- TAO circulate introduces strict zero-emission guidelines for subnets that fail to take care of constructive influx, eliminating dilution and pushing the ecosystem towards a extra aggressive, performance-driven construction.

- The brand new system can’t be manipulated by whales or liquidity tips—solely sustainable exercise and actual AI worth technology decide subnet survival.

- Whereas the transition is uncomfortable, analysts argue TAO circulate might develop into Bittensor’s greatest long-term benefit by rewarding builders who ship actual utility as a substitute of hype.

Proper now, TAO circulate might be the most popular matter contained in the Bittensor ecosystem—particularly throughout the AI-crypto group, the place each change will get dissected prefer it’s world-changing. And actually, this one form of is. The brand new system has reshaped how the community behaves so sharply that many holders are scrambling to actually perceive what it means.

Two separate threads—one from Tao Ouτsider, one other from Andy ττ—have helped unpack the thought. However in addition they sparked extra questions. Collectively, their explanations reveal the actual rigidity behind TAO circulate: it’s strict, unforgiving, and brutally sincere about which subnets should dwell. And surprisingly, that harshness may change into Bittensor’s strongest benefit.

TAO Value Was By no means Alleged to Be the Middle of the Story

Individuals love speaking concerning the TAO value—the swings, the hype, the volatility. However the fact is, Bittensor wasn’t constructed to be a price-driven challenge. The protocol rewards helpful AI outputs, not hypothesis. The previous emission mannequin tried to mirror that by way of value indicators, nevertheless it left room for manipulation, hype spikes, and structural imbalances.

TAO circulate is the try to repair that.

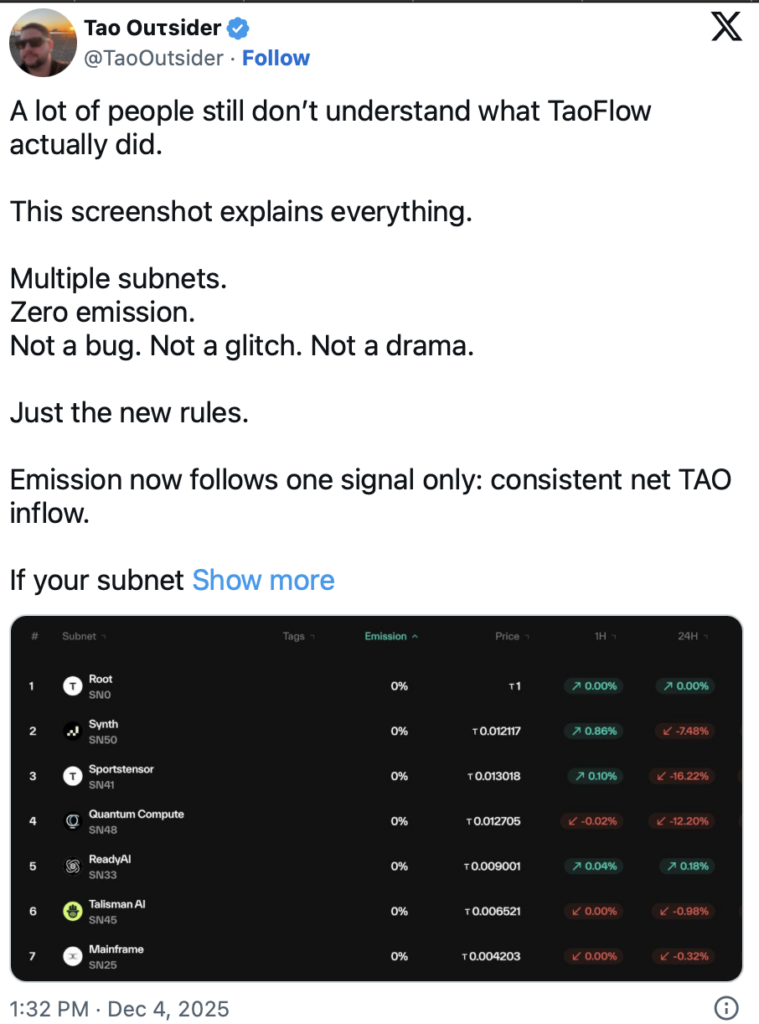

As Tao Ouτsider defined, previous guidelines don’t apply anymore:

- Subnets now function below one common rule: preserve constructive internet TAO influx

- Subnets with zero influx earn zero emissions

- Weak momentum? They’re lower immediately—no grace interval

This will sound harsh, nevertheless it solves a long-standing problem: weak subnets leaking worth from the system. With TAO capped at 21 million provide, each token printed issues. About 10.4M is circulating right now. Eliminating emissions to underperforming subnets reduces dilution and strengthens long-term shortage.

TAO circulate isn’t punishment—it’s cleanup.

A Sharper, Extra Aggressive Economic system Emerges

TAO circulate doesn’t simply change incentives—it rewires your complete financial system.

Subnets are compelled to compete once more. Some sit in zero emission proper now, however that doesn’t routinely imply failure. Many are actual groups with good merchandise, simply caught in a tough patch. They will nonetheless rebound, appeal to stake, and climb again into emission territory.

This makes Bittensor really feel extra alive—extra like a aggressive market and fewer like a leaderboard the place early entrants keep forward without end.

Andy ττ took it additional by clearing up an enormous false impression:

TAO circulate can’t be manipulated by whales or liquidity tips.

- Excessive value doesn’t save a subnet with no participation

- Low value doesn’t kill a subnet with sturdy influx

- Circulation relies on sustainable exercise, not hype

The protocol rewards what truly issues: actual utilization and actual contributions.

TAO Circulation Might Be the Stress Take a look at the Ecosystem Wanted

Many groups concern the brand new system. Subnet demise. Inconsistent rewards. Volatility. The standard checklist. However Andy ττ argues that the majority of those fears miss the larger image.

TAO circulate eliminates previous benefits the place subnets survived off hype or momentum with out delivering worth. Now, efficiency is the one metric. If influx is secure? You survive. If not? You’re lower.

Kurtosis rising exhibits subnets separating into winners and losers. That separation feels uncomfortable—nevertheless it’s additionally crucial. Networks can’t develop by rewarding the center without end.

Tao Ouτsider summed it up completely:

“Winners earn circulate. Losers lose. Construct one thing folks need or watch your emission keep at zero.”

It’s blunt. Nevertheless it’s the closest factor to a mission assertion you’ll ever get.

Might TAO Circulation Turn out to be Bittensor’s Greatest Energy?

This shift feels messy proper now, particularly for groups pushed into zero emission. Communities are confused, builders are careworn, and subnets are being compelled to rethink every part—from incentives to product path.

However that’s additionally what progress appears like.

A community that punishes stagnation and rewards actual contribution turns into stronger long-term. TAO’s future is determined by builders who create worth, not momentum chasers on the lookout for straightforward emissions. TAO circulate isn’t a bug or a flaw—it’s Bittensor evolving into what it at all times claimed to be.

A real, aggressive financial system for machine intelligence.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.