Abstract

The every day setup factors to a dominant bearish regime, with the token buying and selling under its predominant shifting averages. Momentum on the upper timeframe is weak, confirmed by an RSI close to oversold however not but excessive. Furthermore, the MACD on the every day chart is flat and damaging, underlining pattern exhaustion slightly than contemporary draw back acceleration. Volatility is contained, with a modest Common True Vary that implies a managed slightly than panic-driven decline. In the meantime, the broader crypto market is barely constructive over 24 hours, however sentiment stays fragile. Total, the image is considered one of cautious sellers nonetheless in cost, whereas discount hunters watch for clearer affirmation earlier than stepping in aggressively.

Dogecoin crypto value: Market Context and Path

On the macro degree, the whole crypto market capitalization sits close to 3.03 trillion {dollars}, up barely by about 0.47% within the final 24 hours. This delicate restoration coexists with a robust Bitcoin-led market regime, as BTC dominance hovers round 57.3%. In such phases, capital tends to favor the majors, whereas meme cash and high-beta property battle to draw sustained inflows.

Moreover, the Worry & Greed Index stands at 23, firmly within the “Excessive Worry” zone. That studying alerts a market the place members stay defensive, typically preferring secure names or just staying on the sidelines. For this token, that backdrop normally interprets into restricted speculative urge for food and fewer willingness to chase short-term rallies.

In distinction with the cautious but barely rising international market cap, this asset stays below stress on the upper timeframe. That stated, the dearth of aggressive promoting climaxes hints at a managed downtrend slightly than a capitulation state of affairs, leaving room for a possible stabilization section if broader threat sentiment improves.

Technical Outlook: studying the general setup

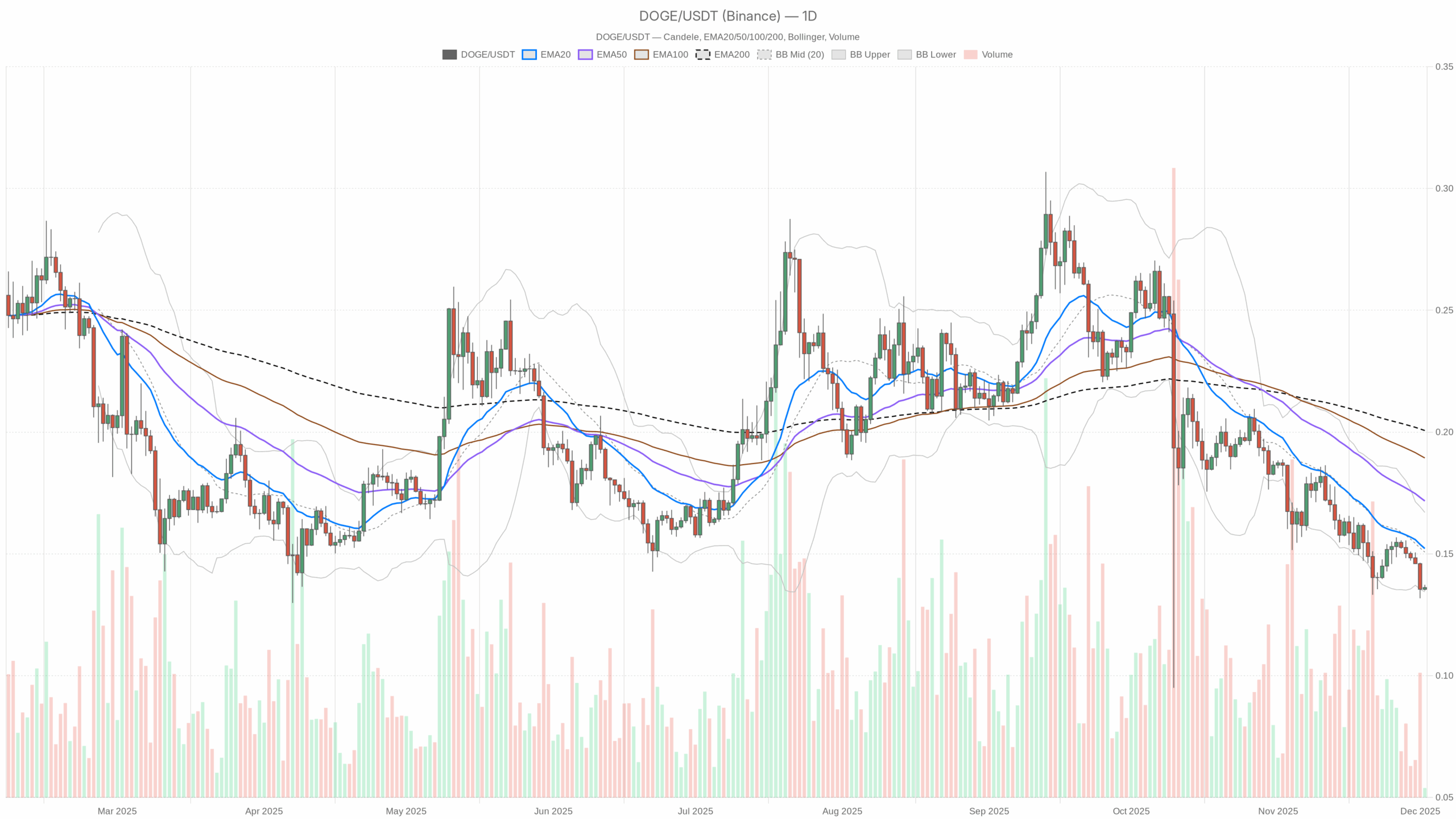

On the every day chart, value is closing round $0.14, under the 20-day exponential shifting common at $0.15, the 50-day at $0.17, and the 200-day at $0.20. This alignment of shifting averages above present value clearly displays a well-established bearish construction, the place each bounce thus far has been capped earlier than regaining the longer-term pattern traces.

The 14-day RSI sits close to 33, a degree that signifies weak momentum however not an outright oversold excessive. In apply, this implies sellers nonetheless dominate, but draw back stress is not accelerating strongly. Typically, such readings precede both a pause within the decline or a uneven consolidation, slightly than a direct sharp rebound.

The MACD line and sign on the every day timeframe are each round -0.01, with a histogram near zero. This flat configuration reveals a lack of clear momentum in both course, according to the thought of a maturing downtrend slightly than a contemporary breakdown. Bears stay in management, however they aren’t urgent as aggressively as within the early section of a selloff.

Bollinger Bands on the every day chart have their mid-line close to $0.15, an higher band round $0.17, and a decrease band near $0.13. With value fluctuating not far above the decrease band, the market is signaling a managed, low-volatility drift towards the draw back, slightly than wild spikes. The 14-day ATR close to $0.01 reinforces this message: every day ranges are comparatively small, pointing to a market that’s grinding decrease as a substitute of collapsing.

Every day pivot ranges cluster across the present value, with the primary pivot and first resistance near $0.14 and the primary assist close to $0.13. This configuration tells us that intraday sentiment is finely balanced across the present zone, the place small shifts in flows can shortly determine whether or not value leans towards testing assist or making an attempt a modest bounce.

Intraday Perspective and DOGEUSDT token Momentum

On the hourly chart, the image is barely much less damaging. The asset trades round $0.14, in step with its 20- and 50-period EMAs, whereas the 200-period EMA sits simply above at $0.15. This implies a short-term stabilization section, the place sellers are much less aggressive however patrons nonetheless lack the conviction to push by means of the longer shifting common.

The hourly RSI close to 44 displays this equilibrium: momentum is mildly bearish, but not stretched. In the meantime, the MACD round zero with a flat histogram confirms that intraday strikes are being dominated by vary buying and selling slightly than a transparent pattern. Because of this, scalpers and day merchants are doubtless specializing in small oscillations inside a good band as a substitute of trend-following methods.

On the 15-minute timeframe, circumstances look much more impartial. Worth hovers close to all key EMAs at $0.14, with an RSI round 56, a degree appropriate with a modest bullish bias however not a strong impulse. Bollinger Bands are very tight, and the ATR on this timeframe is successfully flat, signaling compressed volatility that may precede sharper strikes as soon as a catalyst emerges.

Key Ranges and Market Reactions

From a tactical perspective, the world round $0.13 emerges as a key assist zone, aligned with the decrease every day Bollinger Band and the primary pivot assist. If value drifts again towards that area and finds patrons, it might reinforce the thought of a creating consolidation ground after a protracted decline.

On the upside, the band between $0.15 and $0.17, the place the 20-day EMA and the higher Bollinger Band reside, represents the primary significant resistance space. A every day shut above this band can be an early signal that bears are shedding management, doubtlessly opening the way in which for a take a look at of the upper 50-day EMA. Nonetheless, so long as the token stays capped under these ranges, each rebound is best interpreted as a short-covering rally inside a broader downtrend slightly than the beginning of a brand new bullish cycle.

Future Eventualities and Funding Outlook

Total, the primary state of affairs stays bearish on the every day timeframe, with decrease highs and the worth nonetheless under all main EMAs. But the mixture of a moderating RSI, a flat MACD, and compressed volatility hints at a section the place the downtrend is growing old, not accelerating. If the broader crypto market continues to stabilize and concern regularly recedes, this asset may try a gradual rebuilding course of above $0.13, focusing on a problem of the $0.15–0.17 band.

For extra conservative members, ready for a transparent pattern affirmation sign on the every day chart — equivalent to a sustained break above the 20-day EMA with bettering momentum — could also be preferable to making an attempt to select a precise backside. Extra lively merchants, then again, might discover alternatives by buying and selling the vary between close by assist and resistance, at all times aware that the prevailing backdrop nonetheless favors rallies being bought till confirmed in any other case.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding selections.