Be a part of Our Telegram channel to remain updated on breaking information protection

Tom Lee’s BitMine Immersion Applied sciences purchased extra Ethereum (ETH), pushing its holdings previous 3% of the altcoin’s provide.

In line with the on-chain analytics platform Lookonchain, the most important ETH treasury agency globally acquired $199 million value of Ethereum over the previous 48 hours.

On Friday, the corporate purchased 41,946 ETH value $130.7 million. Then, 24 hours later, it acquired one other 22,676 ETH for $68.67 million.

Tom Lee(@fundstrat)’s #Bitmine simply purchased one other 22,676 $ETH($68.67M) 4 hours in the past.https://t.co/H5PQRjt2oBhttps://t.co/Oyc0Cm1tob pic.twitter.com/vey8AwqmnF

— Lookonchain (@lookonchain) December 6, 2025

BitMine Holds Over 3% Of ETH’s Provide

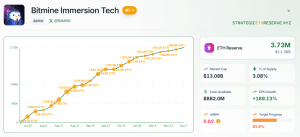

Following these purchases, BitMine now holds 3.73 million ETH tokens value $11.38 billion, knowledge from StrategyETHReserve exhibits.

BitMine ETH holdings (Supply: StrategicETHReserve)

That brings its stash to three.08% of ETH’s complete provide. This has put the agency over 61% in direction of its objective of holding 5% of the crypto’s provide as a part of its “Alchemy of 5%” plan.

BitMine might proceed with its ETH purchases in coming weeks, because it holds round $882 million in money reserves that can be utilized for future buys.

That would enable the corporate to ascertain its dominance within the ETH treasury market, which has seen exercise decelerate previously three months. Throughout this era, ETH acquisitions have fallen 81% from 1.97 million ETH in August to 370K ETH purchased in November.

Throughout that slowdown, BitMine had bought the vast majority of ETH as nicely. Previously month, the agency purchased 679K ETH value $2.13 billion.

Sensible Cash Merchants Are Betting In opposition to ETH In The Quick Time period

Whereas BitMine provides to its ETH reserves, the crypto area’s best-performing merchants by returns, who’re tracked as “sensible cash” merchants on Nansen’s platform, are betting on the short-term depreciation of the altcoin.

Sensible cash merchants added $2.8 million briefly positions over the previous 24 hours, with a cumulative brief place of $21 million.

In the meantime, US spot Ethereum ETFs (exchange-traded funds) are at the moment on a two-day outflows streak. Knowledge from Farside Buyers exhibits that the funding merchandise noticed over $110 million outflows on the finish of the enterprise week.

Buyers pulled $41.5 million from the spot ETH ETFs on Dec. 4, adopted by an extra $75.2 million within the newest buying and selling session.

That was an extension of the adverse pattern seen final week, when the funds recorded outflows for 4 out of the 5 days. The one day that noticed web day by day inflows was on Wednesday, when traders injected $140.2 million into the funds on the day.

ETH Worth Tries To Break Out Of Consolidation Channel

The latest buys by BitMine come because the ETH worth has traded flat previously week following a 9% drop previously month. All through the previous 24 hours, the crypto managed to climb a fraction of a share, knowledge from CoinMarketCap exhibits.

Every day chart for WETH/USD (Supply: GeckoTerminal)

ETH’s flat buying and selling might quickly come to an finish, nevertheless, because the altcoin makes an attempt to interrupt out of the consolidation channel between $2,707 and $3,055 that it has been buying and selling in over the previous fortnight.

ETH has already been capable of cross above the $3,055 resistance, however has since retraced to commerce again under the extent. Ought to bulls attempt to push ETH above this level once more within the subsequent 48 hours, the crypto might find yourself hovering to as excessive as $3,606 within the brief time period.

Conversely, bears taking again management would possibly lead to a continuation of the latest oscillation. In an excessive case, sellers might even push ETH under the $2,707 assist to as little as $2,331.

Technical indicators corresponding to short-term Exponential Transferring Averages (EMAs), the Transferring Common Convergence Divergence (MACD), and the Relative Power Index (RSI) present that momentum has stalled. As such, both bears or bulls can take over and push Ethereum’s worth of their desired path.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection