- Ethereum faces heavy losses however stays above key shifting averages.

- Market sentiment sits in Excessive Concern with largely bearish indicators.

- Quick-term prediction exhibits a ten% rebound, although uncertainty stays excessive.

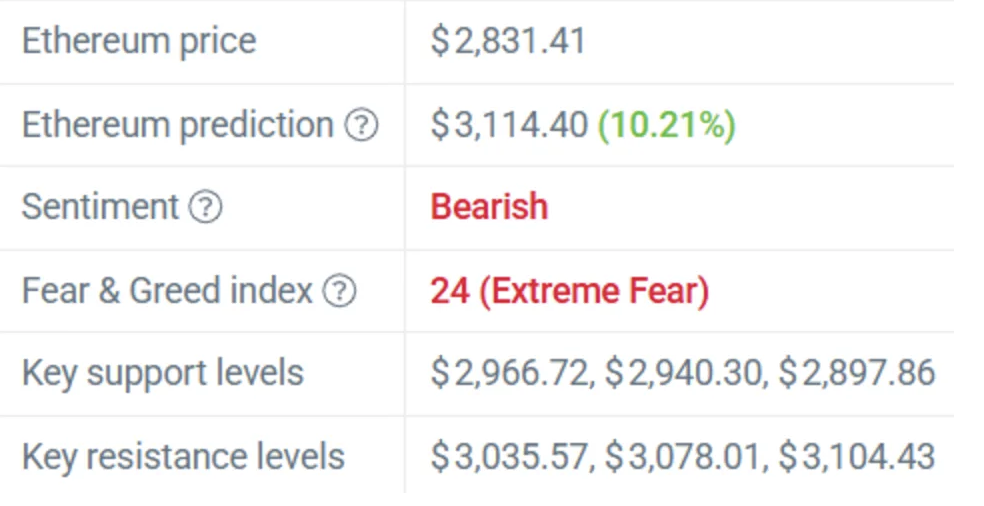

Ethereum has been buying and selling like a bruised and drained bull currently, stumbling more durable than a lot of the market. ETH is sitting round $2,831.41, dropping 5.42% in a single day — a deeper reduce than the broader crypto market’s 6.15% droop. Even in its traditional rivalry with Bitcoin, ETH slipped one other 0.29%. It’s not a reasonably image proper now. Nonetheless, surprisingly sufficient, predictions present Ethereum may climb again to roughly $3,114.40 by December 6, 2025 — a couple of 10.21% rise over the subsequent 5 days. A fast bounce after a heavy fall isn’t inconceivable… however the street isn’t precisely easy.

Ethereum’s Bleeding Stretch Continues, however Sparkles of Life Stay

Zooming out doesn’t assist the temper a lot. ETH misplaced 26.71% over the previous month. Over three months the decline extends to 35.30%. And over the past yr? Down 23.40%. Final December, ETH traded at $3,696.43 — a far cry from at the moment, and even farther from its document excessive of $4,946.50 hit on August 24, 2025. The present cycle paints a blunt image: a excessive at $3,093.87, a low at $2,631.93, and month-to-month volatility of simply 9.48, which isn’t a lot for a coin recognized for explosive swings. Even so, Ethereum managed to squeeze out 14 inexperienced days up to now thirty — tiny breaths of reduction in the course of a storm.

Concern Dominates the Market as ETH Assessments Assist

The broader market at the moment is shifting with the identical emotional tone: concern. The Concern & Greed Index sits at 24 — full-on Excessive Concern. Merchants look cautious, nervous, ready for that “proper” second that not often ever comes. Satirically, concern typically creates the most effective alternatives, the type the place cash slip into low-value zones earlier than the subsequent huge revival.

Key assist zones lie at $2,966.72, $2,940.30, and $2,897.86. On the upside, ETH faces resistance at $3,035.57, $3,078.01, and $3,104.43. Breaking above these ranges may give Ethereum a much-needed new lease on life… however the indicators aren’t precisely cheering. 4 indicators present bullish undertones, whereas twenty-six flash bearish alerts — a heavy 87% leaning towards the draw back.

Indicators Are Combined, however ETH Avoids a Full Collapse

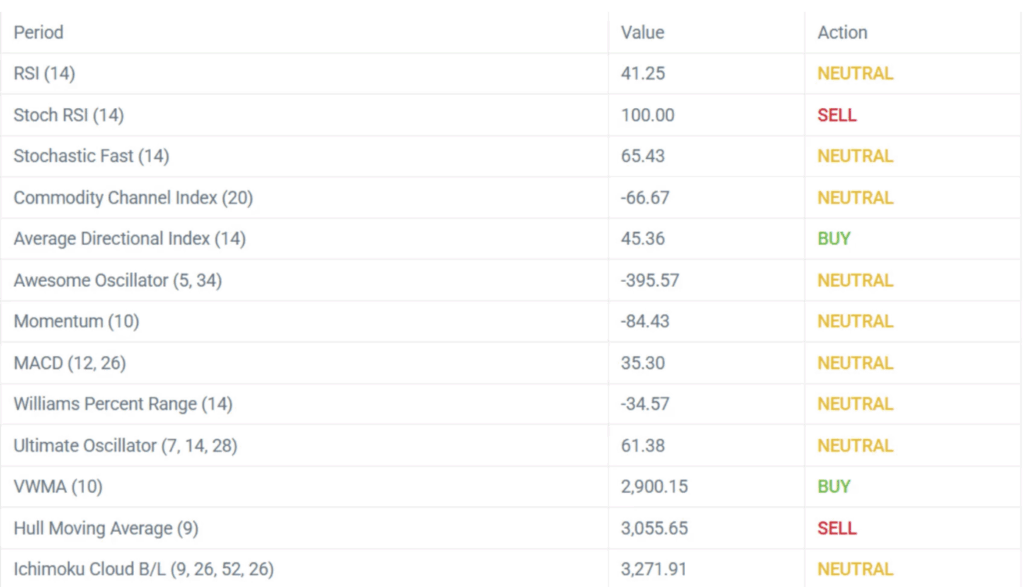

Regardless of the bearish flood, a couple of technical particulars conflict with the doom. The RSI at 41.25 sits in impartial territory, not oversold and never overheated. ETH can also be buying and selling above its 50-day and 200-day easy shifting averages, which usually alerts energy. These contradictions make the present temper a bit complicated — the market feels weak, however not damaged.

What’s Subsequent for Ethereum?

The forecast nonetheless expects an increase over the approaching days, however total sentiment leans towards warning. Ethereum wants that 10.21% push to reclaim its short-term goal, but the trail forward is dependent upon greater than numbers: concern ranges, assist zones, and a market that adjustments route sooner than anybody likes to confess.

Crypto by no means stands nonetheless — not hope, not concern, not Ethereum. Right here is the place endurance turns into technique, and technique turns into survival.

The submit Can Ethereum Get better From Its 3-Month 35% Drawdown and Revisit $3,100+? — Right here is What to Watch Subsequent first appeared on BlockNews.