Be part of Our Telegram channel to remain updated on breaking information protection

White Home AI and crypto czar David Sacks slammed a New York Instances report about his alleged conflicts of curiosity, calling it a ”nothing burger.”

Sacks mentioned on X that despite the fact that he debunked claims made by the paper in correspondence over the previous 5 months, it simply threw up its fingers ”and printed this nothing burger.”

“Anybody who reads the story rigorously can see that they strung collectively a bunch of anecdotes that don’t assist the headline,” Sacks mentioned. “At no level of their fixed goalpost-shifting was NYT keen to replace the premise of their story to just accept that I’ve no conflicts of curiosity to uncover.”

Sacks mentioned he employed the legislation agency Clare Locke, which makes a speciality of defamation legislation, and shared a screenshot of a letter that the agency despatched to the paper that claims it “willfully mischaracterized or ignored the details to assist their bogus narrative.”

The NYT traces up the standard passel of tech journos, runs the 2018 hit piece playbook, and solely manages to make @DavidSacks seem like the proper man for the job.

Lastly, somebody operating AI and crypto…who really is aware of concerning the enterprise of AI and crypto. pic.twitter.com/8egbBfb3dG

— Antonio García Martínez (agm.eth) (@antoniogm) December 1, 2025

The New York Instances alleged in its story that crypto-related investments retained by Sacks, together with stakes held by way of his enterprise agency Craft Ventures, may gain advantage from his White Home function and thus signify a battle of curiosity.

NYT Says Sacks Retains Crypto Investments

Earlier than changing into crypto czar, Sacks and Craft Ventures divested greater than $200 million in crypto and shares tied to crypto, with not less than $85 million of that owned by Sacks himself, the paper mentioned.

Based mostly on monetary disclosures, Sacks has retained 708 tech investments, 449 of those associated to AI corporations and 20 tied to crypto, the NYT report added. All of those investments may gain advantage from Sacks’ means to affect coverage on the White Home, the paper mentioned.

One of many investments was made by Craft Ventures into the crypto infrastructure firm BitGo, which provides a stablecoin-as-a-service. The story mentioned that Craft owned 7.8% of the corporate, which went public in September.

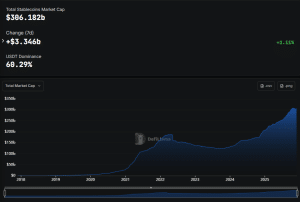

The story famous that Sacks threw his assist behind the GENIUS Act, the primary regulatory framework on the federal degree for stablecoins, which led to a increase within the stablecoin market that resulted within the sector’s complete market capitalization hovering towards $400 billion for the primary time.

Stablecoin market cap (Supply: DefiLlama)

AI Investments Additionally Current A Battle Of Curiosity For Sacks, NYT Says

The paper famous that Sacks and Craft have ties to corporations within the AI area as nicely, and that their valuations skyrocketed because the White Home and Wall Road wager on the expertise’s potential.

The NYT mentioned Sacks’ ethics waivers made in March said that he would shut his investments in AI and crypto. It added that these waivers didn’t disclose when Sacks bought property or the worth of investments he nonetheless held.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection