Firelight introduces XRP staking on Flare, providing yield and on-chain exploit cowl. This innovation goals to reinforce DeFi safety requirements.

Firelight, a brand new decentralized finance (DeFi) protocol, is bringing staking to XRP customers. It additionally supplies protocols with some type of safety towards community hacks. Constructed by Sentora and supported by Flare Community, Firelight permits holders of XRP to stake their tokens. This leads to rewards associated to demand for DeFi “cowl.”

Staking Innovation Unlocks New Utility for XRP

This safety may help protocols take up the losses from exploits. The protocol revealed this in a press launch on Wednesday. The concept is analogous to insurance coverage within the conventional monetary world. That is an space during which the $160 billion DeFi sector nonetheless lags. Billions of {dollars} down in exploits make a broader adoption harder.

Associated Studying: XRP Information: XRP Assessments $2 as Bulls Combat Bears | Stay Bitcoin Information

Connor Sullivan, chief technique officer at Firelight, stated in a press release. He stated, “At this stage of the maturity of DeFi, it wants the identical infrastructure of danger.” This helps one another monetary market. “Firelight supplies an environment friendly capital safety layer that may take up shocks,” he added. This layer mitigates the technical and financial danger. Furthermore, it makes the entire ecosystem extra resilient.

As of December 3, 2025, the worth of XRP is roughly $1.90 to $2.22. Some sources quoted the latest improve in worth. XRP has been on an absolute tear with reviews citing a acquire of over 10%. This occurred on December 3, 2025.

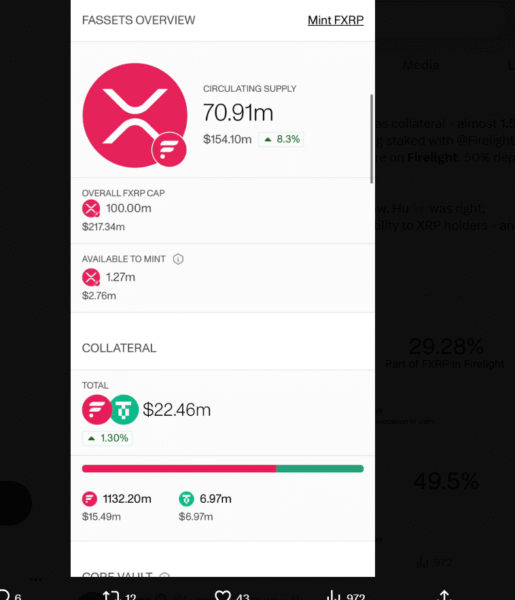

XRP doesn’t help native staking by itself ledger. Firelight, primarily based on the Flare community, permits XRP holders to deposit their tokens. They obtain a liquid staking token referred to as stXRP in return. This permits them to earn yield. This can be a function that was not beforehand out there for XRP.

They will additionally make the most of stXRP throughout the Flare DeFi ecosystem. Examples embody swapping on decentralized exchanges. Moreover, it may be used as collateral. The primary innovation is to make use of the staked XRP as an on-chain insurance coverage layer.

On-Chain Cowl Addresses Main DeFi Safety Dangers

That is the capital that will likely be used to offer cowl. This cowl will be contracted by different DeFi protocols. This protects their belongings in case of hacks or exploits. This immediately addresses a giant danger for the DeFi area.

The protocol is supported by each Sentora and Flare Community. Each are supported by Ripple. They hope to extend the utility and function of XRP. This is part of the larger ecosystem of DeFi.

The protocol was audited 3 times earlier than launch. Corporations included OpenZeppelin and Coinspect. This was along with a bug bounty program supported by Immunifi. This ensured that most safety was sought.

The system is launching in two separate phases. Section 1 provides XRP holders the power to deposit XRP for stXRP. They earn “Firelight Factors.”

Section 2 is the stakeholder capital deployment. It will give the precise DeFi cowl mechanism. This creates incentives for stakers. The rewards are primarily based on actual demand for this insurance coverage in the true world.

This can be a essential initiative, and it goals to carry a layer of safety to DeFi area. This safety is prevalent in conventional finance. It additionally opens up new worth for the holders of XRP. This gives a yield-earning alternative to a beforehand static asset.