Solana continues to sit down on the heart of market consideration as merchants monitor its construction, short-term outlook, ETF flows, and long-term targets.

The previous week delivered recent volatility for SOL, however the newest rebound, mixed with new ETF inflows, brings renewed power to the chart.

With momentum returning, many merchants now have a look at Solana alongside the perfect crypto to purchase now as they plan their subsequent strikes.

This replace breaks down the present setup, the response to key ranges, the newest ETF developments, and what merchants ought to put together for within the coming days.

Whereas SOL provides a high-performance Layer 1 alternative, good cash can also be rotating into high-alpha presale performs centered on the Bitcoin Layer 2 narrative for doubtlessly outsized returns.

Bitcoin Hyper (HYPER) has emerged as a high candidate for the following crypto to blow up, already elevating round $28.9 million in its presale.

Supply – Cilinix Crypto YouTube Channel

Solana Sees Main ETF Rebound After Vanguard Sparks New Inflows

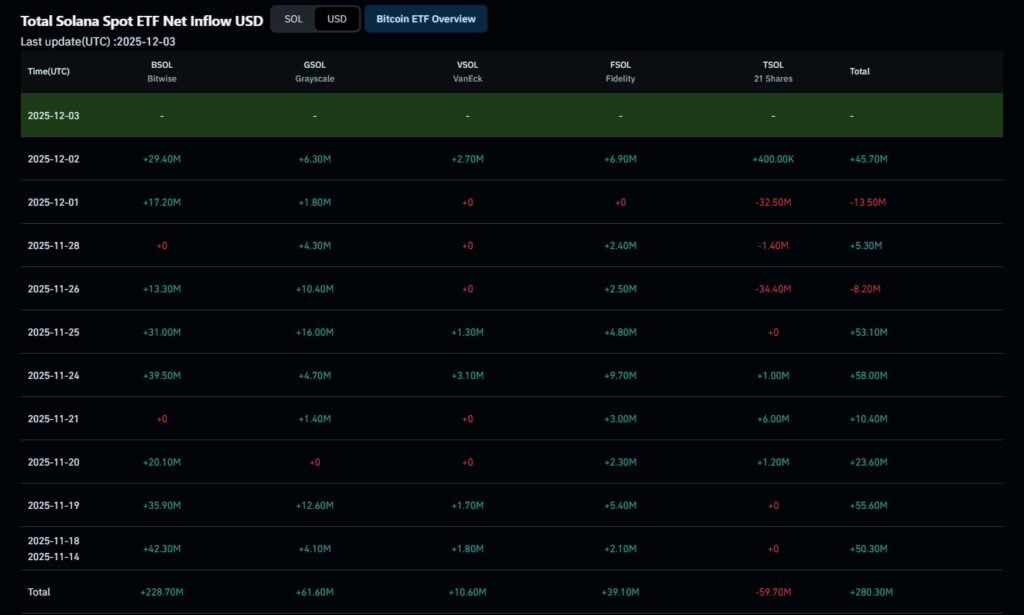

The Solana ETF narrative took successful final week when the Bitwise Spot Solana ETF recorded its first outflows. That tone shifted yesterday when new inflows doubled the prior week’s losses.

Solana introduced in roughly $45 million in recent inflows in a single day, displaying that momentum has turned strongly optimistic once more.

This reversal doubtless got here after information that Vanguard, the world’s second-largest asset supervisor, will open its brokerage platform to permit buying and selling of choose third-party crypto ETFs.

Vanguard controls monumental capital, so any transfer that expands entry to crypto ETFs can affect flows throughout all the market and enhance credibility for the asset class.

Knowledge from SolanaFloor and a number of other dashboards present the dimensions of this surge and spotlight sturdy institutional demand.

Complete cumulative inflows for Solana ETFs now sit above $280 million and are quickly approaching $400 million, with Bitwise’s BSOL driving a lot of the momentum and reaching $574 million in belongings beneath administration.

The inflows come from a number of issuers, not only one. Day by day ETF knowledge exhibits constant inexperienced influx days from Bitwise, Grayscale, Constancy, and VanEck. On days when one issuer data outflows, inflows from the others offset the weak spot, conserving Solana’s complete ETF circulation firmly optimistic.

This broad and resilient demand construction exhibits rising confidence in Solana’s long-term outlook and strengthens its place as probably the most profitable non-Bitcoin, non-Ethereum ETF product launched prior to now two years.

Solana Worth Prediction

Solana (SOL) moved with the broader market, confirming a short-term bullish construction after efficiently defending the help zone close to $123, which matched the lows from November 21.

This protection, fueled by sturdy quantity and SOL intently monitoring Ethereum’s construction, exhibits clear purchaser curiosity. Nonetheless, the upward transfer pushed SOL straight right into a heavy resistance cluster between $141 and $144.

The $144 degree is essential, performing because the Level of Management since March 2024 and aligning with the 30-day rolling VWAP.

As SOL tapped this resistance, the short-term setup started to favor a pullback. Decrease-timeframe charts confirmed bearish divergence, and 4 single-print imbalances sit beneath the present worth, rising the prospect of a retracement.

A dip towards $132 seems to be like probably the most sensible near-term state of affairs, giving SOL room to stabilize and fill liquidity earlier than trying one other push. Merchants additionally want to notice that funding charges have shifted again into optimistic territory, that means lengthy positions now incur funding prices.

Regardless of short-term pullback threat, the higher-timeframe outlook stays intact. SOL constructed a robust native backside at $123, and the worth nonetheless trades inside a dominant vary between $123 and $180.

The primary main goal sits at $150 to $152, which completes the honest worth hole above present worth, with the following determination degree on the vary high between $175 and $180. Merchants ought to deal with these ranges as key determination zones.

A breakout above $180 and a retest of $200 would require a robust shift in fundamentals; with out that shift, the vary construction stays dominant.

Solana Rally Fuels Bitcoin Hyper Presale Surge

Now that Bitcoin is steadying, confidence is rotating again into the crypto ecosystem and Bitcoin Hyper is benefiting. The undertaking is closing in on $29 million raised in its presale as whale patrons help the “Bitcoin Renaissance” thought.

It’s price noting that whereas retail merchants apprehensive about Monday’s drop, on-chain knowledge exhibits some whale wallets shopping for extra $HYPER. This conduct indicators that they see worth right here even throughout uneven market circumstances.

Bitcoin Hyper’s pitch stays easy however bold. It’s a Bitcoin Layer-2 community that makes use of the Solana Digital Machine (SVM) to course of transactions alongside Bitcoin’s principal chain.

The aim is to maintain Bitcoin’s safety and add Solana’s pace so on a regular basis DeFi instruments like lending and borrowing can run easily on Bitcoin.

The event crew additionally constructed good tokenomics. They set $HYPER’s provide at 21 billion as a nod to Bitcoin and supply 40% APY staking rewards to encourage folks to carry by means of the launch.

The following few weeks look clear. Macro headwinds proceed to fade on the similar time Bitcoin’s worth begins to rise once more. When that occurs, merchants often search for higher-risk initiatives in presale, particularly with $HYPER priced at solely $0.013365.

That is additionally the place Borch Crypto steps in, calling Bitcoin Hyper the perfect crypto to purchase now due to its early worth and robust fundamentals.

Traders who need to purchase $HYPER at this stage can go to the Bitcoin Hyper presale web site. Patrons can use SOL, ETH, USDT, USDC, BNB or a bank card.

Go to Bitcoin Hyper

This text has been supplied by one in every of our business companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues by means of the hyperlinks on this text.