- Solana hits main assist with oversold indicators flashing early stabilization.

- Establishments maintain accumulating, with practically $98M in inflows this week alone.

- SOL stays the highest chain in DEX exercise and app income regardless of value strain.

Solana’s newest slide has been testing everybody’s endurance — dipping greater than 10% in simply 24 hours — but a bunch of underlying indicators maintain hinting that the community’s actual momentum hasn’t gone anyplace. SOL is now hovering round $123, touchdown proper on a serious assist zone the place patrons stepped in a number of occasions earlier than. It’s a type of moments the place the chart feels tense, virtually prefer it’s ready to see who steps ahead first: bulls or bears.

On the day by day chart, SOL is flashing clear oversold indicators. The RSI has dropped to 32, its lowest studying in weeks, principally sitting on the sting of basic oversold territory. MACD momentum nonetheless appears bearish, too — no sugarcoating that half. However what makes this fascinating is how the value is bouncing proper on the decrease fringe of a long-term rising construction. That’s normally the place bullish arguments quietly start forming, even when sentiment appears shaky on the floor.

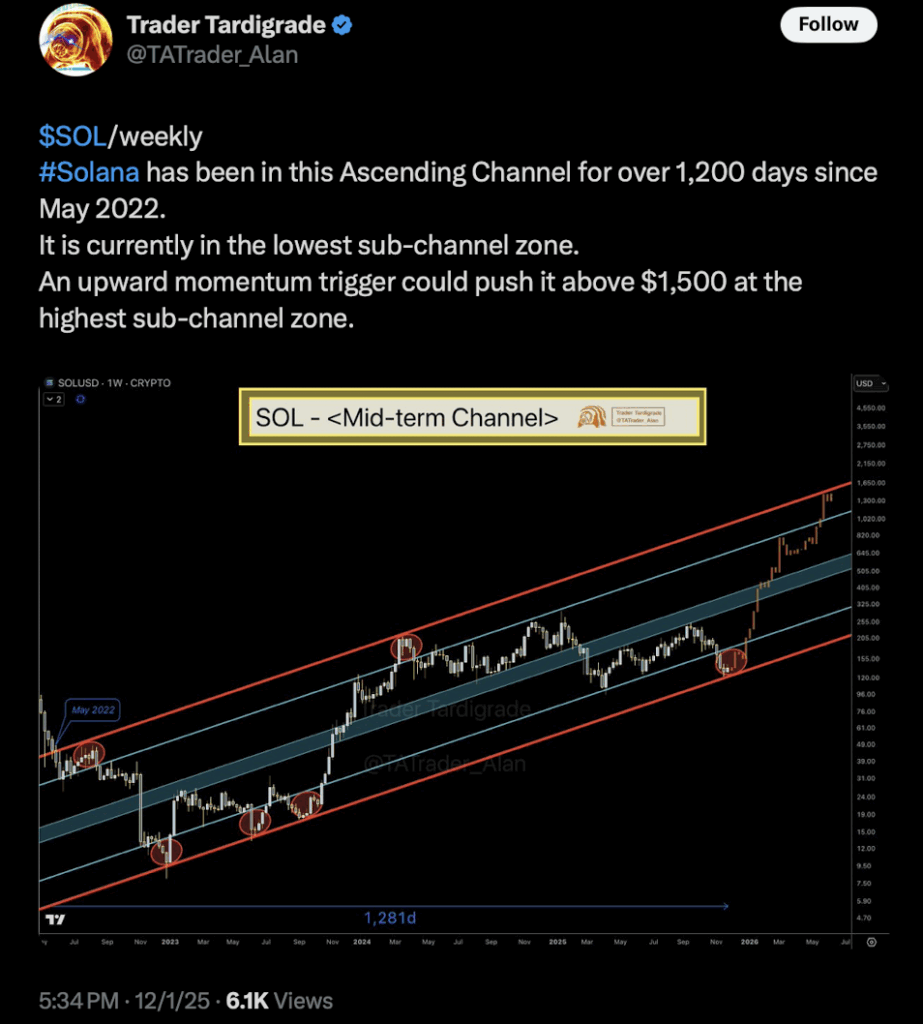

Solana Drops Into the Backside of a Multi-12 months Ascending Channel

Analyst Dealer Tardigrade identified that Solana has stayed inside the identical ascending channel for over 1,200 days — yeah, greater than three years — relationship all the best way again to Might 2022. In keeping with his mannequin, SOL simply returned to the bottom sub-channel zone, the identical area that sparked a few of its largest rallies previously.

If Solana catches even a small elevate from right here, the upward trajectory could possibly be highly effective. The higher channel vary — at its topmost stage — even factors towards a possible transfer above $1,500 if the long-term development stays intact. Sounds insane when the value is sitting at $123, however technically, the construction helps it.

Establishments Hold Shopping for the Dip Like Nothing Occurred

Even with the value pulling again, institutional curiosity hasn’t slowed in any respect. ETF inflows into Solana merchandise are nonetheless climbing quick:

- +83,144 SOL previously 24 hours (over $10.5M)

- +773,311 SOL throughout the final seven days (virtually $98M)

That is the type of regular accumulation that normally indicators long-term positioning — not worry, not panic, and undoubtedly not a market making ready for a collapse. Establishments have a tendency to purchase the place they see long-term worth, not short-term noise.

Solana Nonetheless Dominates On-Chain Exercise

Whereas the token value dips, the Solana ecosystem is doing the alternative — exploding with utilization. During the last 24 hours, Solana was the number-one blockchain in decentralized trade quantity at virtually $3 billion, beating Ethereum, BNB Chain, Base, Polygon, Arbitrum… everybody. And it’s not only a one-day anomaly; Solana additionally leads the 7-day and 30-day home windows for each DEX exercise and app income.

Builders say this stage of site visitors creates a halo impact for brand new protocols. When the whole chain sits on the high of dashboards and analytics screens, new tasks mechanically land in entrance of extra customers and traders. Principally, the community’s visibility turns into free advertising and marketing.

What’s Subsequent for SOL?

Solana is sitting proper in that basic spot the place sturdy fundamentals collide with short-term chart ache. Technically, SOL appears exhausted on the draw back. ETF inflows present institutional confidence hasn’t budged. And the community itself continues to crush each different chain in utilization metrics.

If patrons defend this assist stage and momentum flips even barely, the long-term ascending channel stays intact — and historical past exhibits that rebounds from this precise setup have been sharp, sudden, and fairly dramatic.

Right here is the place endurance may really repay.

The put up Oversold Solana Nears Crucial Rebound Zone With Robust ETF Inflows and Community Utilization first appeared on BlockNews.