Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso and watch the markets shift — Bitcoin is slipping, whereas shares, gold, and tech soar, leaving even seasoned buyers scratching their heads over what comes subsequent. Specialists warn that this divergence may sign deeper structural forces at play and lift questions on future market flows.

Sponsored

Sponsored

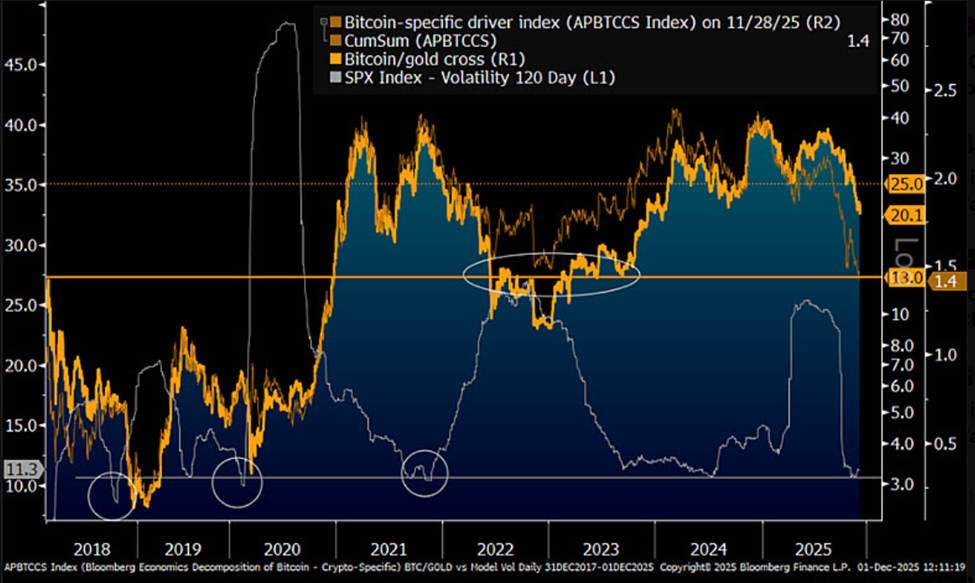

Crypto Information of the Day: Bitcoin/Gold Ratio Alerts Potential Volatility

Bitcoin is falling whereas conventional markets soar, leaving buyers puzzled and analysts digging for solutions. The world’s largest cryptocurrency has dropped sharply, at the same time as equities, gold, silver, and AI-driven tech shares hit report highs.

Mike McGlone, senior commodity strategist at Bloomberg, highlighted a key metric: the Bitcoin-to-gold ratio.

“The roughly 20x ratio of the shop of worth to Bitcoin on December 1 is about 50% beneath the 40x peak reached after President Donald Trump’s reelection,” McGlone famous.

Traditionally, this ratio has served as a gauge of the relative power between Bitcoin and gold. The sharp decline could point out that Bitcoin is underperforming different danger belongings forward of a possible spike in market volatility.

Analysts predict that if the pattern persists, Bitcoin may revisit decrease relative ranges, doubtlessly impacting portfolios with excessive crypto publicity.

Crypto Promote-Off Defies Market Fundamentals

In the meantime, Jeff Dorman, CIO at Arca, described the sell-off as one of many strangest crypto sell-offs ever. Dorman factors out that the broader macro setting is overwhelmingly bullish, with equities, credit score, and treasured metals hitting all-time highs.

Sponsored

Sponsored

That is supported by the Federal Reserve’s fee cuts, sturdy shopper spending, report company earnings, and sustained demand for AI-driven tech.

“The entire ‘supposed causes’ for crypto promoting off are simply debunked or have reversed — MSTR isn’t promoting, Tether isn’t bancrupt, DATs aren’t promoting, NVDA isn’t blowing up, the Fed isn’t turning hawkish,” Dorman defined.

The underlying difficulty, he argues, is structural:

- Crypto-native buyers are exhausted, and

- Institutional cash from main gamers like Vanguard, State Avenue, BNY, JPMorgan, Morgan Stanley, and Goldman Sachs has not but entered the market in significant methods.

Till techniques enable these establishments to purchase seamlessly, liquidity stays constrained.

Sponsored

Sponsored

The divergence between crypto and conventional markets presents each dangers and alternatives. For buyers, the falling Bitcoin-to-gold ratio and the absence of institutional flows recommend heightened short-term volatility.

Nonetheless, the eventual arrival of large-scale institutional cash may create a big upside catalyst as soon as adoption limitations are eliminated.

If the Bitcoin-to-gold ratio continues to say no, it may foreshadow an elevated risk-off sentiment, whereas the sluggish entry of institutional buyers could delay a restoration.

Chart of the Day

Sponsored

Sponsored

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to comply with in the present day:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of December 1 | Pre-Market Overview |

| Technique (MSTR) | $171.42 | $175.33 (+2.28%) |

| Coinbase (COIN) | $259.84 | $264.62 (+1.84%) |

| Galaxy Digital Holdings (GLXY) | $24.80 | $25.28 (+1.98%) |

| MARA Holdings (MARA) | $11.52 | $11.75 (+2.00%) |

| Riot Platforms (RIOT) | $15.48 | $15.73 (+1.61%) |

| Core Scientific (CORZ) | $16.59 | $16.75 (+0.96%) |