- Chainlink’s spot ETF launched with $41M in inflows and $13M buying and selling quantity on day one.

- Establishments are signaling curiosity in regulated altcoin publicity past BTC and ETH.

- Whereas not a blockbuster, LINK’s ETF already holds $64M in property and validates demand for long-tail crypto ETFs.

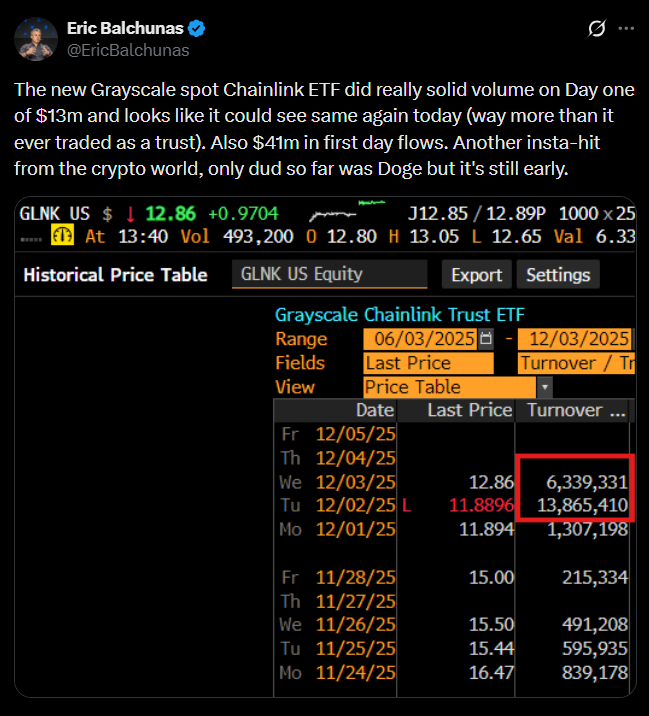

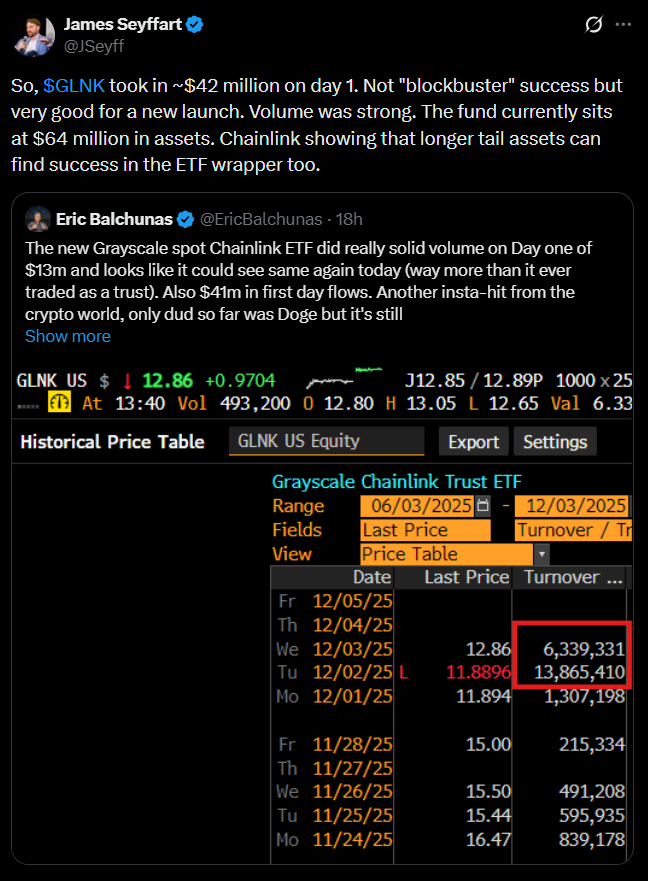

Grayscale’s launch of the primary U.S. spot Chainlink (LINK) ETF has landed with a stronger-than-expected affect, pulling in $41 million in internet inflows on its first day and delivering $13 million in buying and selling quantity regardless of a shaky crypto market. Bloomberg ETF analyst Eric Balchunas known as the debut “strong,” noting that just about each crypto ETF launch this yr has carried out effectively, with Dogecoin being the lone laggard to this point.

Demand Reveals Establishments Need Regulated Altcoin Publicity

The early flows verify a transparent development: institutional buyers need altcoin publicity, however solely by regulated, compliant, ETF-wrapped merchandise that may be built-in into fund mandates, pensions, and treasury methods.

In truth, Chainlink’s ETF outperformed different current altcoin debuts:

• Solana ETF: $8.2M first-day quantity

• XRP ETF: $243M first-day inflows (the strongest altcoin ETF launch of the yr)

Whereas LINK’s debut doesn’t match XRP’s blockbuster begin, it indicators that demand is rising for ETFs tied to altcoins with sturdy fundamentals, actual utility, and energetic developer ecosystems.

Not a Blockbuster — However Nonetheless a Clear Success

ETF analyst James Seyffart famous that LINK’s first day wasn’t a “blockbuster,” however emphasised that the ETF already holds $64 million in property, together with an $18 million seed funding. He highlighted the importance of a long-tail asset like Chainlink seeing success within the ETF wrapper — an vital benchmark for future altcoin merchandise.

Regardless of the ETF launch, LINK’s worth motion stays overshadowed by broader market weak point. The token is up 9.8% this week, however nonetheless down 39% year-over-year, in keeping with Cointelegraph knowledge.

Why Chainlink Attracts Institutional Curiosity

Chainlink isn’t simply one other altcoin — it’s probably the most broadly built-in backend networks in crypto. Its decentralized oracle feeds and cross-chain interoperability companies energy:

• Sensible contract automation

• Tokenized real-world asset methods

• DeFi platforms needing safe exterior knowledge

• Institutional blockchain infrastructure

This provides LINK a utility profile that aligns intently with what conventional finance seems for when exploring blockchain integrations.

A Milestone for “Lengthy-Tail” Crypto ETFs

Chainlink’s ETF debut provides contemporary momentum to the concept ETFs for long-tail property — not simply BTC or ETH — can discover significant market traction. As regulated on-chain merchandise broaden, extra altcoins with real-world utility may see ETF listings in 2025–2026.

If demand continues, the Chainlink ETF’s early success could mark a turning level for altcoin adoption by conventional monetary rails.

The put up Grayscale’s New Chainlink ETF Attracts $41M on Day One – Right here Is What the Robust Debut Indicators for Altcoin Adoption first appeared on BlockNews.