- The SEC halted filings for 3–5x leveraged crypto ETFs, citing the 1940 Act’s 200% leverage cap.

- Direxion, ProShares, and Tidal should revise their proposals earlier than consideration.

- Leverage has surged this cycle, with liquidations practically tripling in comparison with the final.

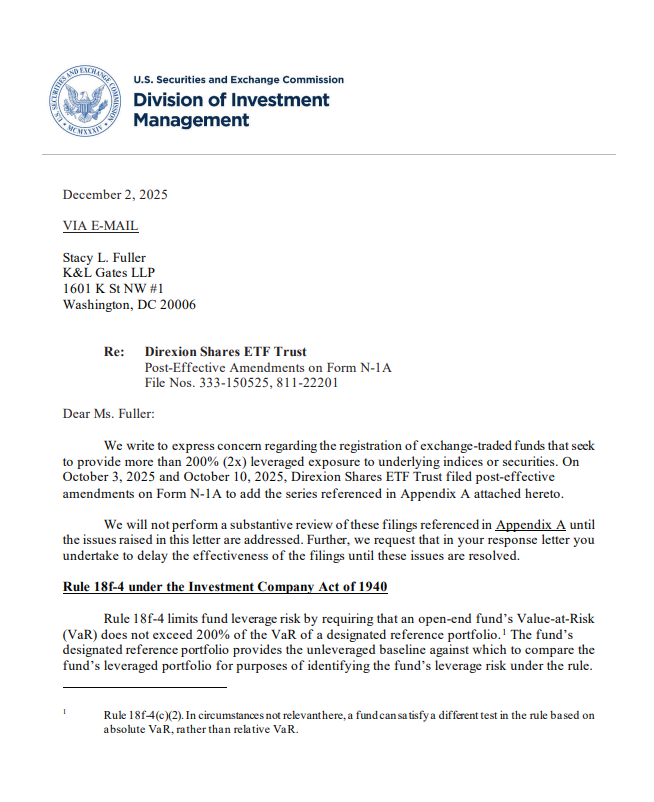

The U.S. Securities and Alternate Fee simply hit the brakes on a wave of extremely leveraged ETF proposals, sending formal warning letters to a number of main issuers and successfully stopping 3–5x crypto leveraged ETFs from transferring ahead — at the least for now. Direxion, ProShares, and Tidal have been all instructed to revise their filings after the SEC dominated that the merchandise would violate leverage limits established beneath the Funding Firm Act of 1940.

SEC Says Leverage Above 200% Breaches Current Regulation

The SEC pointed on to the 1940 Act, which restricts how a lot publicity a fund can tackle relative to its unleveraged “reference portfolio.” Regulators reminded candidates that publicity can’t exceed 200% value-at-risk, which means any ETF designed to ship triple or quintuple returns is routinely out of bounds.

Within the SEC’s phrases: the reference portfolio units “the unleveraged baseline” used to measure danger, and something above a 2x multiplier crosses regulatory strains. The company instructed issuers they have to cut back leverage inside allowed limits earlier than their filings can proceed.

A Uncommon Identical-Day Warning From Regulators

In an unusually quick transfer, the SEC publicly posted the warning letters the identical day they have been issued. Bloomberg analysts highlighted the immediacy of the discharge, calling it a transparent signal the company needs buyers to grasp its issues about amplified merchandise — particularly after a risky stretch for digital property.

The timing isn’t delicate. In October, crypto markets noticed a violent flash crash that erased $20 billion in leveraged positions in a single day, the most important liquidation occasion in crypto’s historical past. That incident triggered industry-wide discussions about extreme leverage and the systemic dangers it creates.

Leverage Is Skyrocketing This Cycle

Analysts say leverage is operating hotter than ever. In response to Glassnode knowledge, liquidations on this market cycle have practically tripled in comparison with the earlier one.

Common day by day liquidations final cycle:

• Longs – $28M

• Shorts – $15M

Present cycle:

• Longs – $68M

• Shorts – $45M

The Kobeissi Letter summarized the state of issues bluntly: “Leverage is clearly uncontrolled.”

Demand for Leveraged ETFs Is Surging — and That’s the Downside

After the 2024 U.S. election, expectations of a friendlier regulatory atmosphere despatched demand for leveraged crypto ETFs hovering. These merchandise supply amplified publicity with out the margin calls and compelled liquidations that plague futures markets. However the SEC’s concern continues to be the identical: even with out margin calls, leveraged ETFs can destroy investor capital shortly, particularly throughout downturns and even sideways value motion.

What Occurs Subsequent

ETF issuers might want to revise their merchandise to adjust to 2x leverage limits in the event that they wish to refile. The transfer additionally indicators the SEC’s broader stance: even because the U.S. opens the door to identify ETFs and tokenization, regulators are unwilling to loosen leverage guidelines that they see as important for shielding retail buyers.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.