- LTC drops 9% however quantity surges 158%, signaling heavy dealer exercise.

- Litecoin holds key multi-year assist between $72–$75, with upside targets at $88–$110.

- RSI and MACD lean bearish, with potential breakdown ranges at $66 and $54–$58.

Litecoin is slipping once more — and this time the drop comes with a shocking surge in buying and selling quantity. Over the past 24 hours, LTC has fallen roughly 9.65%, and the weekly chart doesn’t look significantly better with a 12.14% decline. Promoting strain is heavy, regular, and exhibiting virtually no indicators of easing. Nonetheless, merchants are clearly energetic: LTC is buying and selling round $75.89, and its 24-hour quantity has exploded to $711.87 million, a large 158% bounce. Even with the sell-off, Litecoin’s market cap is holding close to $5.81 billion, signaling that volatility is sparking participation relatively than silence.

Litecoin Holds the Line at a Multi-Yr Pattern Help

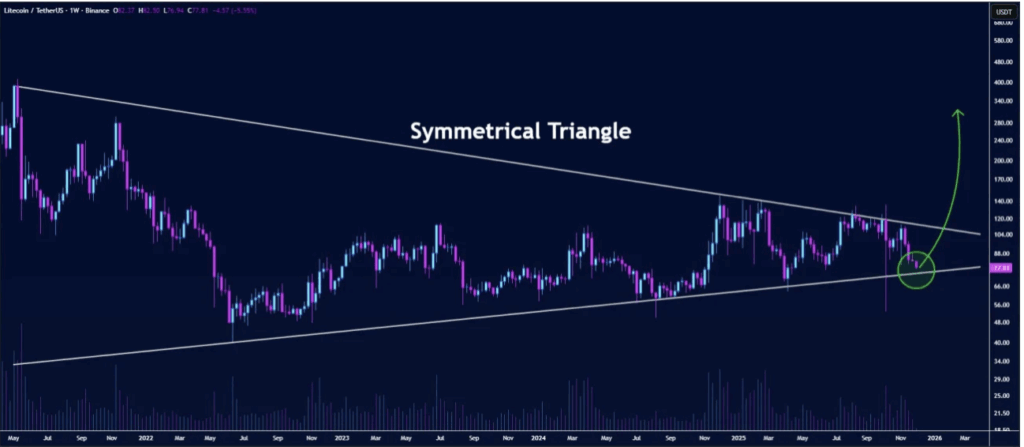

Proper now, Litecoin is sitting immediately on a multi-year trendline inside a big symmetrical triangle — a construction that has performed an enormous function in previous cycles. The area between $72 and $75 has traditionally acted as a powerful purchase zone, a spot the place whales and long-term supporters are inclined to step in. Quantity staying managed throughout this pullback hints at what merchants name an “accumulation section,” regardless that value motion seems painful within the brief time period.

Crypto analyst @butterfly_chart identified that if LTC rebounds from this space, the primary upside targets sit round $88–$90. Additional resistance ranges cluster close to $104 and $110. A breakout above the descending facet of the triangle may spark a a lot wider rally — probably towards $180, with a long-term goal resting someplace between $200 and $250.

However — and it’s a giant “however” — the breakdown situation nonetheless issues. A weekly shut under $70 would weaken your entire multi-year construction and make sure the lack of that trendline assist. In that bearish case, LTC might drop towards $66, and ultimately to the $54–$58 zone if promoting strain snowballs. Till that breakdown occurs, although, the broader construction nonetheless leans towards a attainable upside reversal.

Momentum Indicators Lean Bearish, however Oversold Indicators Are Rising

Litecoin’s momentum indicators are portray a cautious, barely gloomy image. The RSI at the moment sits at 38.05, properly under its shifting common of 49.04, confirming rising promoting strain and weak shopping for energy. The formation of decrease highs provides to this bearish weight, exhibiting that patrons aren’t speeding in but.

On the MACD facet, the studying is -4.04081, sitting simply above the sign line at -4.05323 — extraordinarily shut, however nonetheless damaging. The histogram sits at -0.01242, with pink bars reflecting strengthening downward momentum. The promote facet continues to be firmly in management for now, regardless that some oversold indicators are starting to indicate.

Outlook

Litecoin is sitting on a important stage the place both a powerful rebound or a deeper breakdown can happen. The technical construction nonetheless favors a attainable upside so long as the multi-year trendline holds, however momentum indicators counsel sellers haven’t let go simply but.

Right here is the place the following transfer may decide whether or not LTC is getting ready for an eventual breakout… or slipping into an extended correction.

The publish Litecoin Extends Its Slide as Quantity Surges, Testing a Make-or-Break Help Zone first appeared on BlockNews.