In a not-so-surprising flip of occasions, the bearish orientation of the Bitcoin value has continued into the month of December, suggesting that the premier cryptocurrency might finish the yr within the crimson. Curiously, current on-chain knowledge has supplied insights into the doubtless path of Bitcoin based mostly on the integrity of an necessary value stage.

Lively Market Individuals’ Value Foundation At $82,000

In a December 5 publish on the X platform, market analyst Burak Kesmeci shared an fascinating outlook on the path of the Bitcoin value.

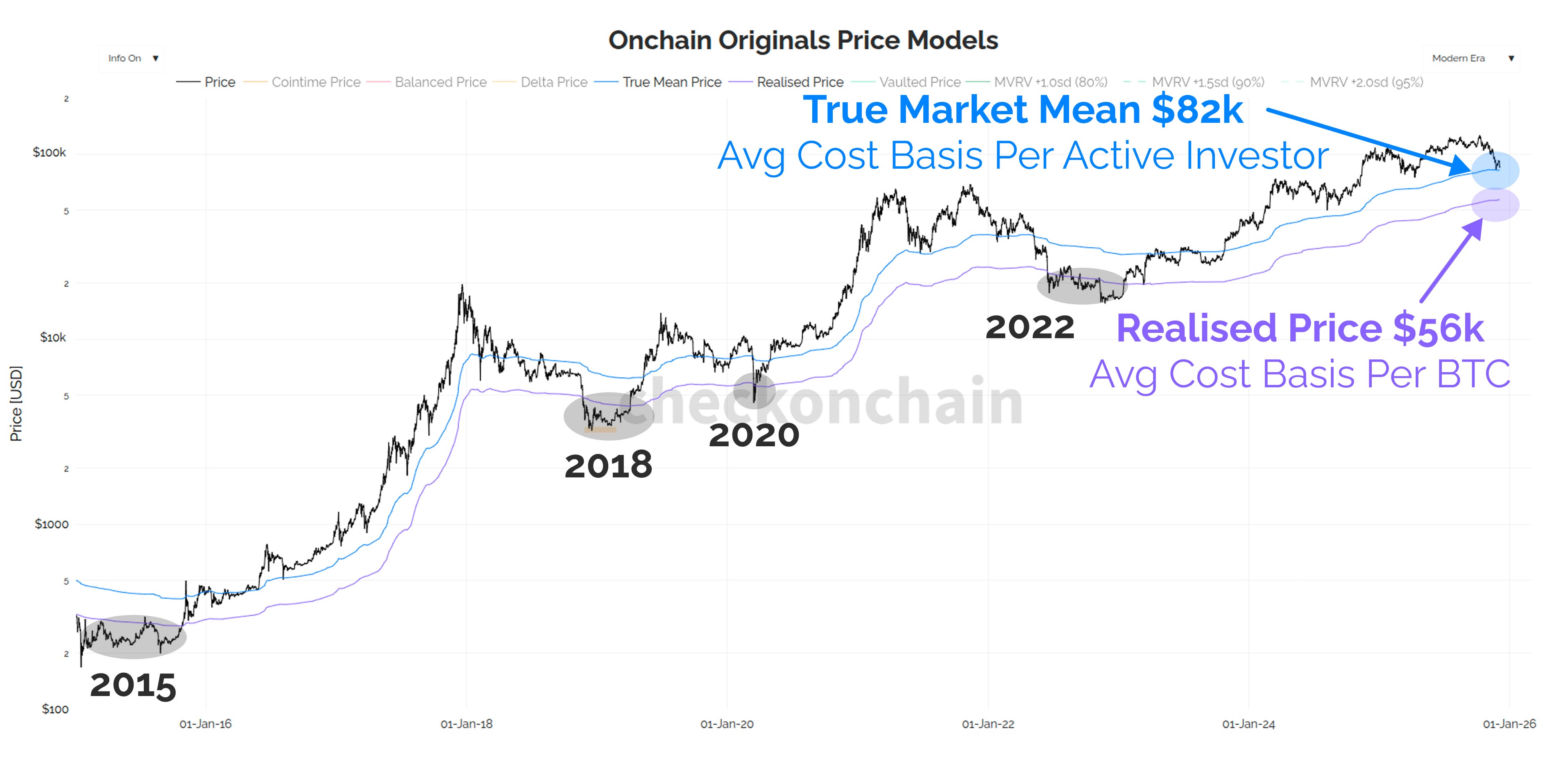

The analyst disclosed that no matter occurs across the $82,000 mark might make or mar Bitcoin’s trajectory within the close to time period. To show why this value area is so necessary, Kesmeci identified that it seems to be the convergence level of two extremely influential value bases in Bitcoin’s historical past.

Associated Studying

Kesmeci revealed that the Bitcoin spot exchange-traded funds have a median buy value of roughly $82,000. As a result of ETFs are one among Bitcoin’s strongest demand sources, monitoring the values of their common cost-basis might function a very good means to inform the place the market stands institutionally.

The crypto pundit additionally referenced the Bitcoin True Market Imply metric, which screens the price at which energetic traders procured their holdings—aside from mined or rarely-moved BTC. Notably, within the present market cycle, Bitcoin’s energetic individuals principally bought their cash round a valuation of $82,000.

What Occurs If $82,000 Fails?

Normally, when value slips beneath any main value help, there’s, in flip, a rise in general promoting strain, as buy-side liquidity is transformed to bearish momentum through losses incurred by traders. Therefore, within the situation the place $82,000 fails to carry, a wave of bearish strain is predicted to ensue, as Bitcoin’s energetic traders attempt to lower their losses.

Nevertheless, Kesmeci expects one thing much more particular to comply with. In response to historic knowledge, at any time when Bitcoin falls beneath its energetic market participant value foundation, it typically falls additional downwards, as if it’s focusing on its Realized Worth.

Associated Studying

In the meanwhile, the Bitcoin Realized Worth sits close to $56,000 — a value stage considerably beneath its traders’ common value foundation. Kesmeci due to this fact warned {that a} slip beneath $82,000 might precede Bitcoin’s sharp downturn in the direction of $56,000.

This may signify an nearly 40% decline from the present value level. As of this writing, the worth of BTC stands at round $89,310, reflecting an over 3% dip previously 24 hours.

Featured picture from iStock, chart from TradingView