XRP holders are about to begin incomes passive revenue on their belongings following the launch of the decentralized finance (DeFi) chain, Firelight Protocol. The community’s launch will present native staking and yield alternatives for Ripple’s native token.

In response to a press launch despatched to CryptoPotato, Firelight’s providers will embody an on-chain financial safety primitive designed to guard DeFi belongings from exploits.

Firelight to Introduce XRP Staking

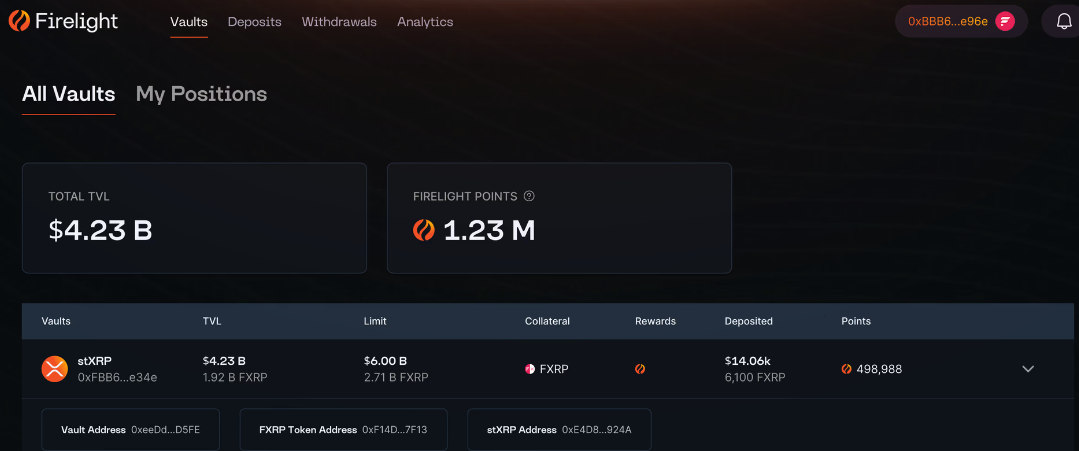

The launch of Firelight will are available in two phases. The primary will permit XRP holders to deposit their belongings into vaults and obtain stXRP, a 1:1, absolutely backed ERC-20 liquid token that’s transferable and can be utilized throughout the Flare DeFi ecosystem. Flare is an interoperability blockchain that enables sensible contracts to entry knowledge throughout different chains and the web.

On Flare, market individuals can use stXRP to swap on decentralized exchanges, as collateral in lending swimming pools, or in contributing to liquidity swimming pools. Depositing XRP in Firelight’s launch vault can even qualify customers to earn Firelight Factors.

Within the first few hours after launch, Firelight’s vault has attracted greater than $4.2 billion price of tokens as per the official web site.

In the course of the second part of the launch, Firelight will attain its sole function – allocating capital deployed by staking their XRP to again a DeFi cowl mechanism. This ensures the protocol sustains actual demand to supply rewards for stakers.

“Firelight goals so as to add a brand new layer of worth for XRP by offering a staking layer that makes use of the staked XRP for offering on-chain cowl. This cowl will be contracted by DeFi protocols to safeguard asset worth in case of hacks and exploits,” the Firelight group said.

Taking a Safety-first Method

Notably, Firelight is taking a security-first method for its launch and the introduction of XRP staking capabilities. The protocol is backed by the blockchain options platform Sentora (previously IntoTheBlock) and Flare. Sentora serves because the technical service supplier, whereas Flare supplies a bridge to attach XRP to the DeFi ecosystem. Ripple backs each Flare and Sentora as they share a dedication to broaden DeFi capabilities for XRP.

Moreover, Firelight has undergone three audits to make sure most compliance with safety protocols. The chain was audited by the main safety platforms, OpenZeppelin and Coinspect, and by a bug bounty program supported by Immunifi.

“Their mixed experience in safe interoperability, protocol design, and community operations supplies Firelight with deep technical assist and a transparent path for long-term ecosystem progress—so XRP holders and builders can construct, safe, and scale real-world purposes with confidence,” the Firelight group added.

The put up XRP Holders Acquire New Yield Alternatives as Firelight Protocol Debuts appeared first on CryptoPotato.