Bitcoin’s aid bounce has slowed down following an aggressive short-term rally. After leaping previous key ranges final week, patrons now face two main challenges: reclaiming management above resistance and coping with weakening on-chain metrics.

Technical Evaluation

By Shayan

The Day by day Chart

BTC’s every day chart exhibits a transparent bounce from the $80K demand zone, pushing worth again into the $90K–$93K resistance block. The asset additionally stays trapped contained in the descending channel and has now stalled slightly below the higher trendline resistance.

The 100-day and 200-day transferring averages (now each round 108K) nonetheless sit method above the present worth. So long as BTC stays beneath these MAs, the broader development can’t flip bullish. The RSI additionally displays uncertainty, sitting round 45 and failing to interrupt into bullish territory.

This makes the $90K–$95K space essentially the most essential short-term zone. A clear break and every day shut above this area may sign a development shift. Till then, this transfer stays a bear market rally inside a bigger downtrend.

The 4-Hour Chart

Zooming into the 4H chart, Bitcoin has fashioned a construction resembling a breakout and retest from a descending trendline that started forming in late October. After a number of rejections at $94K, BTC pierced above this trendline however is now hovering simply across the $91K degree once more.

Whereas the native market construction appears to be like constructive, a bearish divergence is clear on the RSI, and momentum is weakening. If patrons fail to carry above the $90K degree within the coming classes, a drop again towards the $80K zone is on the desk. On the flip aspect, a stable push above $94K would put 100k+ targets again in play rapidly.

On-Chain Evaluation

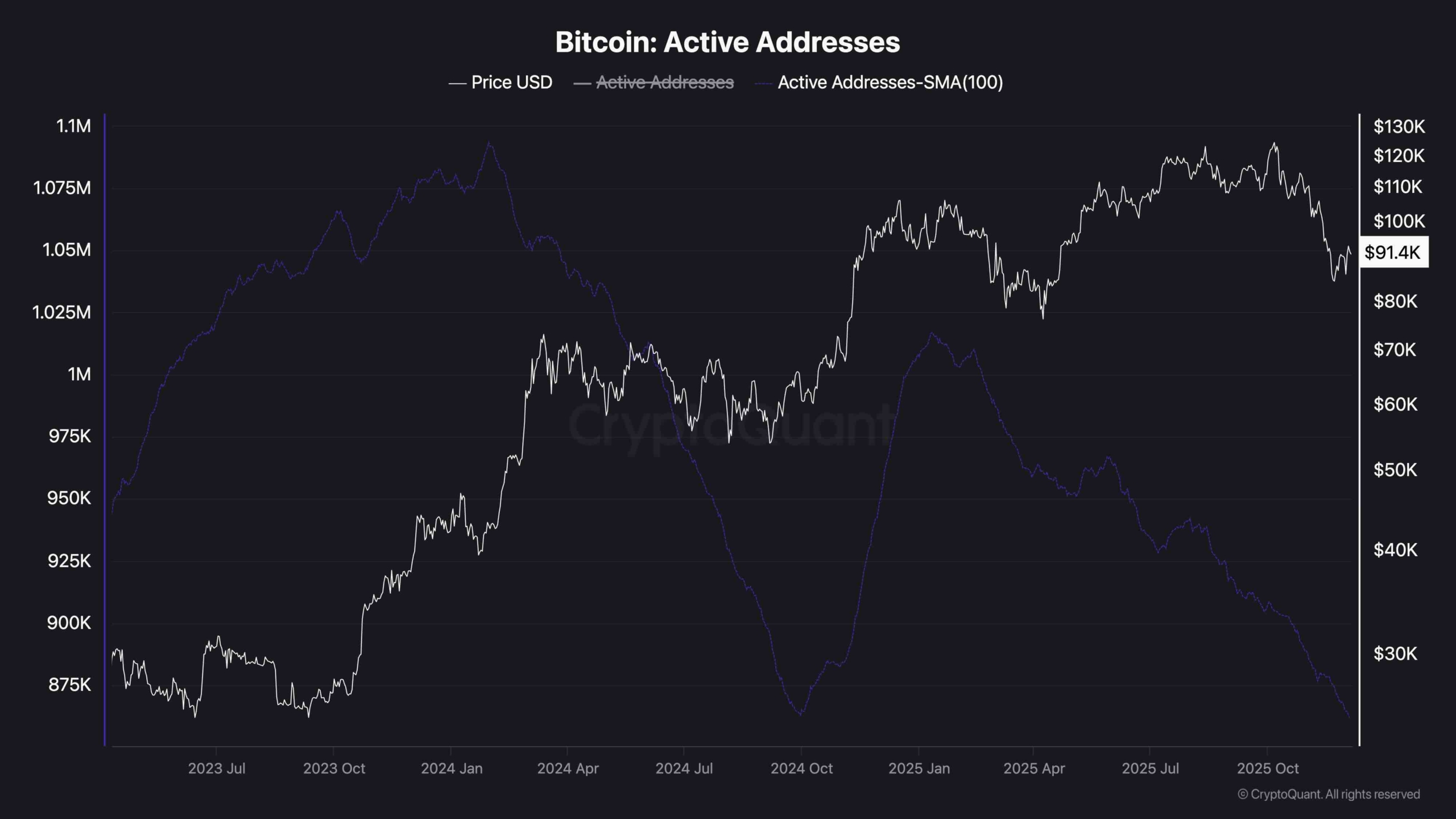

Lively Addresses (100-Day Transferring Common)

The on-chain image will not be serving to the buyers a lot proper now. Lively Bitcoin addresses have been steadily declining since February 2025, even whereas the value made new all-time highs. That divergence lastly performed out throughout the sharp drop in October and November.

Now, despite the fact that worth has bounced from 80k to 91k, energetic addresses (measured with the 100-day SMA) proceed to fall, lately dipping beneath the 875k degree. This means that retail and person exercise remains to be shrinking, and the rally is probably going being pushed by fewer members, probably whales or institutional merchants.

Sustained rallies usually require renewed community exercise and person engagement. Till a development reversal in tackle exercise happens, this bounce stays suspect from a basic perspective.

The publish Bitcoin Value Evaluation: Drop to $80K Nonetheless Attainable if BTC Doesn’t Reclaim This Key Stage Quickly appeared first on CryptoPotato.