Bitcoin is up 1.9% over the previous week and continues to climb steadily since December 1. It trades close to $93,300 after a flat 24 hours, however the chart is hinting at a breakout, adopted by a potential 15+% transfer.

Consumers have stepped again in, however not those that the Bitcoin value would wish to maintain the rally.

Sponsored

Consumers Step In as Bitcoin Presses Towards a Break

Bitcoin has traded down since mid-November, constructing strain to the draw back. But, the value has been rising since December 1 and is now pushing into a possible breakout construction. The identical is confirmed by a growing inverse head-and-shoulders sample on the 12-hour chart. That sample often seems close to market bottoms and helps the concept of a restoration.

Nonetheless, a clear 12-hour shut above the neckline could be crucial for the breakout hopes to rise.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here

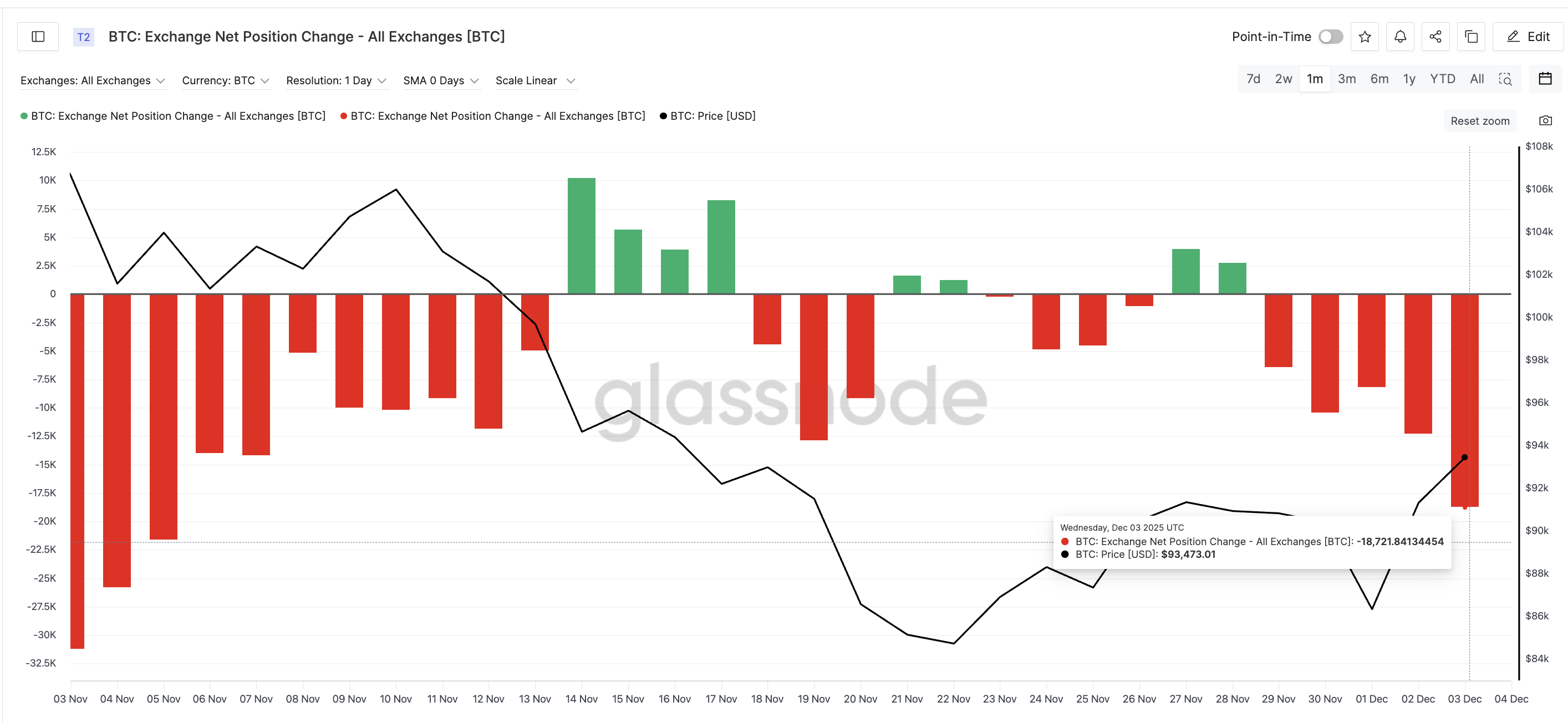

The strongest affirmation comes from spot flows. Alternate web place change tracks whether or not cash transfer into exchanges to promote or out of exchanges to carry. On November 27, exchanges noticed web inflows of three,947 BTC, displaying promoting strain. By December 3, the metric flipped to –18,721 BTC, that means heavy outflows.

Sponsored

A shift of greater than 22,000 BTC in favor of patrons exhibits that demand returned sharply throughout this climb.

This enchancment units the opening chapter, however the subsequent a part of the story explains why the rally nonetheless feels unstable.

The Purchaser Combine Reveals a Hidden Weak spot

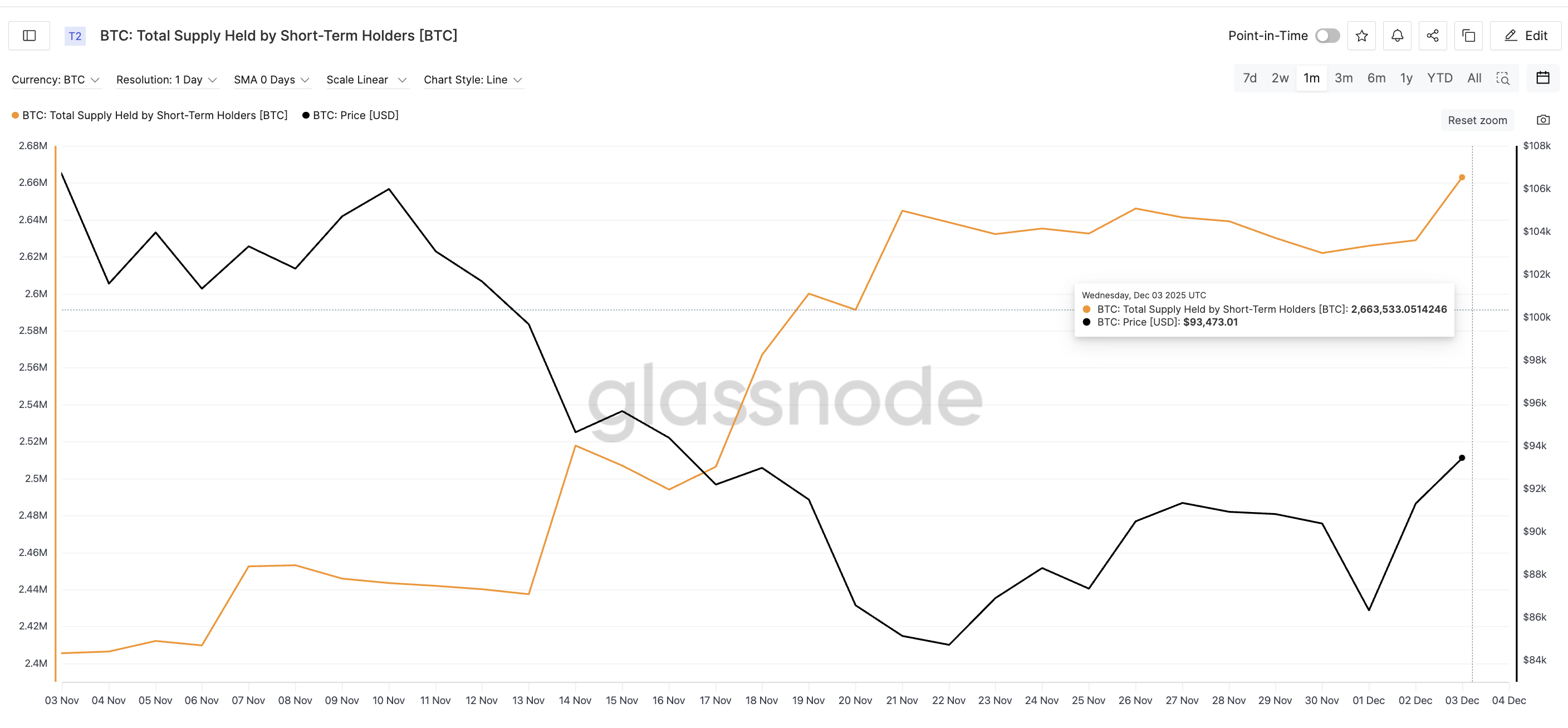

Quick-term holder provide has risen from 2,622,228 BTC on November 30 to 2,663,533 BTC as of December 3. Quick-term holders are wallets that hold cash for only some weeks. They purchase rapidly, however additionally they promote rapidly.

Their rising provide, a rise of just about 1.6%, typically seems bullish on the floor, nevertheless it means the rally hopes are being carried by essentially the most reactive group out there. If the Bitcoin value stalls, they’re often the primary to take income.

Sponsored

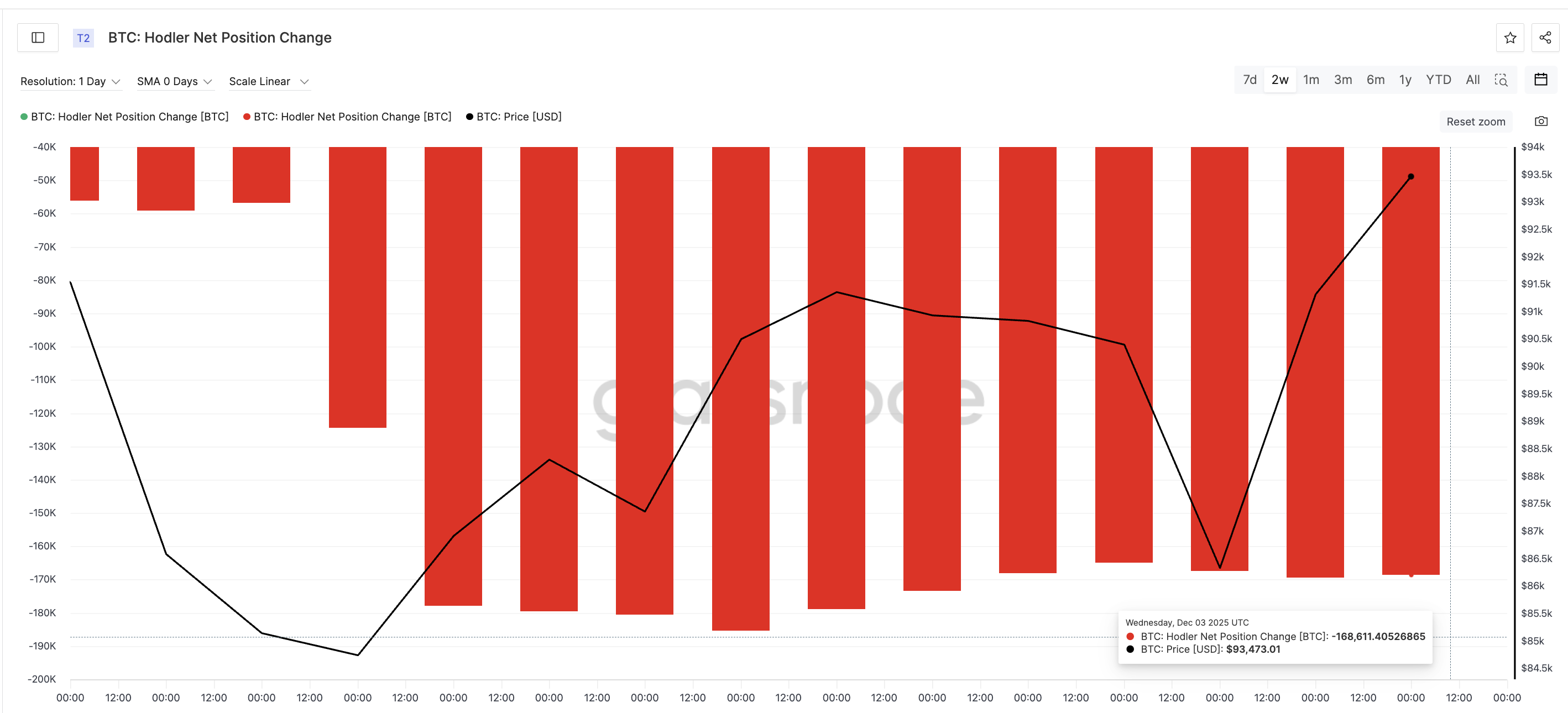

Lengthy-term holders, the group that anchors robust breakouts, haven’t joined in. Their web place change, proven through the HODLer web place change metric, has been unfavorable for the fourteenth straight day. The most recent studying sits at –168,611 BTC.

Till long-term holders flip into web patrons, any breakout stays weak to fast reversals triggered by speculative cash.

This imbalance explains why the Bitcoin value is urgent towards a sample break however nonetheless lacks the depth wanted for a safe rally.

Sponsored

Bitcoin Value Ranges That Affirm or Spoil the Transfer

The Bitcoin value sits just below the neckline at $93,200. A 12-hour shut above this stage confirms the inverse head-and-shoulders sample and unlocks the following checkpoints at $96,600, $99,800, and $104,000.

If patrons push via these ranges with actual power, the total extension of the sample lands close to $108,300, which marks the potential 15% transfer referenced earlier.

Weak spot exhibits if Bitcoin slips beneath $90,400, a stage the place patrons stepped in throughout latest dips. Dropping that zone invitations a deeper check close to $84,300, and a fall beneath $80,500 invalidates all the construction.

For now, Bitcoin is making an attempt a sample break with enhancing spot flows, rising speculative demand, and cautious long-term holders. The chart has room for a 15+% extension, however clearing $93,200 with actual conviction decides whether or not that transfer really begins.