Bitcoin continues to commerce close to $92,000 after this week’s rebound, but a rising cluster of on-chain indicators now suggests the market has already slipped right into a bearish cycle.

This stands in sharp distinction to current predictions from market leaders like Tom Lee and Arthur Hayes, who argue Bitcoin might nonetheless shut the yr considerably greater.

Sponsored

Sponsored

Bullish Predictions Conflict With Knowledge

Lee lately softened his earlier $250,000 goal and now expects Bitcoin to stay above $100,000 into year-end.

In the meantime, Arthur Hayes maintains a way more aggressive view, calling the current dip to the low $80,000s a cycle backside and forecasting a possible transfer towards $200,000–$250,000.

Nevertheless, the present market construction doesn’t align with both state of affairs.

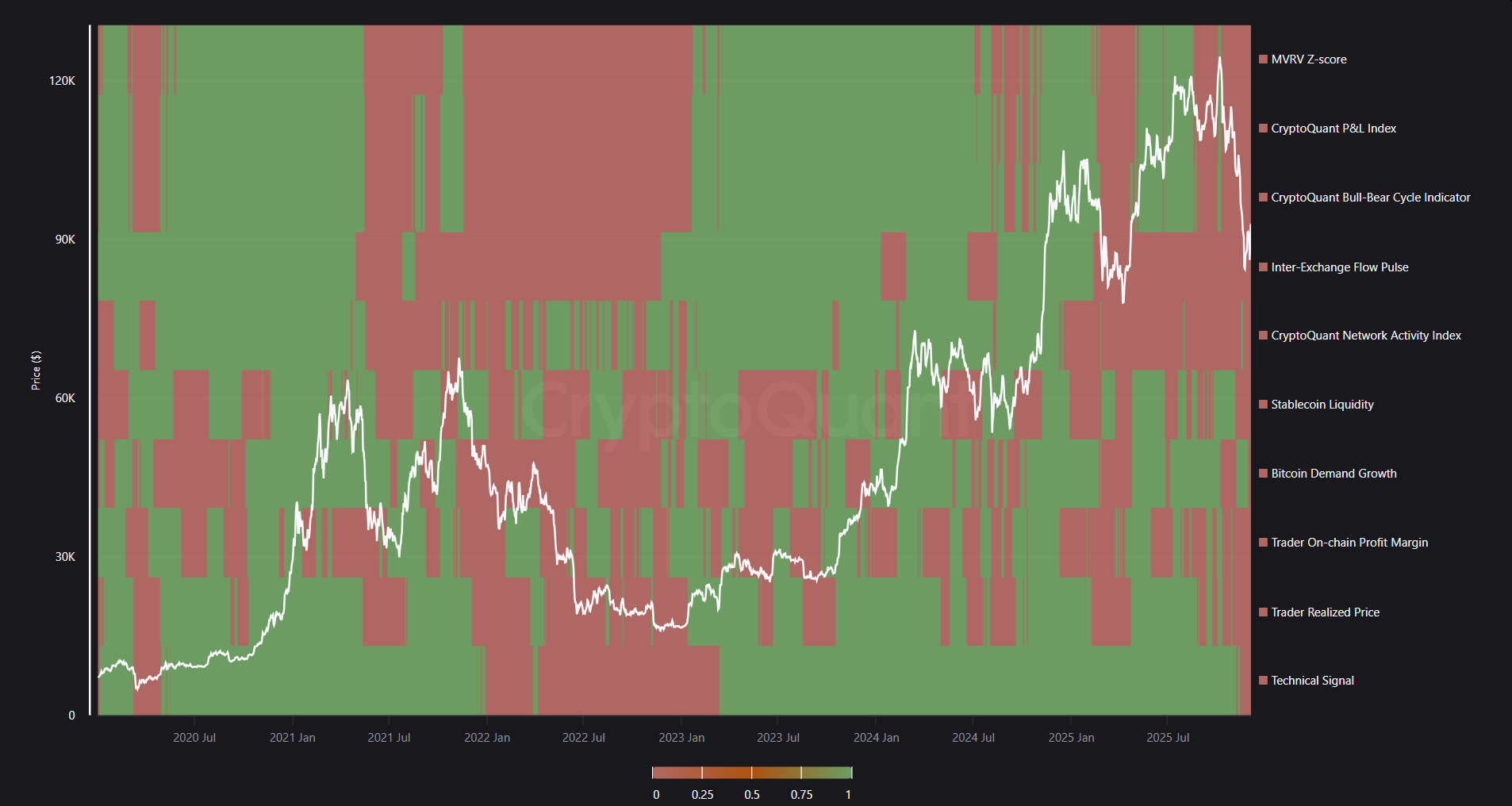

CryptoQuant’s Bull Rating Indicators composite exhibits why. Throughout earlier bull phases, together with late 2023 and early 2025, the mannequin displayed broad inexperienced circumstances throughout valuation, demand development, community exercise, and stablecoin liquidity.

Since mid-2025, these elements have turned constantly crimson. MVRV Z-score has flipped into overheated territory, community exercise has weakened, and stablecoin shopping for energy has declined.

The sample resembles the early phases of the 2022 downturn moderately than a continuation of the 2025 rally.

Sponsored

Sponsored

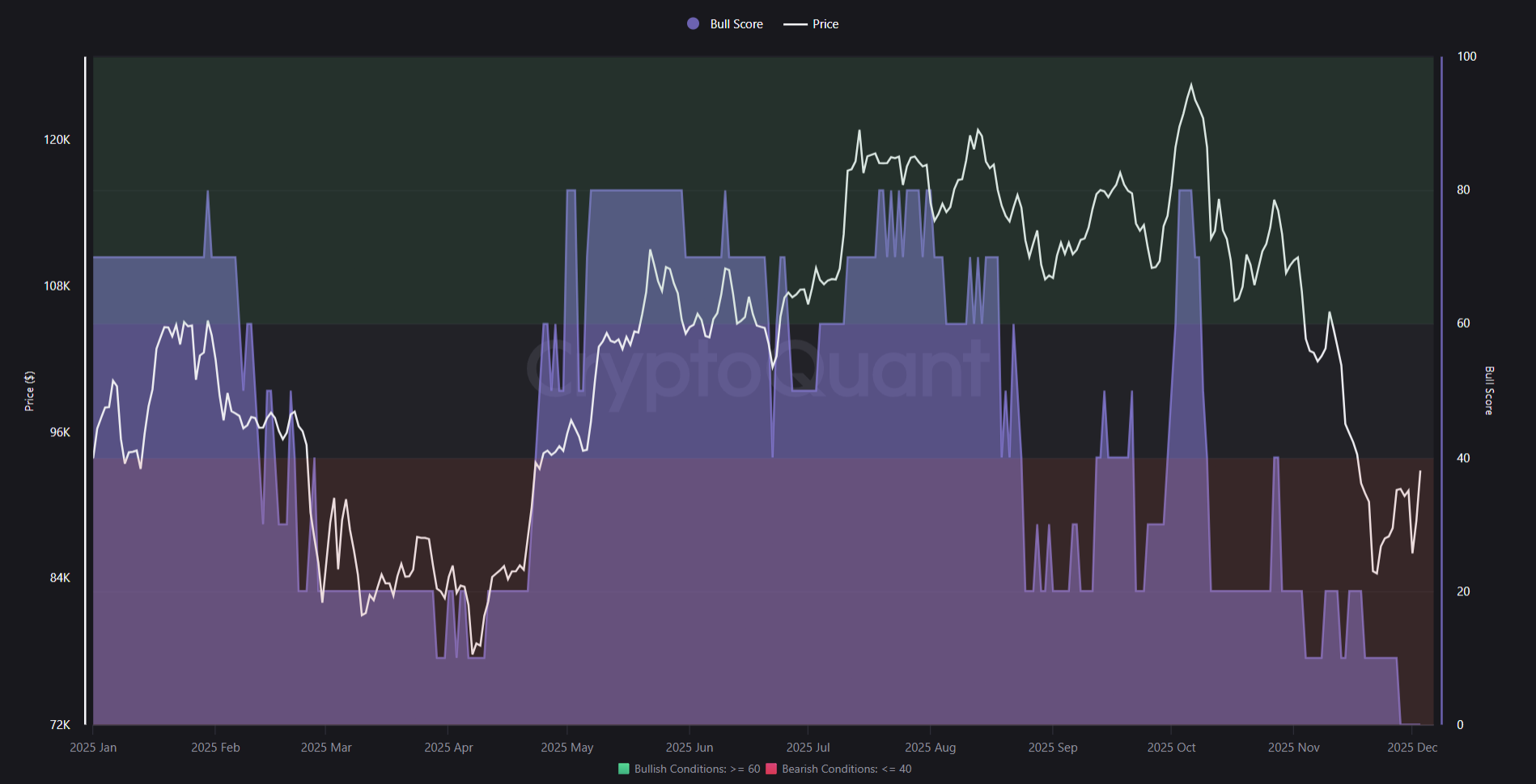

Additionally, the Bull Rating Index, presents a extra granular view. Bitcoin spent the primary half of 2025 in bullish territory with readings above 60.

By late August, the rating started falling sharply, dropping beneath 40 in October and remaining flat by way of November regardless of short-term worth volatility.

The newest studying sits within the 20–30 vary, deep inside bearish circumstances. The bounce from final week’s lows has performed little to shift the underlying cycle indicators.

One other, the Bull Rating mapped to cost, reinforces this view. The mannequin has transitioned from inexperienced “additional bullish” indicators earlier this yr to persistent crimson “bearish” and “additional bearish” readings throughout September, October, and November.

Even the current restoration towards $92,000 is categorized as a bearish-zone rally, mirroring distribution phases seen in earlier cycle tops.

Sponsored

Sponsored

Momentum Metrics Strengthen the Bitcoin Bearish Case

Market momentum indicators now echo the identical cycle shift. RSI stays impartial round 50, signalling a scarcity of conviction behind this week’s advance.

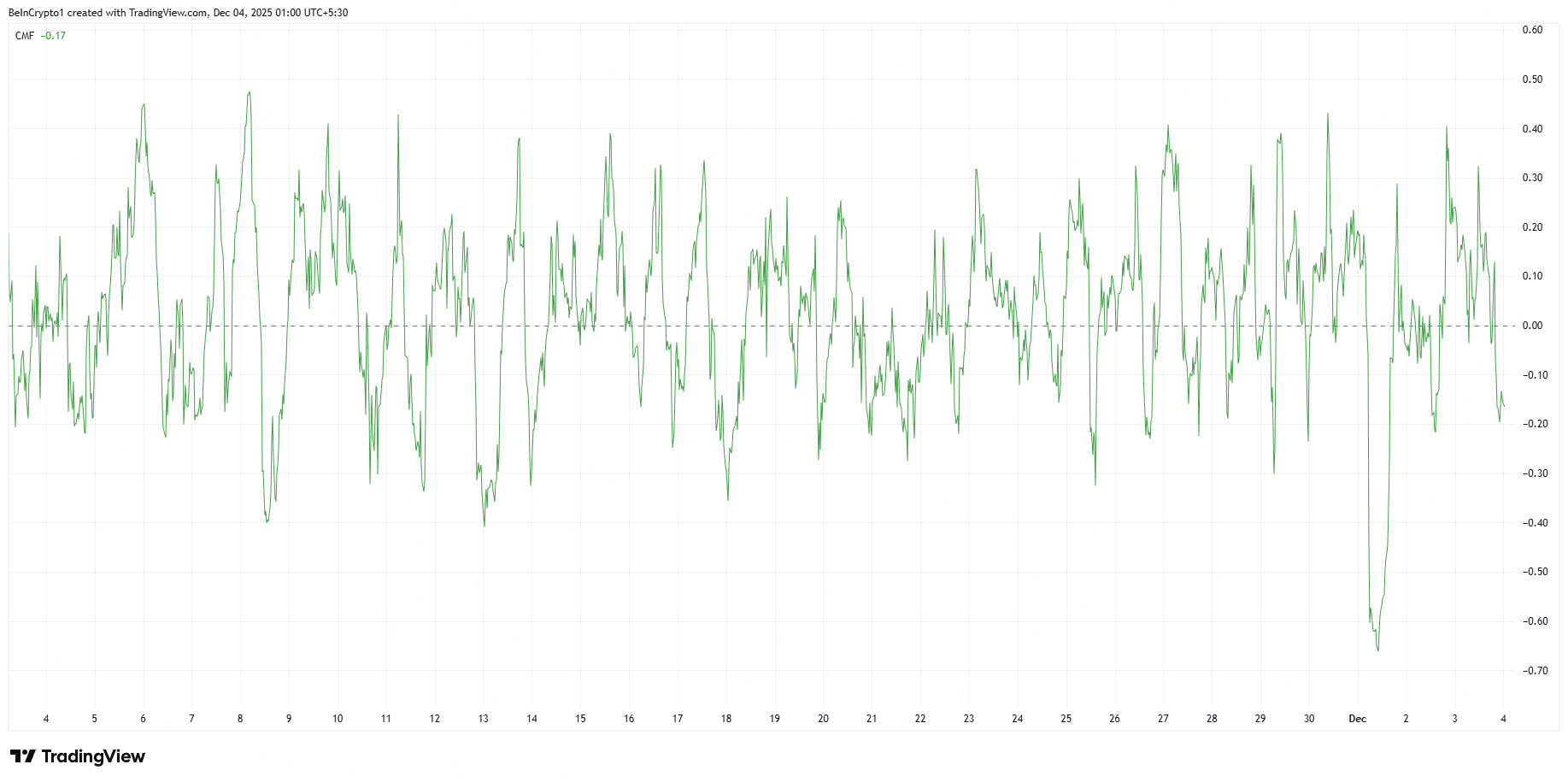

Chaikin Cash Stream has stayed detrimental for a lot of the month, reflecting continued capital outflows whilst worth recovers.

Whereas MACD lately flipped optimistic, the histogram already exhibits weakening amplitude. This means the transfer lacks sustained momentum.

Sponsored

Sponsored

Further indicators deepen the warning. Brief-term RSI spikes above 70 in current days failed to carry, displaying sellers stay lively throughout each try at a breakout. CMF’s incapacity to return to optimistic territory highlights ongoing distribution moderately than accumulation.

In the meantime, MACD’s fragile crossover mirrors circumstances seen throughout previous bear market rallies, the place momentum improves briefly earlier than rolling over.

Taken collectively, on-chain, liquidity, and momentum indicators level to a structural shift right into a bearish cycle.

Whereas Tom Lee and Arthur Hayes argue that Bitcoin might regain its earlier energy, present market information suggests the alternative.

Until stablecoin liquidity, community exercise, and demand development rebound decisively, Bitcoin’s current restoration is extra seemingly a brief bounce than the start of a brand new upside section.