- NFT Technique tokens convert high-end NFT collections into liquid, tradeable ERC-20 tokens that feed a self-sustaining treasury purchase/promote + burn cycle.

- Each technique token funnels a portion of buying and selling charges right into a treasury that mechanically buys flooring NFTs and relists them, then burns token provide with resale earnings.

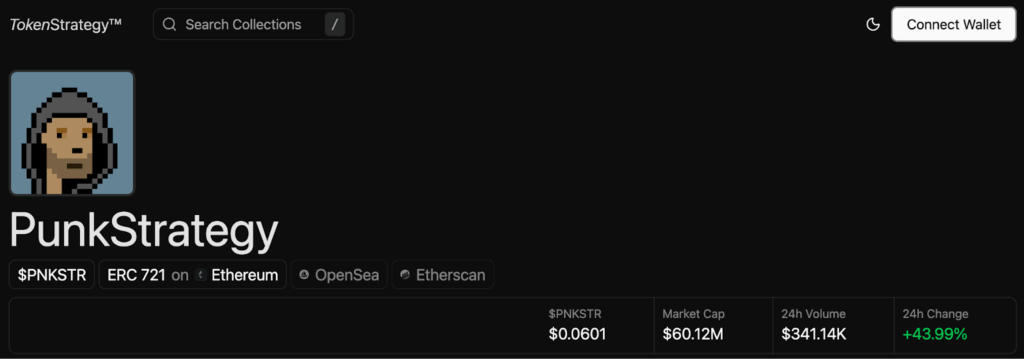

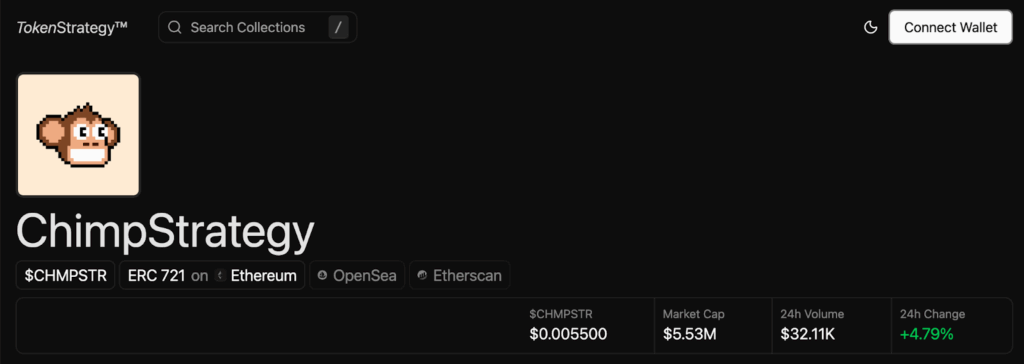

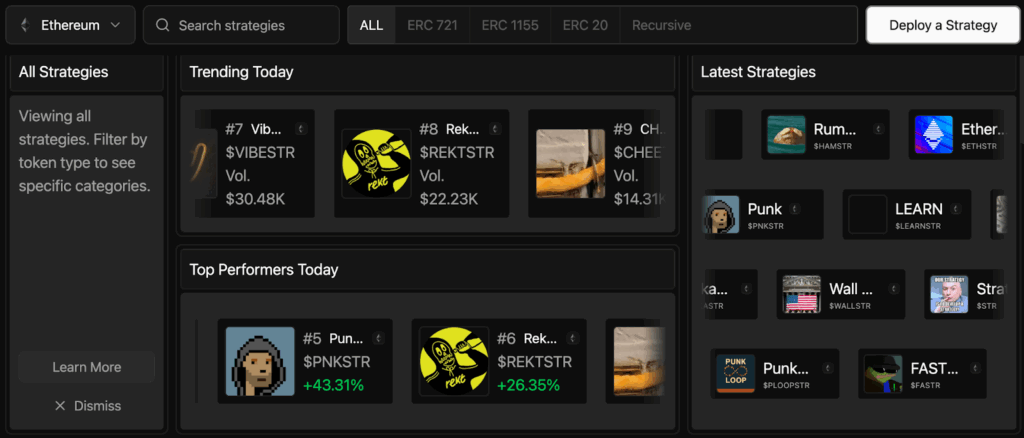

- PNKSTR, VIBESTR, and CHIMPSTR are the biggest such tokens at this time — every tied to a distinct NFT assortment and danger/reward profile.

Why “NFT Technique” — And What Drawback It Solves

NFTs (ERC-721) had been revolutionary for creating distinctive digital possession. However their uniqueness additionally makes them illiquid in comparison with fungible tokens. Historically, getting publicity to a “blue-chip” NFT like CryptoPunks or a brand new premium PFP assortment meant shopping for a single NFT — usually requiring tens or a whole bunch of ETH, and locking up capital till a purchaser got here alongside.

“NFT Technique” tokens purpose to vary that. As an alternative of forcing buyers to personal a single NFT, they wrap publicity into fungible ERC-20 tokens that anybody can purchase or promote. On prime of that, through a mechanism of buying and selling charges, automated NFT purchases, resales, and token burns, these technique tokens create a form of perpetual, on-chain flywheel: liquidity

As of late 2025, technique tokens have emerged as one of many important improvements within the NFT + DeFi convergence.

How the Mechanism Works — The Flywheel in Element

- Price Skim on Trades: Every time somebody trades a technique token (purchase or promote), a charge — sometimes 10% — is collected. Most of that charge (≈ 8%) flows into an ETH-denominated treasury.

- Treasury Accumulation → Ground Purchase: When the treasury accumulates sufficient ETH to cowl the ground worth of the most affordable NFT within the assortment, the sensible contract mechanically purchases that NFT from the open market.

- Relist At Markup: Instantly after acquisition, the NFT is relisted on the market at a markup (sometimes ~20 %, i.e. 1.2× the acquisition worth).

- Earnings → Token Burn & Liquidity Return: When the NFT sells, the ETH proceeds are used to purchase again the technique token (e.g., PNKSTR) and burn these tokens, decreasing provide and creating deflationary strain. Extra ETH may additionally be returned to liquidity swimming pools.

- Royalties to Creators (optionally available): For newer technique tokens, a small fraction (e.g. 1%) of commerce charges could also be allotted as royalties for the unique NFT assortment creators — including a possible long-term incentive construction for them.

This loop — commerce charge → treasury → flooring sweep → relist → resale → burn — cycles repeatedly so long as there’s buying and selling exercise. It successfully merges NFT market flooring dynamics with token-level liquidity and deflation mechanics.

Deep Dive: PNKSTR & CryptoPunks

PNKSTR is the unique technique token launched on this mannequin, pegged to CryptoPunks — one of many earliest and most legendary NFT collections on Ethereum.

Why it stands out

- Legacy blue-chip standing: CryptoPunks helped delivery the NFT motion. Their shortage and model recognition make flooring sweeps and buy-pressure extra credible than for a more moderen PFP assortment.

- Robust flywheel impact: As of late 2025, PNKSTR reportedly accomplished a number of buy-sell cycles, burning provide and accumulating ETH whereas recycling worth again to token holders.

- Publicity with out full NFT possession: An investor can get publicity to CryptoPunks flooring motion for a fraction of the associated fee wanted to purchase an precise Punk. Holding PNKSTR successfully indexes you to flooring worth — with added liquidity and decrease capital requirement.

VIBESTR & Good Vibes Membership: Combining Artwork, IP & Technique

VIBESTR ties into the Good Vibes Membership (GVC), a 3D PFP NFT mission launched in 2025. Good Vibes Membership is the product of a collaboration between inventive studio Toast and SuperRare — positioning itself as a high-quality artwork/model IP fairly than purely a speculative PFP.

What differentiates VIBESTR

- Artwork-first NFT assortment: As an alternative of piggybacking off legacy NFT hype, GVC focuses on design high quality, storytelling, and brand-building — which can entice a distinct kind of collector or neighborhood in comparison with pixel-art legacy NFTs.

- Technique token mechanics identical as PNKSTR: VIBESTR makes use of the identical charge → treasury → floor-buy → relist → burn flywheel, giving buyers publicity to GVC’s flooring fluctuations with out proudly owning an entire NFT.

- Potential for model/utility upside: As a result of Good Vibes Membership goals to construct a broader IP — presumably with media, neighborhood, or way of life angles — VIBESTR holders might profit not solely from flooring sweeps but additionally from upside tied to real-world adoption or model development. This provides a distinct dimension in comparison with purely floor-driven NFTs.

CHIMPSTR & the Chimpers Narrative: Technique Meets IP Potential

CHIMPSTR is the technique token tied to the Chimpers assortment. Not like pure art-first or legacy-bright collections, Chimpers appears to place itself as a model and IP with storytelling, neighborhood, and presumably future utility (video games, media, licensing).

What CHIMPSTR brings to the desk

- NFT Technique mechanics + model upside: Like PNKSTR and VIBESTR, CHIMPSTR applies the NFTStrategy flywheel. However its worth may additionally admire if the underlying Chimpers model efficiently expands — giving token holders publicity to each flooring mechanics and long-term IP development potential.

- Diversification profit: For portfolio-minded NFT buyers, holding CHIMPSTR alongside PNKSTR and VIBESTR permits spreading danger throughout completely different collections, kinds, and use-case visions (legacy artwork, new artwork, model/IP).

What This Means for Buyers

Potential Upsides

- Decrease-cost publicity to top-tier NFTs while not having 30–100+ ETH for a full NFT.

- Liquidity and suppleness: ERC-20 tokens commerce on DEXs, so entry and exit are simpler than promoting a full NFT (which regularly takes time and excessive purchaser demand).

- Automated floor-support mechanism: The buy-sell-burn cycle can present steady shopping for strain, presumably serving to stabilize NFT flooring costs.

- Portfolio diversification: Technique tokens provide a option to unfold danger throughout a number of NFT collections with out proudly owning particular person items.

Remaining Ideas

TokenStrategy.enjoyable and the broader NFTStrategy mannequin symbolize a novel try to unravel certainly one of NFTs’ long-standing issues: illiquidity. By wrapping NFT collections into fungible ERC-20 tokens and embedding an automatic purchase/promote/burn flywheel, they make it doable to deal with high-end NFTs like tradeable, yield-bearing property.

Among the many present leaders — PNKSTR (CryptoPunks), VIBESTR (Good Vibes Membership), and CHIMPSTR (Chimpers) — every presents a definite taste of publicity. PNKSTR offers legacy blue-chip NFT publicity, VIBESTR pairs art-forward new-age PFPs with a brand-first imaginative and prescient, and CHIMPSTR brings doable IP upside plus floor-linked mechanics.

That stated — this mannequin remains to be experimental and speculative. It depends closely on constant quantity, market liquidity, and execution. For anybody pondering of diving in, it is smart to deal with technique tokens like high-risk / high-variance crypto bets: begin small, diversify throughout collections, and hold an in depth eye on treasury well being and floor-price dynamics.

The submit What’s TokenStrategy.enjoyable? Every thing to Know Concerning the Rise of “NFT Technique” Tokens first appeared on BlockNews.