For years, XRP has been on the middle of intense debate within the crypto world. As soon as considered as a prime resolution for international funds, it has turn into controversial as a result of regulatory stress, unstable value swings, and shifting investor confidence.

$XRP beforehand surged to $3.65 throughout main bull runs however retraced sharply afterward. Now the token is transferring sideways as merchants look forward to a brand new catalyst. It presently trades close to $2.05 and stays the fourth-largest cryptocurrency by market cap.

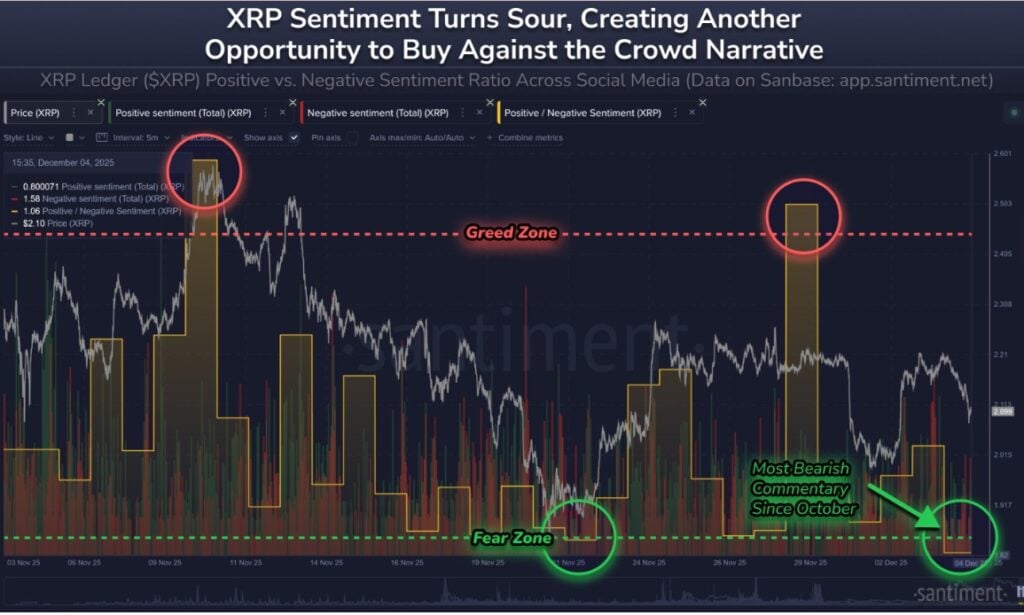

XRP’s social sentiment has fallen to its weakest stage since October, putting the asset firmly again in what Santiment refers to because the “concern zone.” With market circumstances turning shaky, traders are actually centered on XRP value prediction and whether or not the token stays among the best crypto to purchase now.

Santiment notes that comparable sentiment drops in previous cycles usually preceded robust XRP rallies. Regardless of the present uncertainty, this stage of concern has traditionally marked the beginning of main recoveries.

How Institutional Adoption May Form XRP’s Function in Cross-Border Funds

Regardless of previous volatility and lengthy stretches of stagnation, the general panorama is shifting quickly as main monetary establishments start embracing digital property at an unprecedented tempo.

Beginning January 5, 2026, Financial institution of America will start CIO protection of 4 Bitcoin ETFs, together with BITB, FBTC, Grayscale Mini Belief, and IBIT, permitting over 15,000 advisers throughout Merrill, the Personal Financial institution, and Merrill Edge to proactively advocate regulated crypto merchandise for the primary time.

For traders drawn to thematic innovation and prepared to deal with larger volatility, a small allocation of 1% to 4% in digital property could also be appropriate, in keeping with Chris Hyzy, CIO of Financial institution of America Personal Financial institution.

He additionally emphasised that this strategy ought to concentrate on regulated merchandise, cautious allocation, and a stable understanding of each potential beneficial properties and dangers. This marks a pointy distinction to earlier years when banks actively distanced themselves from crypto.

As international adoption accelerates, blockchain expertise and tokenization have gotten integral to future monetary infrastructure, with XRP anticipated to play a significant position in cross-border funds and new monetary rails.

Though present market circumstances nonetheless contain sharp swings and intervals of bearish volatility, these cycles usually precede prolonged bull runs.

Supply – Cilinix Crypto YouTube Channel

XRP Value Prediction

XRP’s short-term outlook has shifted barely after latest value motion didn’t generate robust bullish continuation. The asset beforehand confirmed momentum, however its incapacity to react strongly at key lower-timeframe imbalance zones signaled a brief slowdown.

Even so, the general market construction for $XRP doesn’t seem bearish, as indicators akin to damaging funding charges usually align with bottom-forming circumstances. XRP has additionally proven indicators of absorption, the place promoting stress will increase however value stays secure, signaling potential energy.

For the previous few weeks, XRP has been consolidating between its main help at $2 and resistance close to $2.25, suggesting a managed surroundings fairly than a breakdown setup. $XRP is predicted to search out help once more and make its means towards the unfilled imbalances round $2.18 to $2.20.

As soon as value revisits these ranges, the response will assist decide whether or not a full breakout can lastly happen. For now, the long-term goal of $2.40 to $2.41 stays intact.

Prime Contender for the Greatest Crypto to Purchase Now Earlier than Yr-Finish

With the weekend approaching, merchants are carefully watching potential value actions for XRP whereas trying to find the following high-potential crypto. One standout is Bitcoin Hyper (HYPER), presently in presale and already exceeding $29 million in funding.

Bitcoin Hyper is rising as among the best crypto presales of 2025-2026, introducing a high-speed Bitcoin layer 2 chain designed for scalability and effectivity. By enabling near-instant transactions and decrease charges, it expands the performance of Bitcoin with out making a separate ecosystem.

The platform helps funds, decentralized functions, and monetary companies like lending and borrowing, all secured with zero-knowledge proofs and trustless mechanisms. Buyers can take part utilizing fashionable crypto by way of commonplace wallets and financial institution card.

Combining utility with meme-inspired branding, Bitcoin Hyper goals to draw builders and customers whereas sustaining Bitcoin’s decentralized ethos. Whereas XRP stays a well-liked alternative for merchants, Bitcoin Hyper stands out for its excessive progress potential in a unstable market.

Go to Bitcoin Hyper

This text has been offered by one in every of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our industrial companions might use affiliate applications to generate revenues by way of the hyperlinks on this text.