Be a part of Our Telegram channel to remain updated on breaking information protection

Attempt urged MSCI to rethink a proposal to take away Bitcoin treasury companies from its indexes, warning that it might scale back traders’ entry to ”the fastest-growing a part of the worldwide financial system.”

Attempt was responding to MSCI’s resolution to think about excluding firms with greater than 50% of their belongings in crypto from benchmark eligibility. A call is due on Jan. 15.

Attempt, the 14th-largest listed BTC treasury agency, mentioned in a letter to CEO Henry Fernandez that the brink can also be “unworkable,” arguing Bitcoin volatility would consistently push companies above and beneath the restrict.

MSCI had mentioned many traders view digital-asset-treasury companies extra like funds than working companies, which might make them ineligible for inclusion in MSCI’s fairness indexes.

The letter comes as analysts warn that the removing of firms similar to Technique, Metaplanet, and others from inventory indexes will likely be a significant blow to the crypto business.

JPMorgan mentioned Technique’s removing may set off as much as $2.8 billion of outflows for the company Bitcoin purchaser’s inventory, with as much as $12 billion in danger if different index suppliers observe MSCI’s lead.

Massive Bitcoin Corporations Are Taking part in A Main Half In The AI Growth

Attempt CEO Matt Cole rejected MSCI’s view that enormous crypto treasury companies symbolize funding funds, and pointed to how Bitcoin miners, which frequently have giant quantities of BTC on their steadiness sheets, are serving to facilitate the AI increase with their surplus power and infrastructure.

https://t.co/5gdKWpFATh

— Matt Cole (@ColeMacro) December 5, 2025

“Among the firms with the biggest Bitcoin holdings are miners who’re turning into vital AI infrastructure suppliers,” Cole mentioned.

“All these miners are quickly diversifying their knowledge facilities to supply energy and infrastructure for AI computing,” he added. “However whilst AI income is available in, their Bitcoin will stay, and your exclusion would too, curbing shopper participation within the fastest-growing a part of the worldwide financial system.”

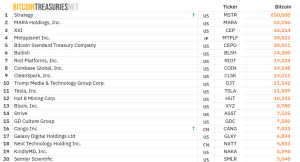

High 20 BTC DATs (Supply: Bitcoin Treasuries)

Cole additionally mentioned that a number of Bitcoin miners have just lately change into “distributors of alternative for tech giants’ computing wants, and that these firms are “ideally positioned” to satisfy the rising power demand from AI companies.

BTC Structured Finance Is Rising

Cole additionally mentioned that the removing of crypto treasury companies would lower off firms that supply traders the same product to quite a lot of structured notes linked to Bitcoin’s returns which can be at the moment provided by conventional finance giants similar to JPMorgan, Morgan Stanley, and Goldman Sachs.

“Bitcoin structured finance is as actual a enterprise for us as it’s for JPMorgan,” he mentioned. “It could be uneven for us to compete in opposition to conventional financiers weighed down by a better price of capital from passive index suppliers’ penalties on the very Bitcoin enabling our choices.”

`Unworkable’ 50% Threshold

Cole elaborated on his competition that MSCI’s 50% threshold is “unworkable in follow.”

“Tying index inclusion to a numeric threshold for famously risky belongings may trigger extra frequent turnover in funds benchmarked to MSCI’s merchandise,” he wrote.

That, in keeping with Cole, would increase the administration prices and improve the danger of monitoring errors as firms “flicker out and in of funds in proportion to their holdings’ volatility.”

Along with the elevated administration and monitoring errors, Attempt’s CEO mentioned that it’ll even be tough to measure when an organization’s holdings attain 50%.

“There are an growing number of devices by which firms achieve that publicity, many complicated,” the CEO mentioned.

“If an organization holds Bitcoin structured merchandise like JPMorgan’s or Technique’s, does that depend towards the 50%?” he requested. “Would it not fluctuate relying on the product, or would devices past spot holdings provide prepared methods of avoiding MSCI’s rule?”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection