- Whale transactions have dropped sharply, weakening DOGE’s short-term energy.

- Retail is dominating Futures buying and selling whereas whales accumulate slowly on Spot.

- Historic patterns trace at a potential rally if broader market circumstances enhance.

Dogecoin has been wobbling a bit, dropping underneath the $0.15 line whereas someway nonetheless hanging onto its top-10 spot out there. The final week of November seemed fairly bullish for many main belongings, but DOGE solely managed to crawl up round 4% — not horrible, however undoubtedly not the form of transfer that excites a memecoin crowd. With its market cap sitting close to $22 billion, the chain’s latest on-chain conduct appears to present some clues about why issues really feel sluggish. Humorous sufficient, outdated feedback from Vitalik Buterin praising Dogecoin have resurfaced, including a bizarre nostalgia undertone to the present dip. However the true query is lingering: is DOGE gearing up for a bounce, or is that this simply the beginning of one other slide?

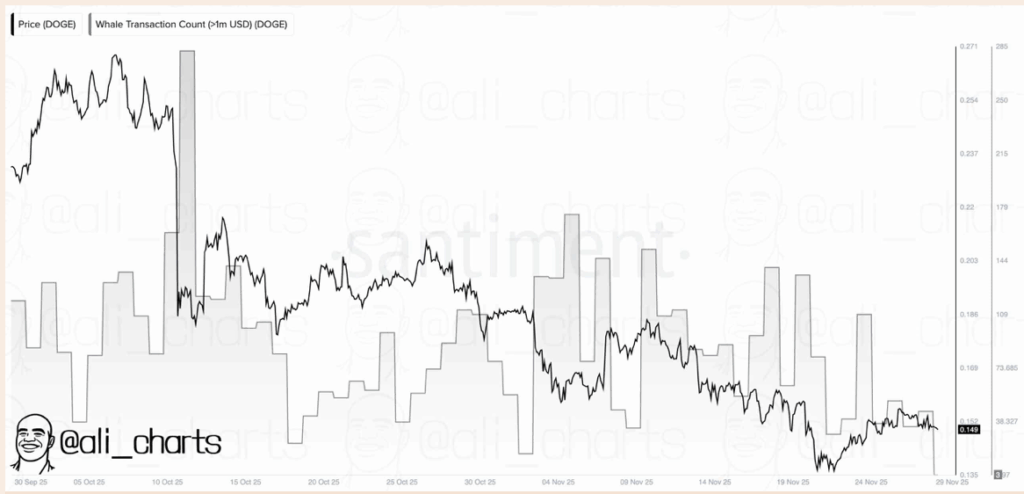

Whale Exercise Drops to Regarding Lows

In line with Santiment, Dogecoin’s whale transactions — particularly these involving over $1 million positions — have fallen off a cliff within the final two months. They dropped from about 285 all the way down to underneath 38, which is a fairly dramatic slowdown. When whales and massive establishments step again, liquidity weakens and costs are likely to drift or pull again. That explains why DOGE hasn’t been in a position to reclaim these pre-election 2024 ranges through the latest two-month retracement. The worth, overlaid on the identical chart, has fallen from $0.271 all the best way all the way down to $0.13 at one level. Traditionally, drops like this have generally marked main turning factors… however provided that different alerts line up with it.

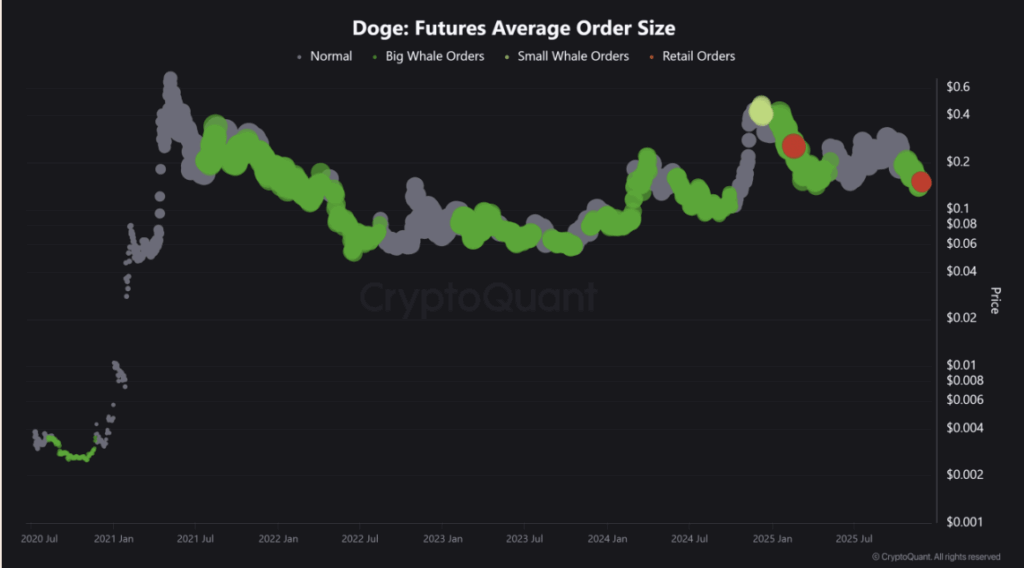

Retail Dominates Futures Whereas Whales Slowly Accumulate

CryptoQuant’s information paints a barely extra sophisticated image. Whereas whales have backed off from Futures exercise, they’re nonetheless lively on Spot — which often hints at accumulation. However the accumulation appears gradual and cautious, not the form of aggressive shopping for that pushes the value sharply larger. In the meantime, Futures positions are crowded with retail merchants, which explains a part of the sluggish worth motion. Retail simply doesn’t have the capital firepower to maneuver DOGE meaningfully by itself. Sentiment readings present that futures merchants had been bearish with a rating of 1.31, mainly signaling they had been promoting into the weak point. Good Cash, though small in quantity, leaned faintly bullish, which simply provides one other layer of blended alerts.

Might Dogecoin Stage a Shock Rally?

Technically, Dogecoin did break under a key worth degree, however right here’s the place issues get fascinating — historic information from This autumn 2024 exhibits that when DOGE broke under the identical two-touch assist, the following transfer was really a rally. Analyst Dealer Tardigrade identified an identical sample forming now, suggesting DOGE may “pump” and presumably even push previous $0.60 if circumstances line up. However all of this nonetheless relies upon closely on the broader crypto market. The complete area has been struggling, and DOGE hasn’t been an exception, although the retreat in each worth motion and on-chain exercise could be getting near the purpose the place reversals have a tendency to look. Right here is the place the following few weeks may determine whether or not this dip was exhaustion… or simply the calm earlier than a stronger transfer.

The publish Will DOGE Repeat Its Historic Pump After This Deep Retrace? — Right here is. first appeared on BlockNews.