November was not an excellent month for the Bitcoin (BTC) bulls, for the reason that asset’s value tumbled by roughly 17%.

As a substitute of bringing some hope, December delivered much more ache, and now the massive query is whether or not the valuation will collapse to $50,000 or stage a resurgence to $120,000 by Christmas. To achieve a clearer perspective, we determined to ask 4 of the preferred AI-powered chatbots for his or her tackle the matter.

What’s Extra Possible?

ChatGPT prompt {that a} sharp decline to $50K earlier than December 25 is feasible however would require a significant unfavourable catalyst. Such occasions can be a meltdown of a preferred crypto trade (much like what occurred with FTX in 2022) or a brand new navy battle throughout the globe.

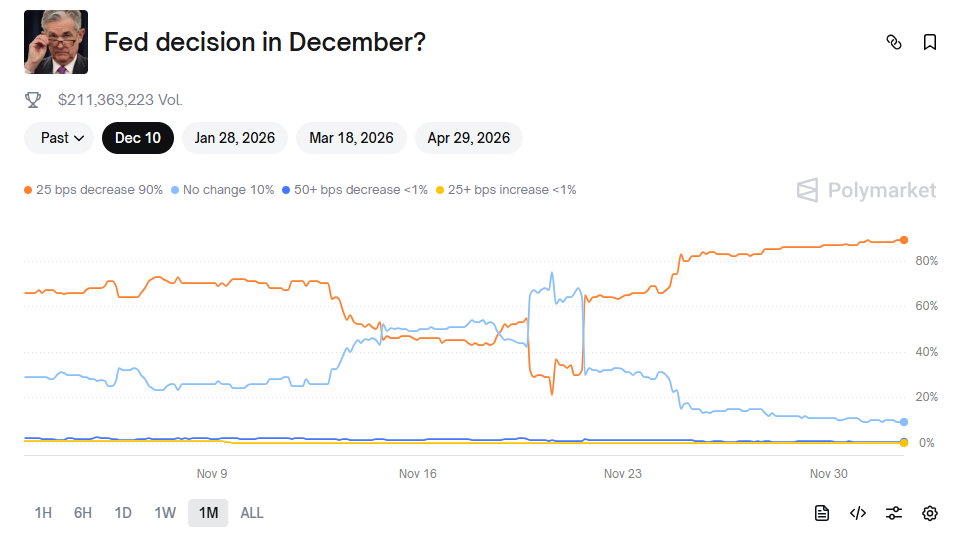

The chatbot assumed that an surprising Federal Reserve rate of interest hike may even have the identical impact. America’s central financial institution will resolve on December 10 whether or not to chop, increase, or maintain the benchmark unchanged, and as of this writing, the percentages of a 0.25% lower stand at 90%.

ChatGPT sees a barely larger probability of a pump to $120K earlier than Christmas. Nonetheless, such a value explosion would rely closely on elements like renewed institutional inflows into spot BTC ETFs, an enormous shopping for spree by whales, and general macro optimism.

In conclusion, the chatbot estimated that the almost definitely state of affairs for the main digital asset is to hover between $70,000 and $95,000 by December.

Grok took a much more bullish stance, insisting {that a} collapse to $50,000 earlier than Christmas is solely off the desk for BTC.

“That stage implies a 43% plunge from right here, defying the liquidity floodgates opening this month (QT finish, stimulus). Count on consolidation round $86K-$90K early December, then a push to $110K-$120K by December 25 if resistance cracks. A real bear market feels untimely on this bull cycle; we’re in “teenage volatility” en path to maturity.”

Different Opinions

Perplexity additionally leaned towards the bullish goal. It claimed BTC is extra prone to check $120,000 than plummet to $50,000 based mostly on technical setups and macro tailwinds outweighing short-term consolidation dangers.

For its half, Google’s Gemini stated each ranges symbolize “excessive ends of the spectrum” with robust arguments for each. On the similar time, the chatbot estimated {that a} return to $50K is much less possible than a leap to $120K regardless of the present bearish sentiment.

The put up $50K or $120K by Christmas? Right here’s What 4 AIs Count on for Bitcoin appeared first on CryptoPotato.