- PENGU falls 12% as heavy outflows speed up promoting strain.

- Indicators like SAR and MFI verify fading momentum and bearish management.

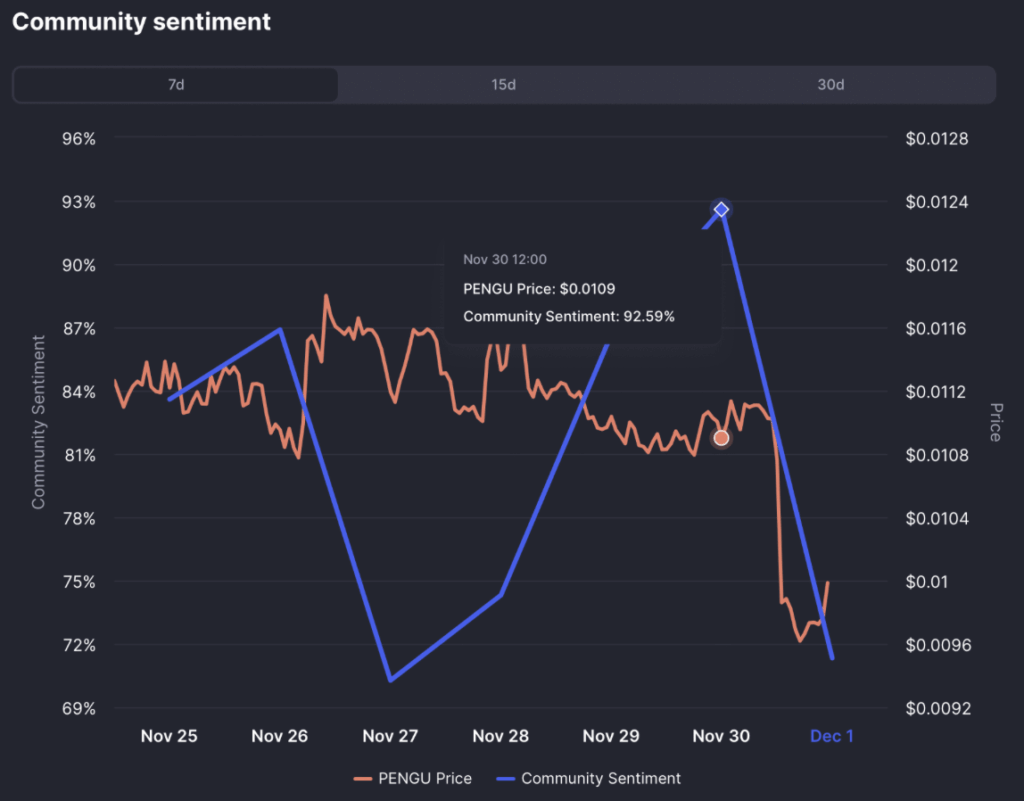

- Sentiment drops from 90% to 72% bullish, with $6.5M exiting derivatives positions.

PENGU, as soon as one of many louder memecoins on the charts, has been leaking capital for days — and the promote strain lastly tipped it over the sting once more within the final 24 hours. Outflows dragged the value down one other 12%, leaving Pudgy Penguins [PENGU] buying and selling round $0.0097 on the time of writing. And it’s not simply PENGU feeling the sting. All the memecoin sector is getting crushed, posting a mean decline of 27% in a single day. Capital is fleeing the sector, and PENGU is sitting proper within the heart of the storm.

PENGU Will get Rejected at Resistance, Once more

The newest drop got here proper after PENGU tapped into a widely known resistance wall — the identical one which has smacked the token down a number of occasions earlier than. Every contact tends to set off sell-offs, and this time wasn’t any totally different. Liquidity in that zone is thick, and sellers clearly used it to unload baggage.

The final time PENGU hit this actual resistance, it suffered a brutal 53% crash earlier than discovering a neighborhood backside. The common of the final three reactions is a bit gentler — round 31.7% declines — however as we speak’s rejection nonetheless suits the sample.

A breakout above this descending resistance often sparks larger rallies, however… this wasn’t a kind of moments. As a substitute, PENGU is probably going getting ready to seek for the closest help earlier than trying something significant on the upside.

Momentum Drains Out as Indicators Flip Clearly Bearish

Momentum isn’t doing PENGU any favors proper now. Each the Parabolic SAR and the Cash Stream Index (MFI)verify that bullish power has evaporated.

- The Parabolic SAR dots are above value, which is mainly a flashing purple signal that promoting strain is dominant and additional decline may be very doable.

- The MFI sits within the 30–50 zone, which is taken into account bearish territory. It alerts outflows, weak demand, and low shopping for curiosity general.

Nevertheless — barely noticeable, however nonetheless current — the MFI is inching upward. Which means some capital is flowing again in, although not almost sufficient to offset the heavy promoting that triggered this complete downturn.

Neighborhood Sentiment Drops Sharply as Merchants Pull Again

The PENGU neighborhood isn’t as loud because it was weeks in the past. In keeping with CoinMarketCap’s sentiment information, bullish confidence has fallen from over 90% to 72% as of Nov. 30. That’s nonetheless a majority, however the drop is steep and alerts shifting expectations from 1000’s of buyers — greater than 375,000 responses had been counted.

In the meantime, the derivatives market added extra gas to the decline. About $6.5 million left open positions as merchants backed away from danger. Mixed with a weakening funding charge, the exodus suggests the market expects extra draw back strain within the close to time period.

Outlook

PENGU is caught between heavy promoting, weak momentum, and fading neighborhood optimism. Till it finds help — and holds it — the trail of least resistance stays downward. If sentiment shifts once more or the MFI continues pushing upward, a reduction bounce may type, however proper now sellers are nonetheless firmly in management.

Right here is the place the market waits to see if PENGU can stabilize… or sink additional.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.