- Polymarket odds for BTC ending 2025 at solely $80K have climbed to 40%, displaying rising warning.

- Chances for $95K and $100K have fallen to 61% and 32%, reflecting tempered expectations.

- Merchants look like shifting focus towards 2026 for stronger upside potential.

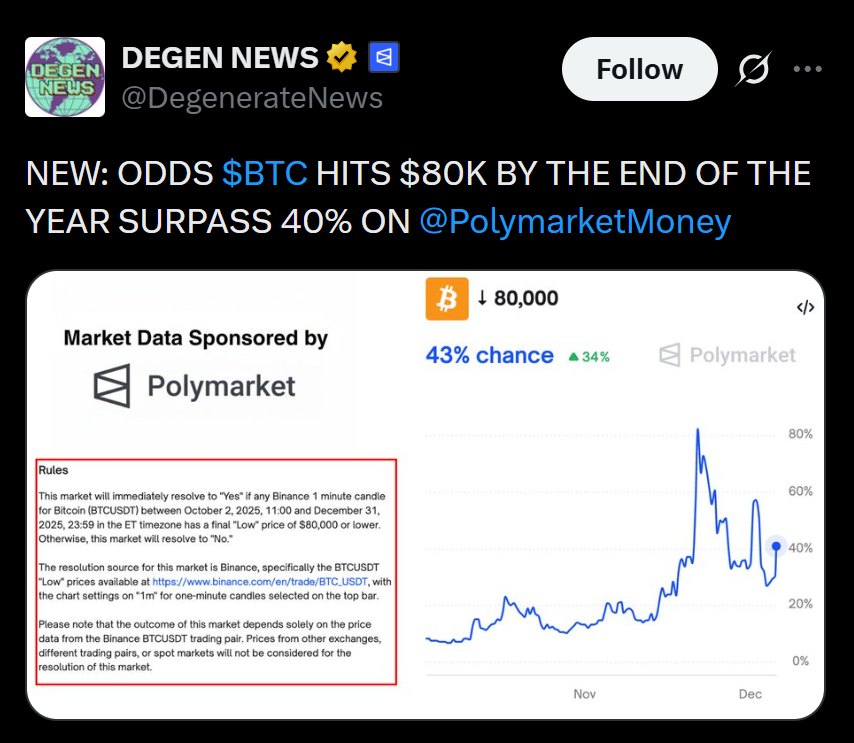

Polymarket merchants are rising extra skeptical about Bitcoin’s capability to push increased earlier than 2025 closes out. Odds for BTC ending the 12 months at solely $80,000 have climbed to 40%, which is a noticeable soar from earlier weeks when merchants have been much more optimistic. The shift means that sentiment is cooling quick, with expectations softening round Bitcoin’s capability to reclaim its momentum after latest uneven value motion.

Polymarket’s Actual-Time Odds Paint a Totally different Image

Polymarket features as one of many largest international prediction markets, letting customers place bets on future occasions — together with crypto milestones — with dwell odds adjusting in actual time. Bitcoin markets on the platform observe chances for main value ranges similar to $80,000, $95,000, and even $100,000 earlier than December 31, 2025. As merchants recalibrate their expectations, these odds have change into a form of sentiment barometer, displaying how confidence rises or fades relying on BTC’s every day swings.

BTC Targets Fall as Merchants Reassess the Street Forward

With solely weeks left within the 12 months, merchants appear much less satisfied that Bitcoin can mount a powerful breakout. Odds for BTC hitting $95,000 have slipped to 61%, whereas the probabilities of a $100,000 end sit at a modest 32%. That quantity was far increased earlier this 12 months however has progressively light as volatility, macro noise, and liquidity issues weigh on conviction. It’s not outright bearishness — however it exhibits a market that’s bracing for a quieter shut.

What This Means for Bitcoin Going Into 2026

The shifting chances additionally counsel that merchants might now be wanting past the year-end and towards 2026, the place many analysts nonetheless anticipate a bigger cycle peak. For the second, Polymarket odds merely replicate a market digesting latest turbulence and tempering its expectations. Whether or not BTC surprises to the upside — or stalls into the brand new 12 months — will rely closely on liquidity situations, ETF flows, and the way shortly sentiment can snap again.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.