Friday is choices expiry day, and there was a rise in derivatives buying and selling in latest weeks, with Binance futures volumes spiking as merchants place themselves for a serious shift in volatility.

Round 247,000 Bitcoin and Ethereum choices contracts are set to run out right this moment. The tranche is lower than a 3rd of final week’s expiry occasion, which noticed virtually 720,000 contracts written off.

Over $4 Billion in Choices Expiry Sparks Volatility Amid Combined Sentiment

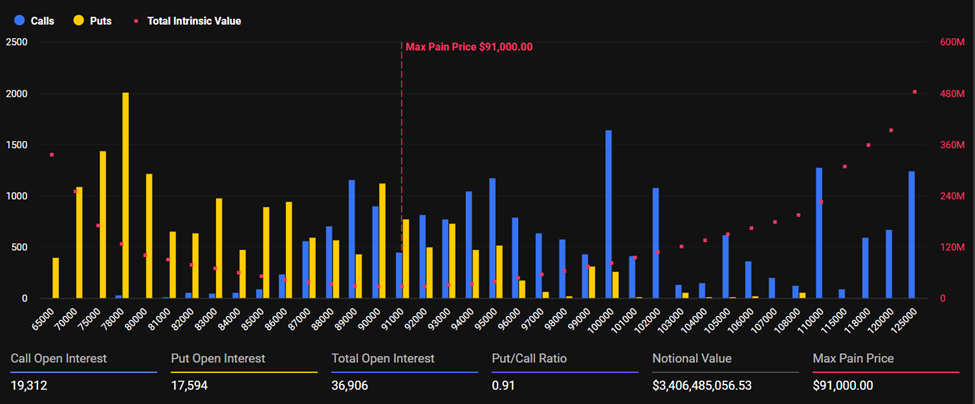

Information on Deribit reveals that over $4.07 billion in Bitcoin and Ethereum (ETH) choices will expire right this moment. For Bitcoin, the expiring choices have a notional worth of $3.4 billion and a complete open curiosity of 36,906.

Sponsored

Sponsored

With a Put-to-Name ratio of 0.91, the utmost ache degree for right this moment’s expiring Bitcoin choices is $91,000, barely under the present BTC value of $92,279.

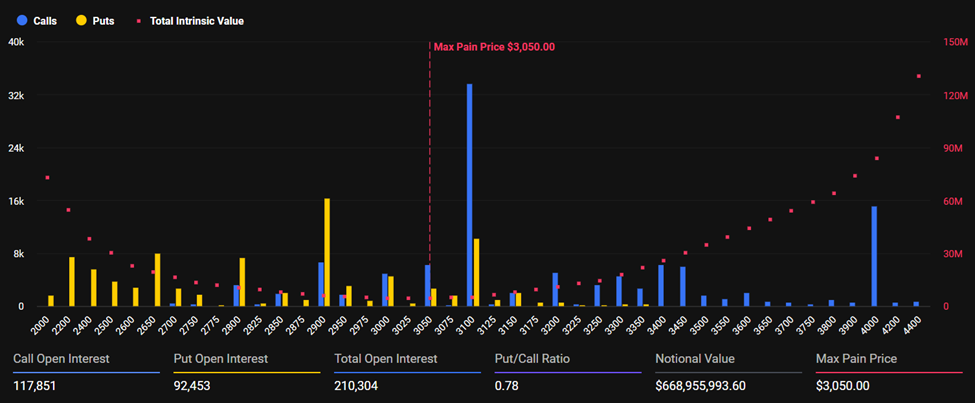

For his or her Ethereum counterparts, the notional worth for right this moment’s expiring ETH choices is $668.95 million, with whole open curiosity of 210,304.

Like Bitcoin, right this moment’s expiring Ethereum choices have a Put-to-Name Ratio under 1, with Deribit information exhibiting a PCR of 0.78 as of this writing. In the meantime, the utmost ache degree, or strike value, is $3,050, barely under the present ETH value of $3,180.

The utmost ache level is an important metric in crypto choices buying and selling. It represents the value degree at which most choices contracts expire nugatory. This situation inflicts the utmost monetary loss, or “ache,” on merchants holding these choices.

Notably, right this moment’s expiring Bitcoin and Ethereum choices are considerably decrease than final week’s. On November 28, BeInCrypto reported that over $15 billion in expiring choices was highlighted, that includes 145,482 BTC and 574,208 ETH contracts, with notional values of $13.28 billion and $1.73 billion, respectively.

A PCR under 1 signifies that extra Name (Buy) choices are traded than Put (Sale) choices. Due to this fact, this implies a bullish market sentiment for Ethereum, and bearish sentiment for Bitcoin, which has extra Places than Calls.

Sponsored

Sponsored

With a PCR of 0.91, Bitcoin’s choices market suggests an virtually balanced sentiment, with a slight tilt towards hedging or defensive positioning. Merchants are cautious however not aggressively bearish on BTC.

This balanced outlook comes as buyers speculate whether or not the market will transfer greater or are hedging their portfolios in case of a sell-off.

Ethereum has a PCR of 0.78, suggesting extra calls than places, exhibiting stronger bullish positioning.Merchants are extra optimistic about ETH in comparison with BTC at this second.

Choices Desks See Stealth Positioning Shift

Regardless of uneven spot costs, choices information factors to a quiet however significant rotation into mid-2026 maturities, significantly in Bitcoin.

Institutional desks are reportedly growing name publicity tied to projected charge cuts, ETF demand, and bettering liquidity circumstances.

Sponsored

Sponsored

Open curiosity on derivatives platforms continues to rise, with contemporary inflows signaling merchants are making ready for a multi-quarter rebound. This aligns with observations from derivatives analytics agency Laevitas.

The information mirror a maturing derivatives market that’s more and more dominated by skilled flows.

Analysts Observe Bearish Skew—However Bullish Hints Emerge

Regardless of long-horizon optimism, analysts say near-term sentiment stays conflicted. In a December 2 replace, Greeks.dwell described dealer positioning as:

“Cautiously bullish bias with merchants calling bottoms and anticipating upside, although sentiment is tempered by frustration over uneven value motion and false strikes.”

Sponsored

Sponsored

Greeks.dwell added that put skew stays elevated, indicating the market nonetheless costs in short-term draw back:

“Danger sellers dominating the tape by way of brief put methods… avoiding name shopping for into dumps, studying from February’s $100k to $78k to $95k expiry volatility,” they wrote.

Nonetheless, volatility compression, particularly in Bitcoin, has opened alternatives in ETH choices, the place merchants see comparatively engaging volatility ranges.

Capital Shifts Towards Yield and Preservation

Deribit echoed the broader pivot towards measured, sustainable methods. As volatility steadily cools and extra capital enters the house, merchants are shifting from ‘5–10x flips’ towards capital preservation and sustainable yield.

Heading into right this moment’s choices expiry, merchants ought to anticipate some volatility, which may affect short-term value motion. Nonetheless, markets may settle shortly after 8:00 UTC right this moment when the contracts expire on Deribit as buyers alter to new buying and selling environments