Be a part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor’s technique tried to calm investor nerves by making a $1.44 billion dividend reserve, however its inventory continued its decline with one other 3% fall yesterday.

A press launch mentioned the reserve is supposed to cowl at the least a 12 months of dividends, and in the end two years, to present the corporate a monetary cushion. CEO Phong Le mentioned it at present exceeds the corporate’s near-term payout obligation.

Critics have questioned whether or not Technique can meet obligations from its most popular inventory, a priority that’s amplified by broader market weak spot.

Regardless of the brand new money safeguard, MSTR shares stay in a funk and fell as a lot as 12% yesterday earlier than paring losses.

MSTR has plummeted greater than 35% up to now month and over 53% up to now six months.

Technique share worth (Supply: Google Finance)

Regardless of that, The Kobeissi letter says that even when Technique’s present debt pile of $8.2 billion is subtracted from the agency’s Bitcoin holdings, the corporate’s web BTC nonetheless stands at round $1.8 billion above Technique’s present market cap.

But it surely asks, ”Can Saylor hold shopping for?”

Technique has been at pains to ease investor nerves amid rising skepticism over the sustainability of the crypto treasury enterprise mannequin that the corporate pioneered, and that’s been copied by dozens of others.

So $MSTR‘s new enterprise mannequin is to promote inventory to lift money, then use that money to purchase Treasuries that yield about 4% to fund the issuance of debt and most popular inventory at a value of 8%–10%. How for much longer will buyers faux it is a viable enterprise simply to gamble on Bitcoin?

— Peter Schiff (@PeterSchiff) December 1, 2025

On the weekend, Technique CEO Phong Le mentioned the agency has “extra flexibility than ever” to proceed shopping for Bitcoin, that its capital construction is constructed on long-dated debt and that there isn’t any short-term strain on its means to lift funds.

Earlier, Saylor advised his 4.7 million followers on X that ”I received’t again down.”

Technique Buys Extra Bitcoin

Technique additionally introduced that it has added to its huge Bitcoin stockpile with one other $11.5 million purchase. Based on an 8-Okay submitting with the US Securities and Change Fee (SEC), Technique purchased 130 BTC between Nov. 17 and Nov. 30 at a mean worth of $89,960.

Technique has acquired 130 BTC for ~$11.7 million at ~$89,960 per bitcoin. As of 11/30/2025, we hodl 650,000 $BTC acquired for ~$48.38 billion at ~$74,436 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/UkWX7PRHms

— Michael Saylor (@saylor) December 1, 2025

Technique Now Holds Extra Than 3% Of Bitcoin’s Provide

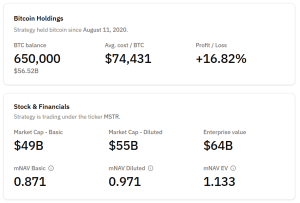

Following the newest spherical of buys, Technique holds a complete of 650K BTC on its steadiness sheet, information from Bitcoin Treasuries reveals. This represents greater than 3% of BTC’s whole provide of 21 million cash.

Technique BTC holdings (Supply: Bitcoin Treasuries)

Total, the corporate’s BTC holdings are valued at $56.52 billion, with the common worth for the acquisitions at $74,431 per Bitcoin.

Technique Reduces 2025 Revenue And Yield Targets

The agency’s newest Bitcoin buys got here amid a broader crypto market stoop, which has seen BTC’s worth drop a fraction of a p.c up to now week and greater than 21% within the final month.

That correction and and Technique’s inventory plunge has prompted it to revise its year-end revenue targets.

Initially, the corporate had predicted that BTC would hit $150K by the top of the 12 months, however not too long ago lowered that focus on to between $85K to $110K.

Along with the revised Bitcoin worth goal, the agency has additionally adjusted its full-year revenue and Bitcoin yield targets. The agency now forecasts a 12 months web revenue starting from a lack of $5.5 billion to a acquire of $6.3 billion. In the meantime, the corporate’s Bitcoin yield goal has been reduce from a previous goal of 30% to a spread of twenty-two% and 26%.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection