Be part of Our Telegram channel to remain updated on breaking information protection

A bunch of ten banks are planning on launching a euro-pegged stablecoin that’s compliant with the European Union’s Markets in Crypto-Belongings (MiCA) framework.

In a latest discover, BNP Paribas mentioned that it will be a part of 9 different banks based mostly within the EU to launch the stablecoin “within the second half of 2026.” The stablecoin can be launched via an Amsterdam-based entity referred to as Qivalis.

The launch will, nevertheless, be topic to regulatory approval.

🇪🇺 BREAKING: Ten main EU banks are teaming as much as launch a euro-pegged stablecoin by 2026, underneath a Dutch Central Financial institution–backed entity.

Regulatory approval focused for late 2026.

The stablecoin wars are formally right here.#EU #Stablecoin #Crypto #Blockchain #ECB pic.twitter.com/PbRu44Tqzm— Bruno Dealer (@BrunoTrade87) December 3, 2025

New Euro-Pegged Stablecoin Will Convey “Autonomy” In The Digital Age

Stablecoins are blockchain-based tokens which are backed by liquid reserves of steady property. Common property used for these tokens’ reserves embody fiat currencies.

In 2025, the stablecoin market has boomed amid a friendlier regulatory local weather within the US. A rising variety of main corporations have additionally began exploring blockchain know-how and stablecoins.

In accordance to Qivalis CEO Jan-Oliver Promote, the deliberate launch of the euro-pegged stablecoin subsequent 12 months “isn’t nearly comfort – it’s about financial autonomy.”

The token will current “ new alternatives for European firms and shoppers to work together with onchain funds and digital asset markets in their very own forex,” the CEO added.

Stablecoins Pose Little Risk To Europe, Says ECB

The EU banks’ deliberate euro stablecoin launch comes after the European Central Financial institution (ECB) mentioned that stablecoins pose little menace to Europe.

In a monetary stability overview that was printed in direction of the top of November, the ECB mentioned that its evaluation that stablecoins pose a minimal menace to monetary stability is because of each the low adoption charges and the pre-emptive regulatory framework established by the European Union for these tokens.

The report, which was authored by monetary stability consultants Senne Aerts, Claudia Lambert, and Elisa Reinhold, did, nevertheless, warn that the expansion of the stablecoin market have to be regularly monitored.

The ECB’s evaluation of stablecoins contradicts the views of Dutch Central Financial institution Governor Olaf Sleijpen, who reportedly warned of the potential danger to financial coverage because the stablecoin market grows.

USD Stablecoins Account For The Majority Of The Market

The stablecoin market cap soared to above $300 billion for the primary time this 12 months, and at the moment stands at about $311.4 billion, based on information from CoinGecko.

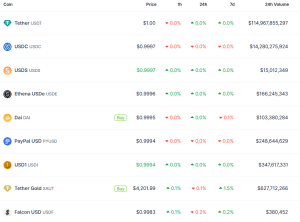

Of that capitalization, USD-pegged tokens account for almost all of the market. Extra particularly, Tether’s USDT, which has a market cap of over $114.9 billion, and Circle’s USDC, which has a complete capitalization exceeding $14.2 billion, are the 2 largest stablecoins available in the market.

Prime stablecoins by market cap (Supply: CoinGecko)

After USD-pegged stablecoins, tokens backed by bodily gold are the next-biggest stablecoins available in the market.

In keeping with the CoinGecko information, the biggest non-USD or gold-backed stablecoin is Circle’s EURC, which at the moment has a market cap of greater than $28.7 million.

Tether had provided a euro-pegged token, EURt, however ended redemptions for the stablecoin on Nov. 25. This was about one 12 months after the corporate mentioned it will discontinue its assist for the token.

Tether mentioned on the time that the choice was based mostly on the EU’s MiCA rules, which the corporate’s CEO, Paolo Ardoino, has mentioned posed systemic dangers for stablecoins.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection