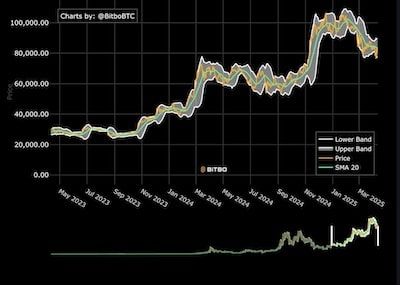

Bitcoin’s Bollinger BandWidth indicator has reached its lowest ranges on report, igniting hypothesis {that a} dramatic value surge might observe, as seen throughout late 2023.

BandWidth at historic lows

On month-to-month timeframes, the Bollinger BandWidth—which measures the proportion distinction between higher and decrease Bollinger Bands—has by no means been smaller.

In accordance with macro strategist Gert van Lagen, every drop beneath a threshold of 100 on this metric has traditionally led to a pointy, parabolic BTC value transfer.

Van Lagen acknowledged:

“Traditionally, each time this triggers, Bitcoin follows with a direct parabolic leg up.”

The newest ‘inexperienced’ sign appeared in November 2023, after which BTC/USD value doubled inside 4 months.

No “purple” occasion was noticed throughout the newest value drawdown, suggesting the bullish setup stays intact.

Market construction and dealer sentiment

Regardless of the technical optimism, some merchants stay unconvinced in regards to the energy of the restoration. One dealer, Roman, described the present state of affairs as:

“Nonetheless only a breakdown & retest state of affairs till confirmed in any other case. Nonetheless going to plan. Quantity is low, MACD/RSI wanted a reset on 1D and beneath, + we dropped 45k with no bounce. I wouldn’t get loud on calling a backside fairly but.”

Key value ranges for 2025

Bitcoin lately hit its highest value in over two weeks, nearing $94,000 amid hypothesis a few new US Federal Reserve chair.

Dealer Daan Crypto Trades famous that the market construction has technically turned bullish after posting a better excessive and better low, however emphasised:

“However to correctly get this going I need to see it maintain above this present value space.”

The $93,500 degree stays a big reference for the 2025 yearly candle. In accordance with analyst Rekt Capital, Bitcoin should shut the month above this zone to safe a inexperienced yearly candle.