Zcash crypto at present sits in a fragile steadiness between a shaken higher-timeframe construction and a extra constructive intraday tone. Merchants are attempting to know whether or not the latest sell-off is solely a deep pullback inside a broader uptrend, or the beginning of an extended section of digestion below heavy market-wide uncertainty.

Abstract

The asset trades round 350 USDT, nicely under its latest shifting averages, signaling a weakened medium-term development. Every day indicators lean cautious, with momentum nonetheless subdued and consumers not but in full management. Nonetheless, intraday information present indicators of stabilization and modest upside bias as value reclaims short-term averages. Volatility is elevated on the day by day chart, so swings round key ranges will be large. In the meantime, the broader crypto market cap is rising over 6% in 24 hours, but sentiment stays in Excessive Worry, hinting at a fragile backdrop. General, traders face a blended panorama the place persistence and strict danger administration are essential.

Zcash crypto at present: Market Context and Path

The broader surroundings is surprisingly constructive, with the entire crypto market capitalization close to 3.15 trillion {dollars} and up about 6.1% over the past day. Furthermore, Bitcoin dominance hovers round 57.4%, confirming that the main coin remains to be absorbing many of the new liquidity. In distinction, the sentiment gauge tells a distinct story: the Worry & Greed Index sits at 23, in Excessive Worry, which means that emotional situations are nonetheless defensive regardless of rising costs. This mix normally factors to an early or fragile section of risk-on, the place members reluctantly add publicity.

Inside this backdrop, ZECUSDT reveals a day by day regime labeled as impartial, reflecting the present indecision. The pair shouldn’t be but in a confirmed bullish surroundings, however the broader market push and robust exercise on main DeFi venues, the place charges have expanded sharply over the past month, recommend that capital is actively rotating throughout the ecosystem. That mentioned, with Bitcoin steering the ship, privacy-focused belongings should nonetheless show they’ll appeal to sustained inflows past speculative bursts.

Technical Outlook: studying the general setup

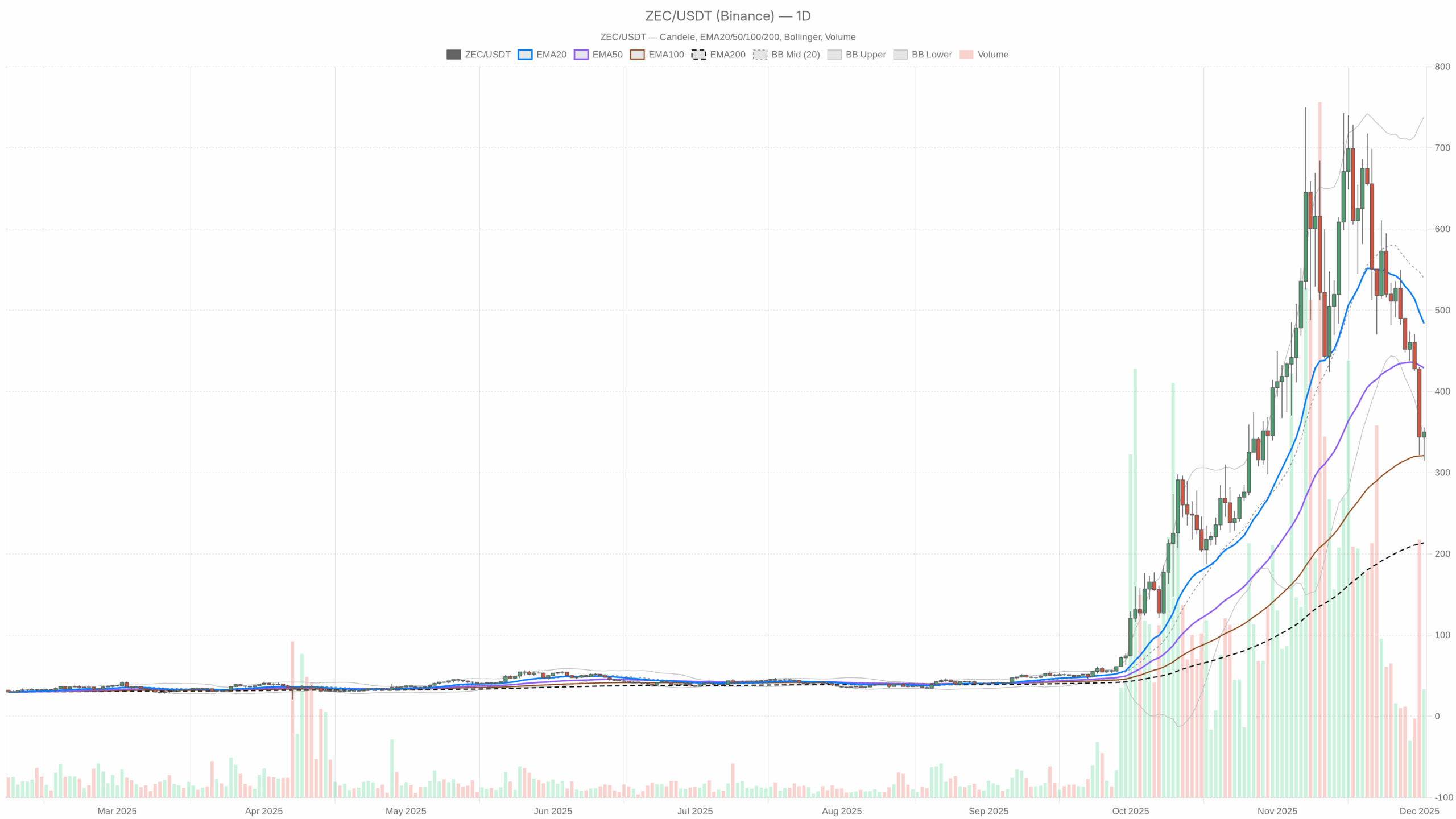

On the day by day timeframe, value closes round 350.1 USDT, materially under the 20-day EMA at 483.65 and the 50-day EMA at 429.07. This configuration reveals a short- to medium-term downtrend inside a nonetheless elevated longer-term construction, as a result of the 200-day EMA at 213.58 stays far under spot. The gap between value and the sooner EMAs signifies sellers have not too long ago dominated, whereas the optimistic hole above the 200-day line retains the door open for a longer-cycle restoration as soon as momentum turns.

The RSI at 14 durations stands close to 37, under the midline however not but oversold. This placement hints at bearish momentum that’s shedding depth fairly than a full capitulation. It implies that promoting stress has cooled considerably, but consumers haven’t reclaimed clear management. Merchants typically interpret this zone as a ready room: both value stabilizes and RSI curls increased, or one other leg down drags it nearer to traditional oversold territory.

Every day MACD deepens this narrative. The MACD line sits round -20.54, nicely under its sign at 14.11, with a unfavourable histogram close to -34.65. This construction confirms a bearish momentum regime, the place earlier down strikes are nonetheless echoing by way of the trend-following indicators. Nonetheless, when the histogram is strongly unfavourable, merchants begin waiting for indicators of exhaustion or a gradual narrowing that might level towards a possible momentum inflection.

Bollinger Bands on the day by day chart place the center band at 539.44, with the higher round 738.46 and the decrease close to 340.43. Value at present hovers simply above the decrease band, which usually alerts draw back extension with rising mean-reversion potential. It suggests the asset has stretched to the decrease volatility envelope and will both consolidate sideways or stage a technical bounce again towards the mid-band, particularly if sellers start to tire.

The 14-day ATR is about 75.02, a excessive worth relative to the present value zone. This means elevated volatility, which means that even intraday fluctuations will be massive when measured in proportion phrases. Consequently, place sizing and wider cease placement turn out to be important, since regular noise can in any other case set off untimely exits.

Intraday Perspective and ZECUSDT token Momentum

On the hourly timeframe, the image appears to be like extra balanced. Value close to 350.04 trades barely above the 20-period EMA at 338.99 however nonetheless under the 50-period EMA at 364.7 and the 200-period EMA at 453.82. This setup displays a short-term try and rebuild bullish construction inside a broader corrective context. It hints that intraday dip consumers are lively, however they’re nonetheless working beneath heavier resistance from increased shifting averages.

The hourly RSI at 53.47 sits simply above the impartial 50 line, implying mildly optimistic momentum intraday. In the meantime, MACD on this timeframe reveals the road at -7.15 versus a sign at -11.49 and a optimistic histogram round 4.33. This alignment factors to early bullish momentum crossover, the place the short-term development is making an attempt to show up even because the longer development stays cautious.

Zooming additional in, the 15-minute chart paints an much more optimistic short-term story. Value at 350.04 stands above each the 20-period EMA (334.98) and the 50-period EMA (333.58), whereas nonetheless under the 200-period EMA at 363.94. The RSI round 70 suggests sturdy intraday momentum, bordering on overbought, which frequently alerts that short-term merchants have chased the transfer and will quickly pause or take earnings. MACD on this micro timeframe is comfortably optimistic, confirming that latest hours have belonged to the bulls.

Key Ranges and Market Reactions

Every day pivots assist map out the place this tug-of-war may intensify. The primary day by day pivot sits near 340.25, just under present costs, appearing as a primary reference help after the newest rebound. A deeper cushion emerges across the S1 space close to 324.5; if the asset slips again towards this zone, merchants will watch to see whether or not consumers rapidly defend it, which might underline a creating accumulation section after the latest decline.

On the upside, the primary vital response space seems round 365.86, roughly aligning with intraday resistance clusters. A clear transfer and sustained maintain above that band would reinforce the thought of a short-term bullish reversal try, opening area towards the confluence of the 50-day EMA round 429 and the Bollinger midline close to 539. In such a situation, each method to those increased ranges will take a look at how dedicated new consumers actually are after weeks of stress.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

Future Situations and Funding Outlook

General, the primary situation on the day by day chart stays cautiously bearish to impartial, with value nonetheless compressed close to the decrease Bollinger Band and under short-term shifting averages. Nonetheless, bettering intraday momentum and modest bullish alerts on hourly and 15-minute indicators trace that the market is at the least making an attempt to construct a ground. If world crypto capitalization continues to broaden whereas concern step by step subsides, this token may transition from defensive consolidation towards a extra constructive restoration section. Till day by day momentum confirms a shift, although, traders might favor staggered entries, clear invalidation ranges below close by helps, and a deal with capital preservation whereas they anticipate development affirmation.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.