- MSCI might take away Technique (MSTR) from main fairness indexes by Jan. 15.

- JPMorgan estimates as much as $8.8B in outflows if index suppliers observe swimsuit.

- Technique’s inventory is down 37% this 12 months as Bitcoin volatility raises sustainability considerations.

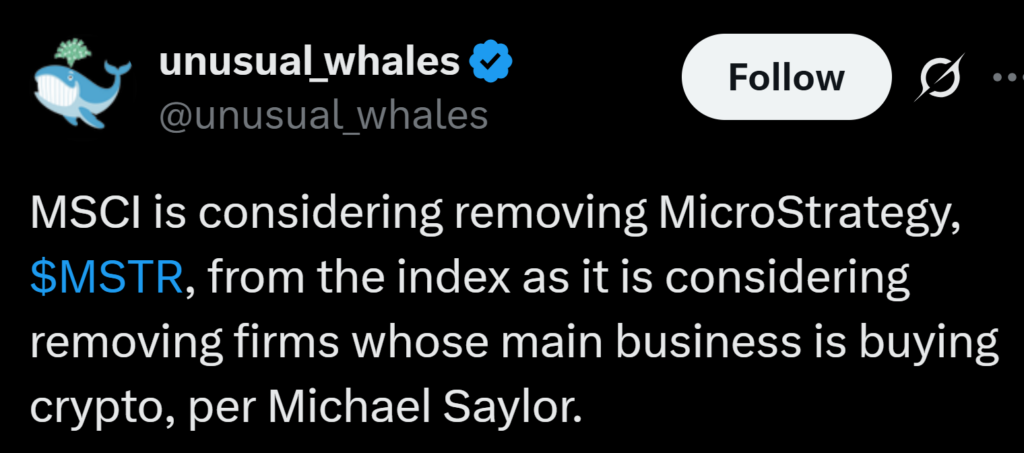

Technique (MSTR), the biggest publicly traded holder of Bitcoin, is now in discussions with index big MSCI over whether or not the corporate will stay a part of main fairness benchmarks. Reuters reviews {that a} resolution is anticipated by Jan. 15, setting the stage for what might be some of the consequential rulings in Technique’s historical past as a public agency.

MSCI Assessment Might Set off Main Outflows

JPMorgan analysts warned final month that Technique’s elimination might result in as a lot as $8.8 billion in outflows if different index suppliers observe MSCI’s lead. As a result of Technique sits inside indexes like MSCI USA and MSCI World, it’s robotically held by an enormous vary of passive index funds. Any elimination would drive these funds to promote their positions, probably pressuring Technique’s already unstable inventory.

Michael Saylor confirmed that discussions with MSCI are underway, although he stated he wasn’t certain JPMorgan’s estimates had been correct. Even so, the scenario highlights the rising stress between Technique’s aggressive Bitcoin technique and the expectations of conventional fairness benchmarks.

Bitcoin Volatility Fuels Stress on Technique

Technique holds 650,000 BTC on its stability sheet, making it the biggest company Bitcoin holder on this planet. However the place has been underneath scrutiny after Bitcoin fell from an all-time excessive above $120,000 to lows close to $82,000 in current weeks. Whereas BTC has since recovered to round $93,000, it stays 26% under its peak — and critics argue that Technique’s heavy use of debt and fairness issuance to purchase extra Bitcoin is changing into more durable to justify.

The corporate’s inventory has dropped 37% this 12 months, amplifying questions on sustainability as markets cope with heightened volatility and index suppliers assessment publicity.

What Occurs Subsequent

The MSCI resolution now looms giant over Technique’s speedy future. If it retains its index placement, the corporate avoids huge structural outflows. If it’s eliminated, the promoting stress might be important — and should redefine how fairness benchmarks deal with firms with crypto-dominant stability sheets.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.