Bitcoin purchases. One analyst summarized the bullish case, noting MicroStrategy has capital, conviction, substantial web asset worth, and money move to assist continued acquisitions. Nevertheless, some supplied various theories, together with the potential for inventory buybacks or asset restructuring.

This ambiguity displays Saylor’s historical past of cryptic messages. Supporters view his posts as deliberate indicators of technique, whereas skeptics query if they’re merely for engagement. Nonetheless, the timing of this sign, together with monetary disclosures, factors to greater than mere commentary.

First Admission: Bitcoin Gross sales Stay an Possibility

In a big shift from MicroStrategy’s “by no means promote” philosophy, CEO Phong Le publicly admitted the corporate might promote Bitcoin if sure disaster circumstances come up. MicroStrategy would think about a sale provided that two triggers happen: the inventory trades beneath 1x modified Internet Asset Worth (mNAV) and the corporate can’t increase new capital by means of fairness or debt.

Sponsored

Sponsored

Modified Internet Asset Worth measures the corporate’s enterprise worth divided by its Bitcoin holdings. As of November 30, 2025, the mNAV was close to 0.95, near the edge. If it drops beneath 0.9, MicroStrategy might be pressured to liquidate Bitcoin to satisfy its $750 to $800 million annual most well-liked share dividend obligations.

The corporate issued perpetual most well-liked inventory all through 2025 to fund Bitcoin acquisitions. Based on official press releases, the 8.00% Collection A Perpetual Strike Most popular Inventory requires quarterly dividends beginning on March 31, 2025. These ongoing obligations add new liquidity strain, particularly as fairness markets grow to be much less receptive to new issuances.

This coverage change introduces a measurable danger threshold. Analysts now think about MicroStrategy very similar to a leveraged Bitcoin ETF: benefiting from appreciation in bull markets, however uncovered to amplified dangers when liquidity tightens.

Bitcoin Worth Motion and Strategic Implications

Bitcoin’s latest worth motion provides important context to each Saylor’s message and Le’s admission.

MicroStrategy’s portfolio confirmed a 22.91% achieve ($11.08 billion) as of November 30, 2025, bringing its valuation to $59.45 billion. Nevertheless, its inventory declined by greater than 60% from latest highs, revealing a spot between Bitcoin features and shareholder returns. This hole impacts the mNAV calculation and raises questions concerning the technique’s sustainability.

Some neighborhood members acknowledge this rigidity. One observer commented on X that inexperienced dots might counsel extra Bitcoin acquisitions, however the important thing subject is whether or not MicroStrategy can maintain by means of deep drawdowns with out pressured liquidation. This underscores the technique’s problem: robust in bull markets however unproven in downturns.

Based on the corporate’s third-quarter 2025 monetary outcomes, it held roughly 640,808 bitcoins as of October 26, 2025, with an authentic value foundation of $47.4 billion. The next development to 649,870 BTC by November 30 highlights ongoing accumulation regardless of volatility.