Bitcoin is holding firmly above the $92,000 stage after a number of days of aid and a stronger-than-expected rebound throughout the market. But regardless of the optimistic value motion, analysts stay deeply divided. Some interpret this transfer as a traditional aid rally inside a broader downtrend, warning that the macro construction nonetheless favors a deeper correction.

Others see the current restoration as the primary signal that Bitcoin could also be stabilizing and getting ready for an additional bullish section. The uncertainty displays the conflicting alerts coming from each derivatives and spot markets.

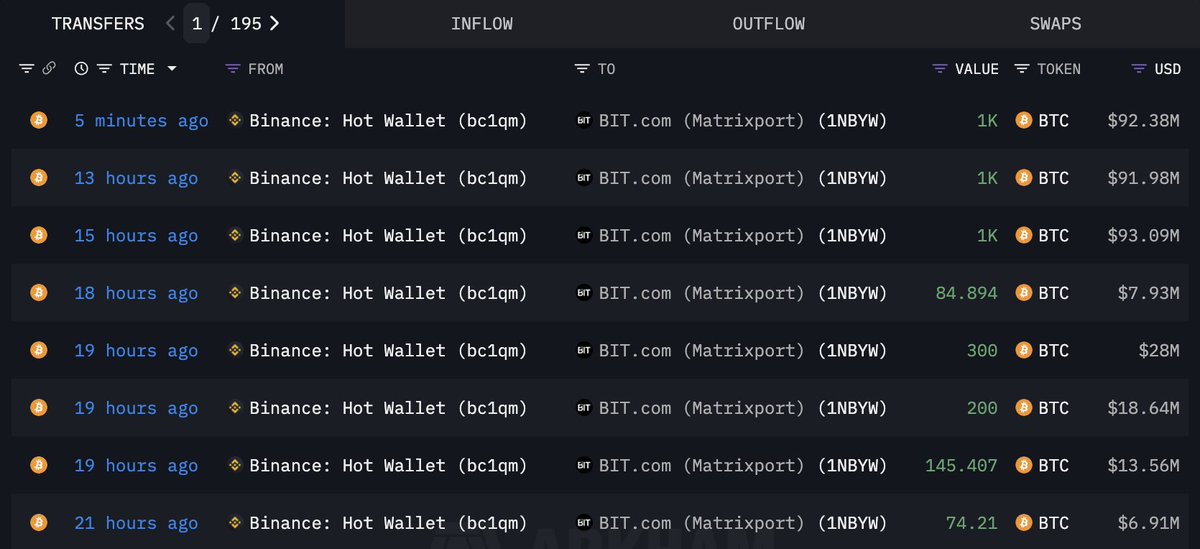

Including gasoline to the dialogue, new on-chain knowledge from Arkham exhibits that Matrixport withdrew 3,805 BTC—value roughly $352.5 million—from Binance throughout the final 24 hours. This can be a important growth, as Matrixport is certainly one of Asia’s largest crypto monetary service platforms, based by Jihan Wu, the co-founder of Bitmain. The agency offers institutional-grade funding merchandise, lending, buying and selling, and asset administration options to high-net-worth shoppers and funds throughout the area.

Giant withdrawals from exchanges by establishments like Matrixport typically sign accumulation, lowered promoting strain, or repositioning for custody and long-term holding. Mixed with Bitcoin’s stabilization above $92K, this knowledge provides an necessary layer of complexity to the present market outlook.

Institutional Positioning and a Altering Macro Panorama

Matrixport’s withdrawal of three,805 BTC from Binance alerts a probably significant shift in institutional positioning. Giant entities not often transfer this dimension of capital with out intention. Such withdrawals usually suggest lowered promoting strain and a choice for custody over trade liquidity, typically interpreted as quiet accumulation.

For a agency managing billions in shopper property, reallocating Bitcoin off exchanges suggests rising confidence in medium-term value stability or an expectation of enhancing market situations.

This transfer arrives at a pivotal second within the international macro surroundings. The Federal Reserve has ended Quantitative Tightening (QT), marking a significant transition from liquidity withdrawal to a extra accommodative stance. Traditionally, the tip of QT has preceded durations of asset reflation, as systemic liquidity begins to stabilize.

On the identical time, Japanese bond yields have surged, signaling stress in one of many world’s most influential funding markets. A spike in Japanese yields typically triggers international liquidity changes, notably via the carry commerce, which might in the end redirect capital towards threat property—together with Bitcoin.

Moreover, markets count on the Federal Reserve to chop rates of interest quickly, additional easing monetary situations. Decrease charges weaken the greenback, scale back funding prices, and usually stimulate inflows into various and high-beta property.

On this surroundings of softening financial coverage and rising liquidity, Matrixport’s aggressive Bitcoin accumulation might mirror rising institutional conviction that the worst of the downturn is behind us—and that Bitcoin could also be coming into a extra favorable macro section.

BTC Value Evaluation: Testing Restoration Momentum

Bitcoin’s day by day chart exhibits the market making an attempt to stabilize after the sharp decline that pushed value towards the mid-$80,000s. The rebound into the $91K–$93K zone marks the primary significant restoration try, however the construction nonetheless displays warning.

BTC stays beneath the 50-day and 100-day SMAs, which have each began to slope downward, signaling that the broader development has not but shifted again in favor of the bulls. Till Bitcoin reclaims these transferring averages with robust quantity, the market will doubtless see this transfer as a aid rally slightly than a confirmed reversal.

Value is at the moment consolidating above the 200-day SMA, a stage that always acts as a long-term development gauge. Holding this area is important; dropping it could threat a deeper drop towards earlier assist zones close to $82K–$84K. Quantity exercise in the course of the bounce exhibits some enchancment, but it stays far beneath the degrees seen in the course of the late-October peak, suggesting that patrons are cautious and enormous gamers usually are not absolutely engaged.

The chart additionally exhibits a transparent lower-high construction forming since September, confirming the bearish strain that has dominated the final a number of weeks. For sentiment to shift decisively, BTC should break above $95K and rebuild momentum towards the psychological $100K mark. Till then, volatility and hesitation stay the defining options of this restoration.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.