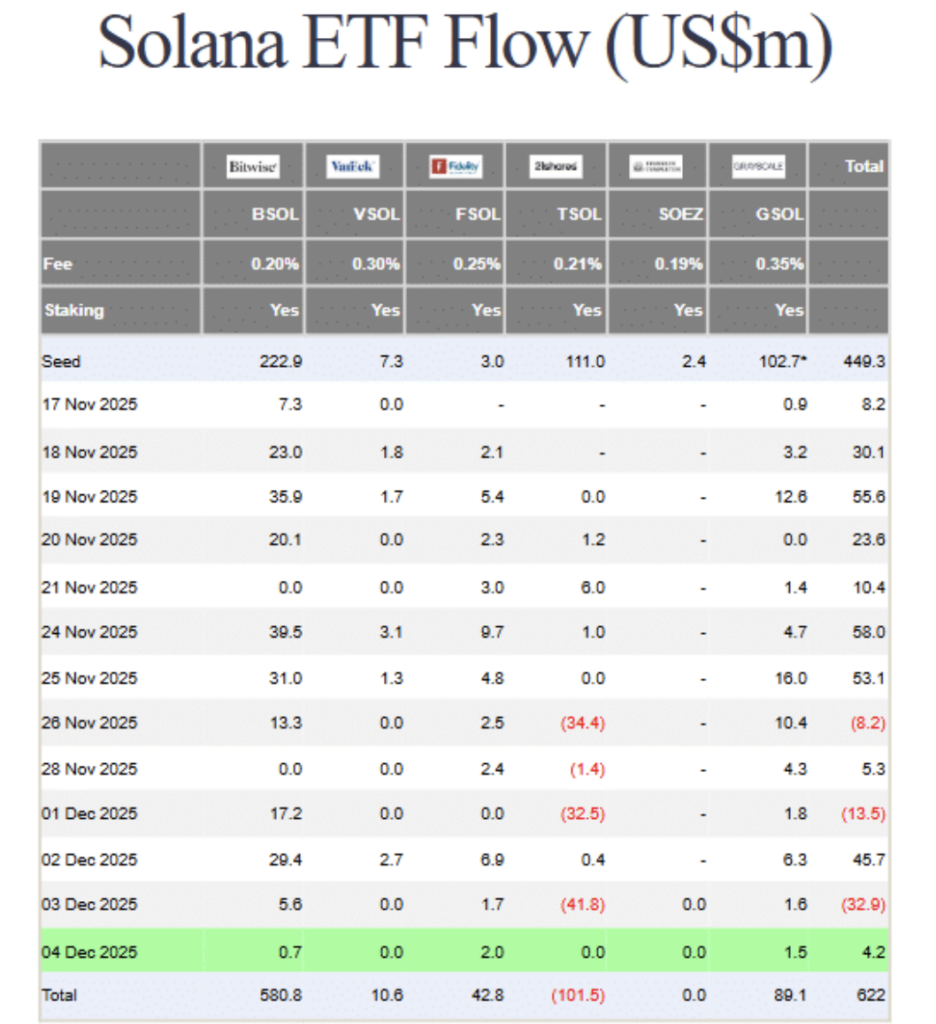

- Solana has launched six spot SOL ETFs in This autumn, drawing round $622 million in inflows, with almost 95% of that flowing into Bitwise’s BSOL ETF.

- Vanguard reversed its long-standing anti-crypto stance and opened its platform to crypto ETFs, together with Solana, signaling a significant institutional shift towards altcoins.

- Regardless of SOL being down about 28% on the yr, robust scalability metrics and the upcoming Alpenglow improve assist a long-term bullish case, conserving a possible transfer towards $500 in play.

With back-to-back ETF approvals, the crypto market is sliding into certainly one of its most aggressive adoption phases ever. And this time, it’s not simply Bitcoin absorbing all of the highlight. Establishments are lastly dipping into altcoins—correctly, not simply with informal curiosity.

Even with out a true “altcoin season,” the info exhibits regular, virtually persistent, institutional demand. Solana has jumped to the entrance of that wave, debuting six spot SOL ETFs in This autumn and attracting about $622 million in inflows already. What’s extra stunning is how concentrated that cash is—almost 95% of it went straight into Bitwise’s BSOL ETF, turning it right into a kind of BlackRock-sized anchor for the Solana ecosystem. If 2024 opened the door, 2025 appears to be the yr altcoins lastly walked by way of it.

Vanguard’s Shift Sends a Main Sign

Including gas to the momentum is Vanguard Group—a reputation no person anticipated to hitch this facet of the financial system so quickly. Managing greater than $11 trillion (sure, trillion with a T), Vanguard is without doubt one of the world’s greatest asset managers. For years they stood firmly in opposition to crypto ETFs. Then on December 2nd, every part modified.

In an entire coverage reversal, Vanguard opened its market to crypto ETFs—together with Solana. That isn’t a small gesture. It’s one of many clearest indicators but that institutional gamers aren’t simply watching anymore—they’re collaborating. And amongst altcoins, SOL has now entered the identical dialog the place beforehand solely Ethereum had a seat.

However why Solana, particularly now, when the worth has been… not nice?

Solana’s Weak Worth Motion Raises Questions

On pure value efficiency, Solana hasn’t been a winner these days. Throughout a number of timeframes, SOL has been one of many weaker large-caps. Yr-to-date, it’s down roughly 28%—its worst yearly efficiency because the brutal -95% crash again in 2022. Each weekly and each day charts inform the identical, reasonably painful, story.

So, what precisely is Vanguard betting on right here? As a result of it’s positively not short-term ROI.

Solana’s Fundamentals Are Doing the Heavy Lifting

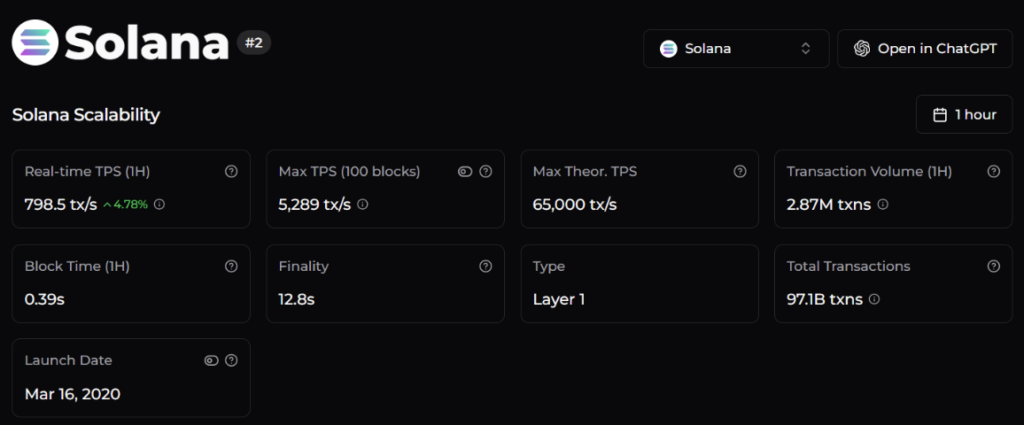

Regardless of the worth weak spot, Solana hasn’t let go of its “Ethereum killer” label. Chainspect’s newest knowledge exhibits why. Solana’s real-time throughput climbed 4.78% up to now hour, reaching roughly 798 transactions per second, whereas transaction finality tightened to 12.8 seconds. These numbers maintain Solana close to the highest of the high-cap blockchain effectivity rankings.

Once you stack this in opposition to Vanguard’s transfer, the technique turns into clearer. This isn’t about buying and selling the each day chart—it’s about proudly owning a chunk of the long-term infrastructure. And with Solana making ready for the Alpenglow improve in Q1 2026, these fundamentals may strengthen even additional.

May SOL Actually Hit $500?

Given the present state of institutional urge for food, the concept of Solana pushing towards $500—roughly a 270% climb from in the present day’s value—doesn’t really feel as unrealistic because it as soon as did. Particularly with ETFs opening the door for contemporary capital, scalability bettering, and main asset managers warming as much as altcoins.

The fast value may look shaky, however the underlying narrative is the alternative. Solana is evolving right into a long-term institutional asset, not only a speculative momentum play. And if this development continues, the subsequent yr may look very completely different from the one Solana buyers simply survived.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.