U.S. prosecutors request a 12-year sentence for Do Kwon, citing large losses, world fallout, and powerful deterrence wants.

Prosecutors in the USA have urged a New York federal decide to impose a 12-year jail sentence on Terraform Labs co-founder Do Kwon. They claimed that his strikes within the collapse of TerraUSD brought on widespread disruptions within the markets. Furthermore, they emphasised the episode hastened failures of assorted main crypto platforms.

Prosecutors Hyperlink Terra Collapse to Wider Market Injury

In keeping with filings reviewed by Bloomberg, the request reached the courtroom on the 4th of Dec. The submitting got here prematurely of an upcoming sentencing listening to that might be held on December 11. Moreover, prosecutors mentioned the magnitude of the losses of buyers surpassed various different high-profile crypto failures. They introduced up numbers that present an estimated $40 billion worn out the world over’s markets.

Associated Studying: Do Kwon Pleads Responsible in U.S. Fraud Case Over $40 Billion TerraUSD Collapse | Reside Bitcoin Information

Moreover, authorities emphasised that Kwon’s actions have been among the many most dangerous in different circumstances in current monetary fraud circumstances. Studies mentioned that they in contrast their fallout to the collapse of FTX. Additionally they talked about losses related to Celsius and OneCoin. Consequently, they contended that the magnitude warranted the imposition of a stiff penalty. They mentioned losses have been larger than these related to Sam Bankman-Fried’s case.

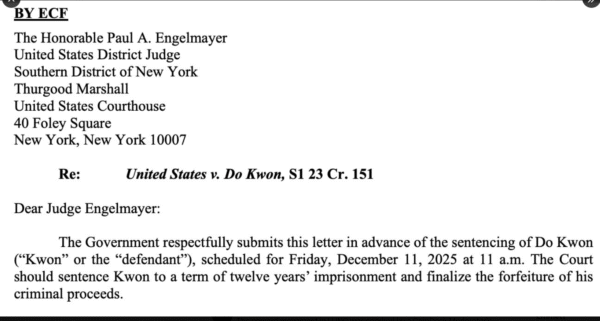

In August 2025, Kwon pleaded responsible to 2 conspiracy expenses of fraud and wire schemes. Below his plea settlement, the prosecutors agreed to suggest a 12-year time period. Nonetheless, Decide Paul Engelmayer retains full discretion to impose so long as 25 years. Consequently, authorized observers stay up for shut consideration on sentencing arguments to be introduced subsequent week.

Protection Cites Harsh Detention Situations in Mitigation Effort

Kwon’s protection workforce has been looking for a extra lenient five-year sentence. They claimed that his practically three-year detention in Montenegro had extreme situations. As well as, they pressured that he’s nonetheless going through prosecution in South Korea the place authorities are looking for a 40-year time period. Due to this, the protection was urging the courtroom to think about aggregating punishments throughout jurisdictions.

Protection statements additionally cited the truth that Kwon cooperated within the plea deal. As well as, they indicated their settlement to surrender substantial property. Court docket paperwork verified that he agreed to surrender greater than $19 million in features. The forfeiture additionally covers various properties related to the proceeds from the scheme. Subsequently, attorneys argued that there must be continued proportionality of extra penalties.

Even so, prosecutors insisted that the lengthy sentence was essential to ship a market sign. They maintained that accountability performs a central position in restoring belief. They went on to say that the Terra collapse was a turning level for some establishments. In keeping with the referred blogs and trade experiences, liquidity failures accelerated throughout exchanges following the decline of Terra.

Regulators Might Tighten Guidelines as Terra Fallout Sparks Liquidation Fears

Analysts level out that the sentencing verdict might be related to forthcoming regulatory debates. They imagine that the strict penalties could affect how future circumstances of crypto fraud go. As well as, they suggest that regulators may enhance oversight to keep away from comparable crises. Because of the heightening of liquidation dangers that occurred after Terra’s fall, there are a number of observers recommending deeper scrutiny of algorithmic stablecoins.

As this Dec. 11 listening to approaches, markets are nonetheless looking ahead to potential implications. Business individuals are afraid that prolonged uncertainty will set off additional enforcement throughout associated entities. Nevertheless, additionally they anticipate that the robust judicial actions might assist to stabilize the requirements. Consequently, buyers and policymakers await some closing determinations that will see future liquidation procedures.