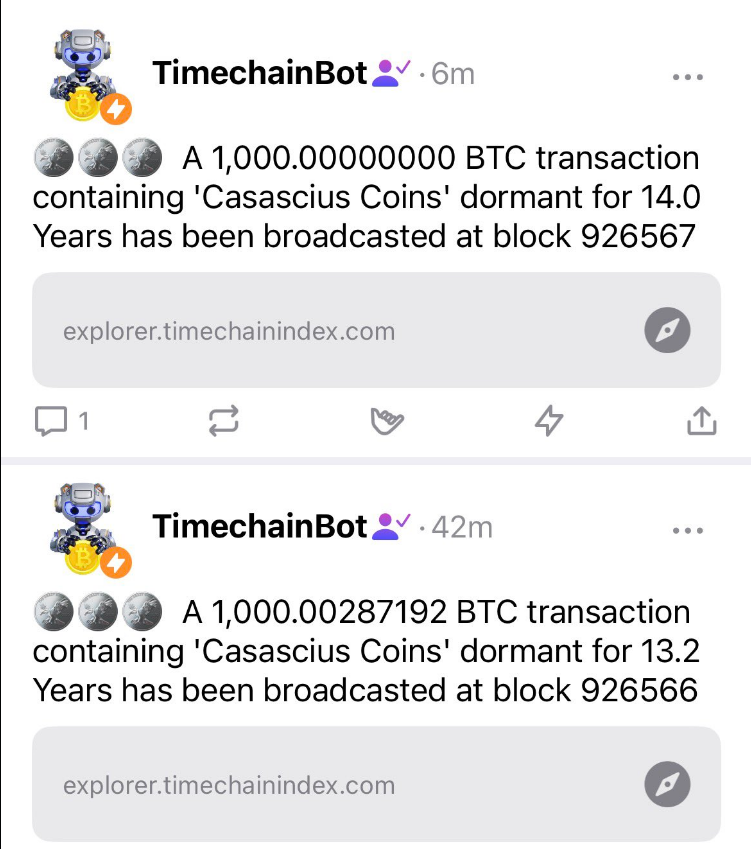

Two long-dormant Casascius cash, every loaded with 1,000 Bitcoin, had been activated on Friday, unlocking greater than $179 million that had sat untouched for over 13 years.

In keeping with onchain information, one of many cash was minted in October 2012 when Bitcoin traded at $11.69. The opposite dates again to December 2011, when BTC was value $3.88, giving that piece a theoretical achieve close to 2.3 million% since minting.

Historic Bodily Cash Activated

Primarily based on studies, Casascius cash (metallic cash) had been produced between 2011 and 2013 by Utah entrepreneur Mike Caldwell as bodily representations of Bitcoin. Every coin or bar hid a paper with a non-public key, and a tamper-resistant hologram coated that key.

Two Casascius cash, every containing 1,000 BTC, have simply moved after being dormant for greater than 13 years. pic.twitter.com/nlFUy39MkD

— Sani | TimechainIndex.com (@SaniExp) December 5, 2025

Information present solely 16 of the 1,000 BTC bars and 6 of the 1,000 BTC cash had been ever made, making this stuff each uncommon and traditionally necessary.

Caldwell shut down the operation after receiving a letter from FinCEN that raised questions on whether or not his enterprise certified as an unlicensed cash transmitter.

How The Cash Labored

The mechanism was easy in apply however strict in final result: whoever eliminated the hologram and revealed the non-public key might declare the total Bitcoin worth saved beneath it.

As soon as that sticker was lifted and the non-public key used, the coin not carried any Bitcoin worth. Primarily based on studies, collectors deal with that second as irreversible. Some homeowners selected to maneuver funds off the bodily cash with out cashing out.

Rarity And Returns

Numbers right here present why collectors and traders watch these occasions intently. Two cash at 1,000 BTC every symbolize an enormous hoard when costs are excessive. Even leaving apart the price of minting, the December 2011 coin’s rise from $3.88 to present market valuations yields a headline-grabbing a number of.

However consultants warn that turning the non-public key into spendable Bitcoin is barely step one; what occurs subsequent is determined by the holder’s decisions. Some will maintain. Others could transfer funds into chilly storage. Promoting shouldn’t be assured.

Derivatives Market Shock

In the meantime, the spot and derivatives markets are experiencing excessive volatility. Primarily based on CoinGlass information, at the moment’s derivatives exercise confirmed an 11,588% liquidation imbalance that overwhelmingly worn out lengthy positions.

Bitcoin, on the time of writing, was buying and selling under $90,000, and greater than $20 million in BTC lengthy liquidations occurred in minutes whereas quick positions barely budged. That form of one-sided strain occurs when many merchants are crowded in the identical path and situations change shortly.

Featured picture from Unsplash, chart from TradingView