- Ripple transferred 250 million XRP into an unknown pockets, tightening liquid provide whereas change reserves fell one other 2.51%, decreasing quick sell-side strain.

- XRP has shaped a possible double backside round $1.99, with worth now eyeing the $2.2443 neckline; a breakout above this degree opens a path towards $2.50.

- Taker Purchase CVD is rising, funding charges have surged over 460%, and shrinking reserves all level to rising bullish momentum, although leverage additionally raises volatility and liquidation danger.

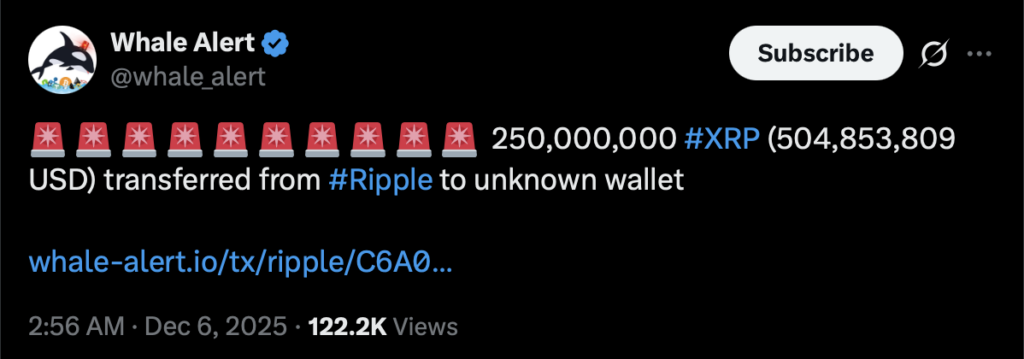

Ripple simply shifted 250 million XRP into an unknown pockets — and the complete liquidity image for the asset modified virtually immediately. The switch, which got here with out warning, pulled a big chunk of provide off the board and instantly sparked debate over what Ripple is likely to be planning subsequent.

Merchants are actually dissecting this transfer carefully. At any time when such a giant quantity exits exchange-adjacent wallets, it reshapes sell-side strain and tightens obtainable provide. And with change reserves already thinning, this one switch provides much more rigidity to the market.

However nobody is aware of the intent behind the transfer — not but. That uncertainty alone is fueling hypothesis about accumulation, strategic repositioning, and even preparation for one thing greater. All of this now blends into the evolving XRP worth construction, which is at a key turning level.

XRP Assessments a Double Backside Close to $1.99 — Can It Maintain?

XRP has carved out what seems like a possible double backside across the $1.99 area. Each dips had been met with onerous pushbacks from patrons, suggesting that merchants nonetheless guard this degree aggressively.

The chart additionally hints that—yeah—XRP would possibly briefly poke towards $1.90 earlier than patrons step in once more. Even with that, the broader construction stays intact.

Value is now creeping up towards the neckline round $2.2443, the large pivot that decides whether or not this sample confirms. A clear break above that line would open the street towards the following main goal at $2.5021.

However this setup nonetheless wants robust follow-through. With out aggressive patrons stepping in, the reversal dangers dropping momentum. For now, a number of on-chain metrics are backing the construction, which makes this second fairly crucial.

Purchaser Aggression Rises as Taker CVD Pushes Increased

Taker Purchase CVD has been climbing sharply, displaying that patrons are actively lifting gives fairly than ready for reductions. This conduct normally seems early in true reversals — the type that flip sentiment earlier than worth even reacts totally.

Each time sellers attempt to sluggish momentum round minor resistance bands, patrons present up and soak up the strain. With Ripple’s big provide withdrawal tightening liquidity much more, this conduct has turn out to be extra noticeable.

The rising CVD curve now strains up completely with the double-bottom try. Merchants see this as proof that actual dedication—not simply leverage—is driving the shift.

Shrinking Trade Reserves Add Gas to the Bullish Construction

Trade Reserves have fallen 2.51%, which sounds small however is definitely significant on high-cap property like XRP. Fewer tokens on exchanges equals fewer tokens able to be bought instantly.

This suits completely with Ripple’s large switch, reinforcing a broader story: provide is exiting the market on the actual second patrons are getting extra aggressive.

Decreased reserves usually act like a strain cooker. As soon as momentum builds, upside reactions have a tendency to maneuver sooner than anticipated. However volatility can even spike if leveraged positions get too crowded.

Nonetheless, the reserve development provides weight to the bullish case taking form proper now.

Funding Charges Surge 460% — Bullish or Too A lot Warmth?

Funding Charges exploded greater than 460%, displaying that bullish leverage is ramping up quick. Merchants are positioning for a breakout above the neckline — possibly a bit too aggressively.

Rising funding normally indicators confidence within the sample… but in addition will increase the danger of a squeeze. If worth snaps downward, over-leveraged lengthy positions could possibly be pressured to unwind, including turbulence.

Even so, the alignment of excessive funding, robust CVD, and shrinking provide paints a really clear image: momentum is tilting upward.

Is XRP Prepared for a Breakout?

Proper now, all main indicators level towards a bullish construction forming beneath the floor:

- Ripple eliminated 250M XRP from liquid circulation

- Trade reserves hold falling

- Taker CVD reveals aggressive patrons stepping in

- The double-bottom sample is sort of full

If patrons reclaim $2.2443 with conviction, XRP opens a clear path towards $2.50. However the whole lot hinges on whether or not $1.99 continues to carry as the bottom layer of help.

For now, the construction leans bullish — and it’s the strongest alignment of indicators XRP has seen in weeks.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.