Bitcoin is coming into a decisive second as promoting stress intensifies and uncertainty continues to grip the market. Bulls are struggling to reclaim increased ranges, and every failed rebound reinforces the prevailing downtrend. With momentum weakening throughout spot and derivatives markets, traders are more and more questioning whether or not BTC can stabilize earlier than extra critical structural injury happens.

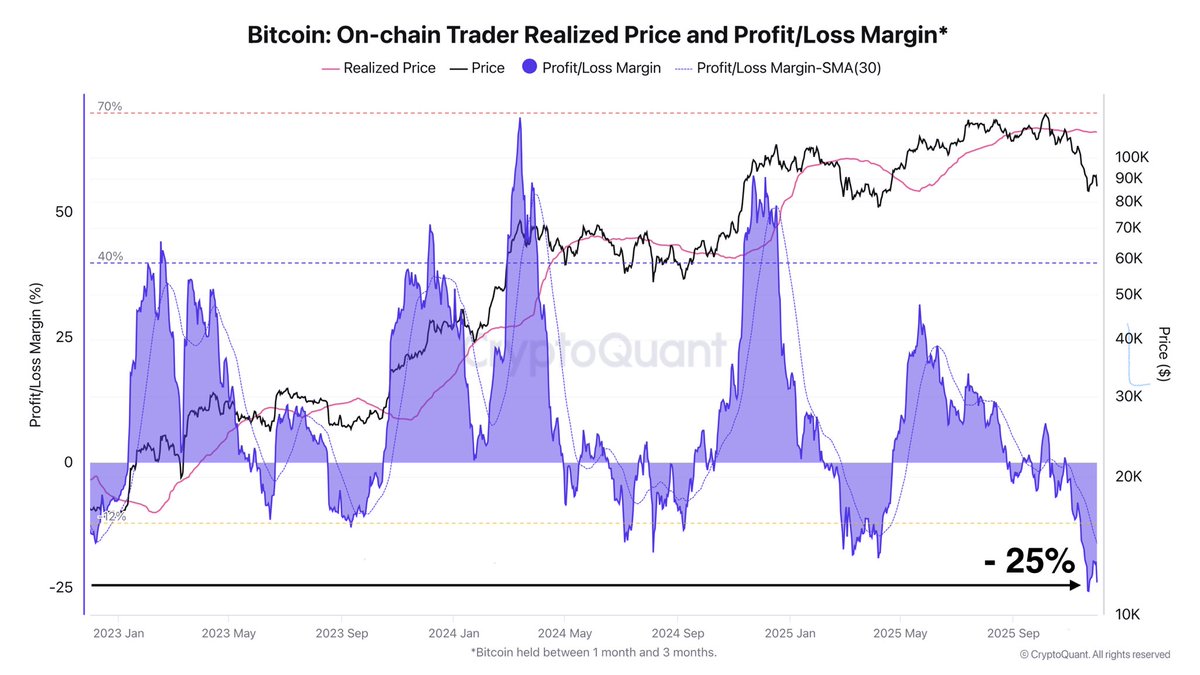

In line with a report by Darkfost, the state of affairs is particularly tough for short-term individuals. With a realized value of $113,692, the BTC 1–3 month cohort is now experiencing the biggest share lack of this whole cycle.

This evaluation focuses completely on the spot market, isolating a gaggle of traders identified for extra speculative habits and quicker response occasions. As a result of these holders sometimes enter throughout robust momentum phases, their capitulation or continued holding typically alerts pivotal shifts in market construction.

The deep losses inside this cohort reveal how aggressively the market has reversed and underscore the mounting stress on shorter-term gamers. As Bitcoin approaches important help ranges, the habits of those traders could decide whether or not the present correction stabilizes — or accelerates right into a broader downturn.

Brief-Time period Holder Capitulation Usually Alerts Backside Formation

Darkfost highlights that the 1–3 month Bitcoin holder cohort has now spent almost two weeks sitting on common unrealized losses between 20% and 25%. Traditionally, this kind of drawdown amongst short-term individuals has tended to happen close to cyclical backside formation.

These merchants sometimes react rapidly to volatility, and when their losses attain this depth, they’re pushed right into a important choice level: promote and exit the market, or maintain and endure additional draw back.

All through this cycle, comparable phases of elevated losses have preceded main inflection factors. As soon as a big portion of those speculative holders capitulates — a course of that seems to have been unfolding in current weeks — promoting stress normally begins to exhaust. This shift typically creates an setting the place accumulation turns into way more enticing for affected person traders who monitor sentiment and realized-price dynamics.

Nevertheless, Darkfost emphasizes that this sample solely holds if the long-term bullish development stays intact. Structural on-chain indicators, broader demand tendencies, and long-horizon holder habits proceed to help the concept that Bitcoin’s macro development has not been invalidated.

Whereas volatility could persist within the brief time period, the alignment of capitulation alerts with a still-intact long-term construction means that present ranges may turn into a possibility for strategic accumulation.

Bitcoin Exams Weekly Degree as Market Searches for Larger-Timeframe Help

Bitcoin’s weekly chart reveals essentially the most important corrective section for the reason that early phases of the cycle, with value falling sharply from the $120,000 area and now making an attempt to stabilize across the 100 SMA close to $84,000–$85,000. This shifting common has traditionally acted as a serious structural help throughout bull markets, and BTC’s present interplay with it marks a important juncture for the broader development.

The breakdown under the 50 SMA was a transparent signal of weakening momentum, signaling that sellers have gained management of the higher-timeframe construction. Nevertheless, the wick fashioned beneath the 100 SMA means that patrons are starting to step in, making an attempt to defend this significant zone. The response up to now is constructive however not but decisive — BTC wants a stronger weekly shut above $90,000 to substantiate stability.

Quantity has elevated through the decline, indicating pressured promoting and capitulation reasonably than natural development reversal. Traditionally, pullbacks into the 100 SMA typically precede medium-term bottoms inside a long-term bullish market, however continuation will depend on whether or not BTC can keep away from a sustained weekly shut under this stage.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.